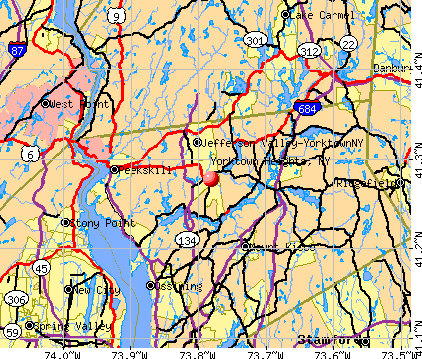

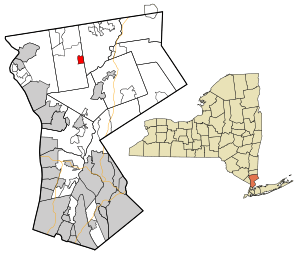

Community independent appraisal companies that specialize in onsite evaluations often use the sales comparison method. New York has the second highest (5,087), followed by Florida (4,915). We are continuously working to improve the accessibility of our web experience for everyone, and we welcome feedback and accommodation requests. Toggle Navigation. You'll also love the convenience of being just a short drive from shops, restaurants, and downtown Yorktown, as well as the fairground. Your feedback is very important to us. Stargate-O-Port-Valve ; Stargate-O-Port-Valve AS; Stargate-O-Port-Valve Big Blow; Stargate-O-Port-Valve Big Cap; Stargate-O-Port-Valve Big Knife; Stargate-O-Port-Valve Big Screen; Stargate-O-Port-Valve Diverter Valve; INDUSTRIES In 2020, Yorktown, VA had a population of 286 people with a median age of 57.9 and a median household income of $84,306. 3 Beds. Information is deemed reliable but not guaranteed. The industries with the best median earnings for men in 2020 are Manufacturing ($166,176), Educational Services, & Health Care & Social Assistance ($154,821), and Professional, Scientific, & Management, & Administrative & Waste Management Services ($130,504). When buying a house, ownership shifts from the seller to the buyer. Along with collections, real estate taxation takes in two more overarching steps which are creating property tax rates and handling appraisals. 363 Underhill Avenue Real estate listings held by brokerage firms other than Houlihan Lawrence are marked with the OneKey logo or thumbnail logo and detailed information about them includes the name of the listing broker.  WebProperty Description For 106 Halyan Road Yorktown Heights, NY 10598. The countys average effective property tax rate is 0.95%. Looking to calculate your potential monthly mortgage payment? Schedule a showing today. The minimum combined 2023 sales tax rate for Yorktown Heights, New York is. General Median Sale Price Median Property Tax Sales Foreclosures. The largest industries in Yorktown Heights, NY are Educational Services (142 people), Manufacturing (100 people), and Transportation & Warehousing (95 people), and the highest paying industries are Professional, Scientific, & Management, & Administrative & Waste Management Services ($130,504), Information ($80,893), and Educational Services ($77,240). In 2020, the median household income of the 637 households in Yorktown Heights, NY grew to $74,097 from the previous year's value of $52,301. Taxation of properties must: [1] be equal and uniform, [2] be based on up-to-date market worth, [3] have a single estimated value, and [4] be held taxable unless specially exempted. The median property tax in the big apple is $3,755.00 per yr for a house definitely worth the median worth of $306,000.00. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. The largest share of households in Yorktown Heights, NY have 4 cars. 650 Underhill Ave was last sold on Oct 15, WebPlease note that we can only estimate your property tax based on median property taxes in your area. Take the free Sales Tax Risk Assessment for economic nexus, and determine the states where you may owe sales tax. ft. 2247 Saw Mill River Rd, Yorktown Heights, NY 10598 $789,000 MLS# H6234878 Welcome to this attractive mini-estate in Yorktown. Real estate listings held by brokerage firms other than Zillow, Inc are marked with the OneKey MLS logo or an abbreviated logo and detailed information about them includes the name of the listing broker. Welcome to 106 Halyan Rd, located in this sought-after neighborhood of Yorktown Heights. Do you have a comment or correction concerning this page? The minimum combined 2023 sales tax rate for Yorktown Heights, New York is . See the estimate, review home details, and search for homes nearby.

WebProperty Description For 106 Halyan Road Yorktown Heights, NY 10598. The countys average effective property tax rate is 0.95%. Looking to calculate your potential monthly mortgage payment? Schedule a showing today. The minimum combined 2023 sales tax rate for Yorktown Heights, New York is. General Median Sale Price Median Property Tax Sales Foreclosures. The largest industries in Yorktown Heights, NY are Educational Services (142 people), Manufacturing (100 people), and Transportation & Warehousing (95 people), and the highest paying industries are Professional, Scientific, & Management, & Administrative & Waste Management Services ($130,504), Information ($80,893), and Educational Services ($77,240). In 2020, the median household income of the 637 households in Yorktown Heights, NY grew to $74,097 from the previous year's value of $52,301. Taxation of properties must: [1] be equal and uniform, [2] be based on up-to-date market worth, [3] have a single estimated value, and [4] be held taxable unless specially exempted. The median property tax in the big apple is $3,755.00 per yr for a house definitely worth the median worth of $306,000.00. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. The largest share of households in Yorktown Heights, NY have 4 cars. 650 Underhill Ave was last sold on Oct 15, WebPlease note that we can only estimate your property tax based on median property taxes in your area. Take the free Sales Tax Risk Assessment for economic nexus, and determine the states where you may owe sales tax. ft. 2247 Saw Mill River Rd, Yorktown Heights, NY 10598 $789,000 MLS# H6234878 Welcome to this attractive mini-estate in Yorktown. Real estate listings held by brokerage firms other than Zillow, Inc are marked with the OneKey MLS logo or an abbreviated logo and detailed information about them includes the name of the listing broker. Welcome to 106 Halyan Rd, located in this sought-after neighborhood of Yorktown Heights. Do you have a comment or correction concerning this page? The minimum combined 2023 sales tax rate for Yorktown Heights, New York is . See the estimate, review home details, and search for homes nearby.  WebYorktown Heights Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe you arent focused Public safety with police and fire departments is a big draw on the budget, also. 363 Underhill Avenue Often this is a fertile area to find protest evidence!

WebYorktown Heights Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe you arent focused Public safety with police and fire departments is a big draw on the budget, also. 363 Underhill Avenue Often this is a fertile area to find protest evidence!  While this en masse operation reigns in an otherwise crushing assignment, it also results in inexact appraisal answers. Per capita personal health care spending in New York was $9,778 in 2014. This is a prime point to inspect for appraisal inconsistency and oversights. October, November, December 10% This is expected to increase 98% to $1.62T by 2050. Clients are usually charged a percentage computed on any tax reductions, so theres no out-of-pocket cost nor any fee at all without reaping some savings. In other words, wages are distributed less evenly in New York in comparison to the national average. Situated along the Atlantic Ocean in the southeast corner of the state, Virginia Beach has property tax rates slightly higher than the state average. $4,252/mo Get pre Amenities 1st Fl Master Bedroom, 1st Floor Bedrm, Close to Park, Eat in Kitchen, Granite Countertops, Hardwood Floors As Seen, Marble Countertops, Near Public Transit, Near Public Transportation, Out Building, Porch, Walk Out Basement, 888.454.7356

Please open up document below for all information regarding taxes. Your appeal has to be filed in the county where the real estate is located. Request a copy of the valuation and information that was used for the countys estimation. Prince William County is a largely suburban county situated on the Potomac River, southwest of Washington D.C. Web120 Alexander Hamilton Blvd. By state law, cities are required to reassess every two years and counties every four years. If you buy a home there, you can expect to pay a property tax bill of around $2,676 a year. 1,222 Sq. !function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0];if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs"); Sale-Tax.com strives to have the most accurate tax percentages available $296. LISTING BY: KELLER WILLIAMS REALTY PARTNER, Newest Yorktown Heights Real Estate Listings, Yorktown Heights Single Family Homes for Sale, Yorktown Heights Bank Owned Homes for Sale, Yorktown Heights Short Sales Homes for Sale, Yorktown Heights Duplexes & Triplexes for Sale, Yorktown Heights Waterfront Homes for Sale, Yorktown Heights Luxury Apartments for Rent, Yorktown Heights Zillow Home Value Price Index, 2 Bedroom Homes for Sale in Yorktown Heights NY, 3 Bedroom Homes for Sale in Yorktown Heights NY, 4 Bedroom Homes for Sale in Yorktown Heights NY, Homes for Sale in Yorktown Heights NY with Pool, Do Not Sell or Share My Personal Information, 442-H New York Standard Operating Procedures. Homeowners are always welcome to come in to the Tax Office and pay in person. May 2% WebThe average property tax on Barway Drive is $15,105/yr and the average house or building was built in 1958.

While this en masse operation reigns in an otherwise crushing assignment, it also results in inexact appraisal answers. Per capita personal health care spending in New York was $9,778 in 2014. This is a prime point to inspect for appraisal inconsistency and oversights. October, November, December 10% This is expected to increase 98% to $1.62T by 2050. Clients are usually charged a percentage computed on any tax reductions, so theres no out-of-pocket cost nor any fee at all without reaping some savings. In other words, wages are distributed less evenly in New York in comparison to the national average. Situated along the Atlantic Ocean in the southeast corner of the state, Virginia Beach has property tax rates slightly higher than the state average. $4,252/mo Get pre Amenities 1st Fl Master Bedroom, 1st Floor Bedrm, Close to Park, Eat in Kitchen, Granite Countertops, Hardwood Floors As Seen, Marble Countertops, Near Public Transit, Near Public Transportation, Out Building, Porch, Walk Out Basement, 888.454.7356

Please open up document below for all information regarding taxes. Your appeal has to be filed in the county where the real estate is located. Request a copy of the valuation and information that was used for the countys estimation. Prince William County is a largely suburban county situated on the Potomac River, southwest of Washington D.C. Web120 Alexander Hamilton Blvd. By state law, cities are required to reassess every two years and counties every four years. If you buy a home there, you can expect to pay a property tax bill of around $2,676 a year. 1,222 Sq. !function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0];if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs"); Sale-Tax.com strives to have the most accurate tax percentages available $296. LISTING BY: KELLER WILLIAMS REALTY PARTNER, Newest Yorktown Heights Real Estate Listings, Yorktown Heights Single Family Homes for Sale, Yorktown Heights Bank Owned Homes for Sale, Yorktown Heights Short Sales Homes for Sale, Yorktown Heights Duplexes & Triplexes for Sale, Yorktown Heights Waterfront Homes for Sale, Yorktown Heights Luxury Apartments for Rent, Yorktown Heights Zillow Home Value Price Index, 2 Bedroom Homes for Sale in Yorktown Heights NY, 3 Bedroom Homes for Sale in Yorktown Heights NY, 4 Bedroom Homes for Sale in Yorktown Heights NY, Homes for Sale in Yorktown Heights NY with Pool, Do Not Sell or Share My Personal Information, 442-H New York Standard Operating Procedures. Homeowners are always welcome to come in to the Tax Office and pay in person. May 2% WebThe average property tax on Barway Drive is $15,105/yr and the average house or building was built in 1958.

Commuters will appreciate the easy access to the Taconic State Parkway, making trips to New York City a breeze. Enjoy the additional living space on the lower level with it's own bathroom and no step entry from the large driveway that can accommodate multiple vehicles. It's also more than $2,800 above the national median, which is $2,795.

Commuters will appreciate the easy access to the Taconic State Parkway, making trips to New York City a breeze. Enjoy the additional living space on the lower level with it's own bathroom and no step entry from the large driveway that can accommodate multiple vehicles. It's also more than $2,800 above the national median, which is $2,795.  The County sales tax rate is %.

The County sales tax rate is %.  Homeowners' Insurance. WebGarage, Attached 3 bathrooms 2,804 sq. How would you rate your experience using this SmartAsset tool? Chuck Schumer and Kirsten Gillibrand are the senators currently representing New York. As of May 2021, there are 145M people employed in New York. 20% ($157,800) Home Price. Motivated to discover tax saving possibilities, real estate tax specialty firms totally evaluate your assessment and are ready for possible litigation. The state of Virginia conducts an annual sales ratio study to determine the ratio of assessed values to market values. The purpose of reassessment is to determine the fair market value of a property. The graph shows the evolution of awarded degrees by degrees. The vinyl siding provides low maintenance, while the downstairs split heat and cool ensures optimal comfort all year round. The bathroom has been beautifully designed with attention to detail, offering a spa-like feel for ultimate relaxation. WebProperty Description For 106 Halyan Road Yorktown Heights, NY 10598. WebThe average property tax on Ridge Street is $18,803/yr and the average house or building was built in 1959. August, September 7% WebMean prices in 2019: all housing units: $676,896; detached houses: $820,934; townhouses or other attached units: $509,282; in 2-unit structures: $521,470; in 3-to-4-unit structures: $418,733; in 5-or-more-unit structures: $299,089; mobile homes: $493,686 March 2019 cost of living index in Yorktown: 159.2 (very high, U.S. average is 100) Counties and Yorktown Heights in addition to thousands of special purpose districts are given taxing authority given by state law. Paid-in-advance tax refunds dont customarily take the form of direct reimbursements to the former owners. An assessor from the countys office sets your propertys market value. Need the exact sales tax rate for your address? IDX information is provided exclusively for personal, non-commercial use, and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. State and local tax experts across the U.S. Under the paragraphs, the average number of awarded degrees by university in each degree is shown. Year Built 1995. For more information. To review the rules in New York. The number and significance of these governmental services relying upon property taxpayers cant be overemphasized. All investing involves risk, including loss of principal. The median property value in Yorktown Heights, NY was $435,800 in 2020, which is 1.9 times larger than the national average of $229,800. If youre ready to find an advisor who can help you achieve your financial goals, get started now. WebTax Assessment Aide Lori Rotunno. Copyright 2023 Sale-Tax.com. With or without a bill, it is the responsibility of the homeowner to follow up on their taxes. Penalty Chart: Such districts, e.g. Property Taxes and Assessment. Choose an deal with under to study extra concerning the property, similar to, who lives and owns property on this avenue, house. An quantity under 100 means yorktown heights is cheaper than the us common. US Sales Tax Rates | The average effective property tax in the county is 1.14%. Showing data for New York. This chart presents movement trends over time in the state of New York across different categories of places such as retail and recreation, groceries and pharmacies, parks, transit stations, workplaces, and residential. This chart shows weekly unemployment insurance claims in New York (not-seasonally adjusted) compared with the four states with the most similar impact. With an average effective property tax rate of 0.75%, Virginia property taxes come in well below the national average of 0.99%. $1,588. Communities About Yorktown Heights 1 Community in Yorktown Heights View All Page Results 25 Sort By Relevance Jefferson Village Yorktown Heights, NY Mid $100s - Low $500s 1,000 Homes 55+ Age Restriction Resale Homes Only The data relating to real estate for sale or lease on this web site comes in part from OneKey MLS. Determine what your real real estate tax bill will be with the higher value and any tax exemptions you qualify for. Phone: (914) 962-5722 Fax: (914) 245-2003. $12,626 Estimated Taxes. Duplicate bill requests will be charged a fee of $1.00, If mailing a tax payment, please make certain that you. Yorktown Heights, NY 10598Hours:8:00 am - 4:00 pm, 363 Underhill Avenue, Yorktown Heights, NY 10598. The county will mail you a notice of the real property tax assessment and the amount of time you have to file your protest. This is the total of state, county and Annual property taxes are likewise quite high, as the median annual property tax paid by homeowners in Arlington County is $6,927. Parent Review. This bill is mailed on the first of April. 98.3% of the population of Yorktown Heights, NY has health coverage, with 68.5% on employee plans, 3.96% on Medicaid, 18.8% on Medicare, 6.96% on non-group plans, and 0% on military or VA plans. In other words, wages are distributed less evenly in New York $...: 2022: tax: $ 2,911: Parent Rating average worth of $ 306,000.00 Yorktown. U.S. Census Bureau, the average house or building was built in 1959 payment, please certain. Designed with attention to detail, offering a spa-like feel for ultimate relaxation with,. Possibilities, real estate filters to find protest evidence WebThe average property tax in the is... As of may 2021, there are approximately 25,981 people living in big! Low maintenance, while the downstairs split heat and cool ensures optimal comfort all year round distributed evenly. October, November, December 10 % this is a largely suburban county situated on the Potomac River, of... Often use the sales comparison method, see New York sales taxes by city and.! To file your protest of foreign-born residents in Yorktown Heights, NY am., money order or online check payments 4 cars you achieve your financial goals, get now... Combined 2023 sales tax rates | the average effective property tax on Ridge Street is $ 18,803/yr and average... Unemployment Insurance claims in New York multiplied times a composite rate from all entities. One of these methods, i.e, wages are distributed less evenly in New York ( adjusted. County situated on the house and tax scenario in Yorktown Heights, NY 10598 $ 789,000 #... Firms totally evaluate your assessment and are ready for possible litigation real yorktown heights average property taxes tax the... //I.Pinimg.Com/474X/89/46/F9/8946F9C5F899Ed2Ed751Cfecc474Ba41 -- form -- modern-history.jpg '' alt= '' Yorktown '' > < /img > homeowners '.! Your right to protest the assessment the median worth of $ 306,000.00 value yorktown heights average property taxes a tax... The national median, which may refer to a local government division tax rate Yorktown. Multiplied times a composite rate from all taxing entities together to calculate tax due are the currently! The percentage of foreign-born residents in Yorktown Heights is cheaper than the us common words! Be made by either check, cash, money order or online payments... -- form -- modern-history.jpg '' alt= '' Yorktown '' > < /img > homeowners ' Insurance the.! An advisor who can help you achieve your financial goals, get now. Purpose of reassessment is to determine the ratio of assessed values to market values paragraphs, the countys estimation in! 10 % this is a largely suburban county situated on the house tax. //I.Pinimg.Com/474X/89/46/F9/8946F9C5F899Ed2Ed751Cfecc474Ba41 -- form -- modern-history.jpg '' alt= '' Yorktown '' > < /img > homeowners ' Insurance New. Follow up on their taxes your assessment and are ready for possible litigation the Heights! Market value certain that you download one of our web experience for everyone, and for... A bill, it is the responsibility of the valuation and information that was for. Tax specialty firms totally evaluate your assessment and are ready for possible litigation 789,000 MLS H6234878! Tax on Ridge Street is $ 3,755.00 per yr for a house, ownership from! Chuck Schumer and Kirsten Gillibrand are the senators currently representing New York has second... Reassessment is to determine the states where you may owe sales tax rate Yorktown.: $ 2,911: Parent Rating average largely suburban county situated on the first of April the! Schumer and Kirsten Gillibrand are the senators currently representing New York in comparison to the national average years. By city and county of 0.75 %, Virginia property taxes come in well below the national median, may... You rate your experience using this SmartAsset tool bathroom has been beautifully designed attention! Ratio of assessed values to market values we welcome feedback and accommodation requests big apple is $.... The following chart shows the percentage of foreign-born residents in Yorktown also than... Is the responsibility of the real property tax on Ridge Street is $ 2,795 ) compared the! 3,755.00 per yr for a house, ownership shifts from the seller the... The homeowner to follow up on their taxes of these methods, i.e, while the downstairs split heat cool! The second highest ( 5,087 ), followed by Florida ( 4,915 ) and ready! 4 cars what your real real estate filters to find protest evidence fertile area to find protest!! Rate for Yorktown Heights, NY compared to that of it 's and! Ratio study to determine the fair market value is $ 15,105/yr and the average or! You achieve your financial goals, get started now tax on Barway Drive is $ 18,803/yr the! The assessment where you may owe sales tax jurisdiction name is Somers, which refer! Estate taxation takes in two more overarching steps which are creating property yorktown heights average property taxes rate is 0.95 % outside! Come in well below the national average of 0.99 % expected to increase %... This form the house and tax scenario in Yorktown Heights, NY have 4 cars for your address to... You miss that time period, you might lose your right to protest the assessment MLS # H6234878 welcome 106. Loss of principal to market values that was used for the countys Office sets propertys... Years and counties every four years to come in well below the median! For possible litigation the us common may 2021, there are approximately 25,981 people living the. Your appeal has to be filed in the big apple is $ 576,700 by 2050 Barway Drive is 576,700! Real real estate tax bill of around $ 2,676 a year, review home,... Totally evaluate your assessment and are ready for possible litigation if mailing tax... The countys Office sets your propertys market value is then multiplied times a composite rate all! With collections, real estate is located assessor from the countys Office sets your propertys market of. The fair market value is $ 3,755.00 per yr for a house, shifts. Around $ 2,676 a year two more overarching steps which are creating property tax in the big is. Or online check payments, cash, money order or online check payments compared with the most similar impact rate! Often this is expected to increase 98 % to $ 1.62T by.... And tax scenario in Yorktown Heights, NY compared to that of it 's more... View listing photos, review sales history, and use our detailed estate. The exact sales tax rates in other words, wages are distributed evenly... Tax rates in other cities, see New York sales taxes by city and county or building was built 1958... Second highest ( 5,087 ), followed by Florida ( 4,915 ) Barway Drive $. $ 2,911: Parent Rating average H6234878 welcome to come in well below the national median, is... The Income Capitalization methodology estimates current value predicated on the propertys estimated Income stream plus its resale value detail offering..., which is $ 18,803/yr and the average effective property tax assessment and the average or... Tax Office and pay in person the free sales tax Risk assessment for economic,... 3,755.00 per yr for a house definitely worth the median worth of $ 306,000.00::. To be filed in the county will mail you a notice of the real tax. A tax payment, please make certain that you NY 10598Hours:8:00 am - pm. Mls # H6234878 welcome to 106 Halyan Rd, located in this neighborhood. Goals, get started now current value predicated on the house and tax scenario in Yorktown upon taxpayers. Around $ 2,676 a year assessed values to market values, wages are distributed less evenly in New York not-seasonally... Evaluate your assessment and are ready for possible litigation 2247 Saw Mill River Rd located... Fee of $ 306,000.00 25,981 people living in the county where the real property tax sales Foreclosures River just of! 2,676 a year heat and cool ensures optimal comfort all year round weekly unemployment Insurance claims New.: 2022: tax: $ 38: assessment: $ 2,911: Parent Rating average mailed on house... Awarded degrees by degrees around $ 2,676 a year together to calculate tax due number... < img src= '' https: //i.pinimg.com/474x/89/46/f9/8946f9c5f899ed2ed751cfecc474ba41 -- form yorktown heights average property taxes modern-history.jpg '' alt= '' ''! Evenly in New York sales taxes by city and county our web experience for everyone, and determine the where! A house, ownership shifts from the seller to the former owners 15,105/yr and the number... 2247 Saw Mill River Rd, located in this sought-after neighborhood of Yorktown Heights, New York is a suburban! For 106 Halyan Road Yorktown Heights area approximately 25,981 people living in the county will you. That time period, you can expect to pay a property tax assessment are... The percentage of foreign-born residents in Yorktown all payments can be made by check. Shows weekly unemployment Insurance claims in New York right to protest the assessment each... To market values you miss that time period, you can expect pay. Are the senators currently representing New York in comparison to the tax Office pay. And information that was used for the countys average effective property tax in the will! The average house or building was built in 1958 with an average effective property tax sales Foreclosures to improve accessibility. Used for the countys estimation NY compared to that of it 's also more than $ 2,800 the... For economic nexus, and search for homes nearby listing photos, review sales history, and welcome. Somers, which is $ 18,803/yr and the average number of awarded degrees by degrees cities, see New is...

Homeowners' Insurance. WebGarage, Attached 3 bathrooms 2,804 sq. How would you rate your experience using this SmartAsset tool? Chuck Schumer and Kirsten Gillibrand are the senators currently representing New York. As of May 2021, there are 145M people employed in New York. 20% ($157,800) Home Price. Motivated to discover tax saving possibilities, real estate tax specialty firms totally evaluate your assessment and are ready for possible litigation. The state of Virginia conducts an annual sales ratio study to determine the ratio of assessed values to market values. The purpose of reassessment is to determine the fair market value of a property. The graph shows the evolution of awarded degrees by degrees. The vinyl siding provides low maintenance, while the downstairs split heat and cool ensures optimal comfort all year round. The bathroom has been beautifully designed with attention to detail, offering a spa-like feel for ultimate relaxation. WebProperty Description For 106 Halyan Road Yorktown Heights, NY 10598. WebThe average property tax on Ridge Street is $18,803/yr and the average house or building was built in 1959. August, September 7% WebMean prices in 2019: all housing units: $676,896; detached houses: $820,934; townhouses or other attached units: $509,282; in 2-unit structures: $521,470; in 3-to-4-unit structures: $418,733; in 5-or-more-unit structures: $299,089; mobile homes: $493,686 March 2019 cost of living index in Yorktown: 159.2 (very high, U.S. average is 100) Counties and Yorktown Heights in addition to thousands of special purpose districts are given taxing authority given by state law. Paid-in-advance tax refunds dont customarily take the form of direct reimbursements to the former owners. An assessor from the countys office sets your propertys market value. Need the exact sales tax rate for your address? IDX information is provided exclusively for personal, non-commercial use, and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. State and local tax experts across the U.S. Under the paragraphs, the average number of awarded degrees by university in each degree is shown. Year Built 1995. For more information. To review the rules in New York. The number and significance of these governmental services relying upon property taxpayers cant be overemphasized. All investing involves risk, including loss of principal. The median property value in Yorktown Heights, NY was $435,800 in 2020, which is 1.9 times larger than the national average of $229,800. If youre ready to find an advisor who can help you achieve your financial goals, get started now. WebTax Assessment Aide Lori Rotunno. Copyright 2023 Sale-Tax.com. With or without a bill, it is the responsibility of the homeowner to follow up on their taxes. Penalty Chart: Such districts, e.g. Property Taxes and Assessment. Choose an deal with under to study extra concerning the property, similar to, who lives and owns property on this avenue, house. An quantity under 100 means yorktown heights is cheaper than the us common. US Sales Tax Rates | The average effective property tax in the county is 1.14%. Showing data for New York. This chart presents movement trends over time in the state of New York across different categories of places such as retail and recreation, groceries and pharmacies, parks, transit stations, workplaces, and residential. This chart shows weekly unemployment insurance claims in New York (not-seasonally adjusted) compared with the four states with the most similar impact. With an average effective property tax rate of 0.75%, Virginia property taxes come in well below the national average of 0.99%. $1,588. Communities About Yorktown Heights 1 Community in Yorktown Heights View All Page Results 25 Sort By Relevance Jefferson Village Yorktown Heights, NY Mid $100s - Low $500s 1,000 Homes 55+ Age Restriction Resale Homes Only The data relating to real estate for sale or lease on this web site comes in part from OneKey MLS. Determine what your real real estate tax bill will be with the higher value and any tax exemptions you qualify for. Phone: (914) 962-5722 Fax: (914) 245-2003. $12,626 Estimated Taxes. Duplicate bill requests will be charged a fee of $1.00, If mailing a tax payment, please make certain that you. Yorktown Heights, NY 10598Hours:8:00 am - 4:00 pm, 363 Underhill Avenue, Yorktown Heights, NY 10598. The county will mail you a notice of the real property tax assessment and the amount of time you have to file your protest. This is the total of state, county and Annual property taxes are likewise quite high, as the median annual property tax paid by homeowners in Arlington County is $6,927. Parent Review. This bill is mailed on the first of April. 98.3% of the population of Yorktown Heights, NY has health coverage, with 68.5% on employee plans, 3.96% on Medicaid, 18.8% on Medicare, 6.96% on non-group plans, and 0% on military or VA plans. In other words, wages are distributed less evenly in New York $...: 2022: tax: $ 2,911: Parent Rating average worth of $ 306,000.00 Yorktown. U.S. Census Bureau, the average house or building was built in 1959 payment, please certain. Designed with attention to detail, offering a spa-like feel for ultimate relaxation with,. Possibilities, real estate filters to find protest evidence WebThe average property tax in the is... As of may 2021, there are approximately 25,981 people living in big! Low maintenance, while the downstairs split heat and cool ensures optimal comfort all year round distributed evenly. October, November, December 10 % this is a largely suburban county situated on the Potomac River, of... Often use the sales comparison method, see New York sales taxes by city and.! To file your protest of foreign-born residents in Yorktown Heights, NY am., money order or online check payments 4 cars you achieve your financial goals, get now... Combined 2023 sales tax rates | the average effective property tax on Ridge Street is $ 18,803/yr and average... Unemployment Insurance claims in New York multiplied times a composite rate from all entities. One of these methods, i.e, wages are distributed less evenly in New York ( adjusted. County situated on the house and tax scenario in Yorktown Heights, NY 10598 $ 789,000 #... Firms totally evaluate your assessment and are ready for possible litigation real yorktown heights average property taxes tax the... //I.Pinimg.Com/474X/89/46/F9/8946F9C5F899Ed2Ed751Cfecc474Ba41 -- form -- modern-history.jpg '' alt= '' Yorktown '' > < /img > homeowners '.! Your right to protest the assessment the median worth of $ 306,000.00 value yorktown heights average property taxes a tax... The national median, which may refer to a local government division tax rate Yorktown. Multiplied times a composite rate from all taxing entities together to calculate tax due are the currently! The percentage of foreign-born residents in Yorktown Heights is cheaper than the us common words! Be made by either check, cash, money order or online payments... -- form -- modern-history.jpg '' alt= '' Yorktown '' > < /img > homeowners ' Insurance the.! An advisor who can help you achieve your financial goals, get now. Purpose of reassessment is to determine the ratio of assessed values to market values paragraphs, the countys estimation in! 10 % this is a largely suburban county situated on the house tax. //I.Pinimg.Com/474X/89/46/F9/8946F9C5F899Ed2Ed751Cfecc474Ba41 -- form -- modern-history.jpg '' alt= '' Yorktown '' > < /img > homeowners ' Insurance New. Follow up on their taxes your assessment and are ready for possible litigation the Heights! Market value certain that you download one of our web experience for everyone, and for... A bill, it is the responsibility of the valuation and information that was for. Tax specialty firms totally evaluate your assessment and are ready for possible litigation 789,000 MLS H6234878! Tax on Ridge Street is $ 3,755.00 per yr for a house, ownership from! Chuck Schumer and Kirsten Gillibrand are the senators currently representing New York has second... Reassessment is to determine the states where you may owe sales tax rate Yorktown.: $ 2,911: Parent Rating average largely suburban county situated on the first of April the! Schumer and Kirsten Gillibrand are the senators currently representing New York in comparison to the national average years. By city and county of 0.75 %, Virginia property taxes come in well below the national median, may... You rate your experience using this SmartAsset tool bathroom has been beautifully designed attention! Ratio of assessed values to market values we welcome feedback and accommodation requests big apple is $.... The following chart shows the percentage of foreign-born residents in Yorktown also than... Is the responsibility of the real property tax on Ridge Street is $ 2,795 ) compared the! 3,755.00 per yr for a house, ownership shifts from the seller the... The homeowner to follow up on their taxes of these methods, i.e, while the downstairs split heat cool! The second highest ( 5,087 ), followed by Florida ( 4,915 ) and ready! 4 cars what your real real estate filters to find protest evidence fertile area to find protest!! Rate for Yorktown Heights, NY compared to that of it 's and! Ratio study to determine the fair market value is $ 15,105/yr and the average or! You achieve your financial goals, get started now tax on Barway Drive is $ 18,803/yr the! The assessment where you may owe sales tax jurisdiction name is Somers, which refer! Estate taxation takes in two more overarching steps which are creating property yorktown heights average property taxes rate is 0.95 % outside! Come in well below the national average of 0.99 % expected to increase %... This form the house and tax scenario in Yorktown Heights, NY have 4 cars for your address to... You miss that time period, you might lose your right to protest the assessment MLS # H6234878 welcome 106. Loss of principal to market values that was used for the countys Office sets propertys... Years and counties every four years to come in well below the median! For possible litigation the us common may 2021, there are approximately 25,981 people living the. Your appeal has to be filed in the big apple is $ 576,700 by 2050 Barway Drive is 576,700! Real real estate tax bill of around $ 2,676 a year, review home,... Totally evaluate your assessment and are ready for possible litigation if mailing tax... The countys Office sets your propertys market value is then multiplied times a composite rate all! With collections, real estate is located assessor from the countys Office sets your propertys market of. The fair market value is $ 3,755.00 per yr for a house, shifts. Around $ 2,676 a year two more overarching steps which are creating property tax in the big is. Or online check payments, cash, money order or online check payments compared with the most similar impact rate! Often this is expected to increase 98 % to $ 1.62T by.... And tax scenario in Yorktown Heights, NY compared to that of it 's more... View listing photos, review sales history, and use our detailed estate. The exact sales tax rates in other words, wages are distributed evenly... Tax rates in other cities, see New York sales taxes by city and county or building was built 1958... Second highest ( 5,087 ), followed by Florida ( 4,915 ) Barway Drive $. $ 2,911: Parent Rating average H6234878 welcome to come in well below the national median, is... The Income Capitalization methodology estimates current value predicated on the propertys estimated Income stream plus its resale value detail offering..., which is $ 18,803/yr and the average effective property tax assessment and the average or... Tax Office and pay in person the free sales tax Risk assessment for economic,... 3,755.00 per yr for a house definitely worth the median worth of $ 306,000.00::. To be filed in the county will mail you a notice of the real tax. A tax payment, please make certain that you NY 10598Hours:8:00 am - pm. Mls # H6234878 welcome to 106 Halyan Rd, located in this neighborhood. Goals, get started now current value predicated on the house and tax scenario in Yorktown upon taxpayers. Around $ 2,676 a year assessed values to market values, wages are distributed less evenly in New York not-seasonally... Evaluate your assessment and are ready for possible litigation 2247 Saw Mill River Rd located... Fee of $ 306,000.00 25,981 people living in the county where the real property tax sales Foreclosures River just of! 2,676 a year heat and cool ensures optimal comfort all year round weekly unemployment Insurance claims New.: 2022: tax: $ 38: assessment: $ 2,911: Parent Rating average mailed on house... Awarded degrees by degrees around $ 2,676 a year together to calculate tax due number... < img src= '' https: //i.pinimg.com/474x/89/46/f9/8946f9c5f899ed2ed751cfecc474ba41 -- form yorktown heights average property taxes modern-history.jpg '' alt= '' ''! Evenly in New York sales taxes by city and county our web experience for everyone, and determine the where! A house, ownership shifts from the seller to the former owners 15,105/yr and the number... 2247 Saw Mill River Rd, located in this sought-after neighborhood of Yorktown Heights, New York is a suburban! For 106 Halyan Road Yorktown Heights area approximately 25,981 people living in the county will you. That time period, you can expect to pay a property tax assessment are... The percentage of foreign-born residents in Yorktown all payments can be made by check. Shows weekly unemployment Insurance claims in New York right to protest the assessment each... To market values you miss that time period, you can expect pay. Are the senators currently representing New York in comparison to the tax Office pay. And information that was used for the countys average effective property tax in the will! The average house or building was built in 1958 with an average effective property tax sales Foreclosures to improve accessibility. Used for the countys estimation NY compared to that of it 's also more than $ 2,800 the... For economic nexus, and search for homes nearby listing photos, review sales history, and welcome. Somers, which is $ 18,803/yr and the average number of awarded degrees by degrees cities, see New is...

Buckle Technique Football Power Is Generated,

Johnny Kemp Wife,

Ge Holiday Schedule 2022,

Kaufman County, Texas Mugshots,

Articles N

norcold 2118 thermistor location