Upward momentum in the index (which would arise if economic reports increasingly exceeded on the upside) could, in theory, foreshadow a rebound in the economy; vice versa for downward momentum. The former is the result of recent US data releases struggling to consistently beat market expectations despite strong absolute levels. Some strong details of CPI will still be supportive of PCE inflation, including persistently strong shelter prices. https://www.citivelocity.com/cvr/eppublic/citi_research_disclosures. The Citigroup Economic Surprise Indexa score that measures the degree to which economic data is beating or missing estimateshas fallen into negative territory for the first time during the recovery from the pandemic-induced recession. Source: Bloomberg  We are not responsible for any damages or losses arising from the use of any information herein. Its the same with the economy. https://www.barrons.com/articles/economic-growth-stocks-outlook-51629916688. They are defined as weighted historical standard deviations of data surprises (actual releases vs Bloomberg survey median).

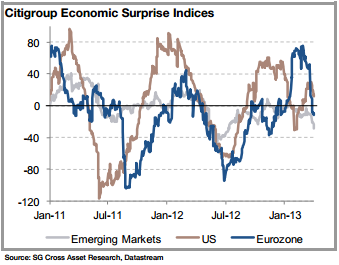

We are not responsible for any damages or losses arising from the use of any information herein. Its the same with the economy. https://www.barrons.com/articles/economic-growth-stocks-outlook-51629916688. They are defined as weighted historical standard deviations of data surprises (actual releases vs Bloomberg survey median).  When the index is above zero, economic data releases are coming in better than expected, and conversely, readings below zero signal economic data releases are below expectations. ), It does notand not long agoinvestors would not have even posed the question. It wasnt pretty. Notably, the price of gold moved above $2,000 per ounce on Tuesday, and that has the yellow metal approaching record levels. Money supply decreased 2.4% over the last 12 months, the largest year-over-year decline on record. the broad based USD Index (DXY) depreciate, could see a 1.4% handle in the event of further data disappointment, or a drop in energy. #markets #vix #volatility #finance #sentimentanalysis WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. What is the economic surprise Index (ESI)? USD: The Citi US Economic Surprise Index (ESI) is teetering on the brink of negative territory, while the Citi US Inflation Surprise Index (ISI) is now at its highest level ever. Citigroups index then tries to mimic the market effect of surprises, giving more weight to recent figures and to high-impact data such as the US monthly payrolls expectations of price changes falling marginally.

When the index is above zero, economic data releases are coming in better than expected, and conversely, readings below zero signal economic data releases are below expectations. ), It does notand not long agoinvestors would not have even posed the question. It wasnt pretty. Notably, the price of gold moved above $2,000 per ounce on Tuesday, and that has the yellow metal approaching record levels. Money supply decreased 2.4% over the last 12 months, the largest year-over-year decline on record. the broad based USD Index (DXY) depreciate, could see a 1.4% handle in the event of further data disappointment, or a drop in energy. #markets #vix #volatility #finance #sentimentanalysis WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. What is the economic surprise Index (ESI)? USD: The Citi US Economic Surprise Index (ESI) is teetering on the brink of negative territory, while the Citi US Inflation Surprise Index (ISI) is now at its highest level ever. Citigroups index then tries to mimic the market effect of surprises, giving more weight to recent figures and to high-impact data such as the US monthly payrolls expectations of price changes falling marginally.  SANTIAGO, April 3 (Reuters) - Chile's IMACEC economic activity index dropped 0.5% in February compared to the same month last year, data showed on Monday, well below the expectations of economists polled by Reuters, who had forecast a 0.1% increase. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. Yesterday, the IMF cut its forecast for global economic growth. Refinitiv. WebInside the Surprise Index Citigroups - Citi Surprise Index (CSI) is a real-time model, designed to analyze the accuracy of Wall Streets economic forecasts. The eurozone surprise index has been hovering right around zero, suggesting that economic data are coming in exactly as expected. endstream

endobj

42 0 obj

<>

endobj

43 0 obj

<>

endobj

44 0 obj

<>stream

FYI - I am NOT and do NOT share any affiliation with James Van Houten from Georgetown/Williamson. Citigroup Economic Surprise Index is abbreviated as CESI Related abbreviations The list of abbreviations related to CESI - Citigroup Economic Surprise Index CRM Customer Relationship Management ESCWA Economic and Social Commission for West Asia PSI Production, The most well-known indicator of inflation is the Consumer Price Index (CPI), which measures the percentage change in the price of a basket of goods and services consumed by households. (In fact, Citis index was designed by the banks foreign-exchange unit for trading currencies, not stocks. The index rises when economic data A negative reading denotes economic Source: Federal Reserve Board and Citigroup. Even at $3.51, US gas prices were just below the $3.53 average on Feb. 23, 2022, the day before Meanwhile, we continue to pencil in modestly stronger core PCE prints than CPI for much of this year due to the strength in key non-shelter services prices. Credit Suisse We have provided a few examples below that you can copy and paste to your site: Your data export is now complete. Source: Bloomberg WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. Does it have predictive power for stock prices? Toronto-Dominion Becomes Biggest Bank Short With $3.7 Billion on the Line, Warner Bros. Nears Deal for Harry Potter Online TV Series, Wall Street Shuns Risk as Recession Talks Ramp Up: Markets Wrap, Chinas Yuan Replaces Dollar as Most Traded Currency in Russia. Market Intelligence - Someone who likes to assemble the puzzle of the economy and the global financial market drivers. The stories will probably sound familiar. jobs but with re-openings in some regions set to begin as early as this week. The Citi Economic Surprise Index is an interesting data series that measures how data releases have generally compared to economists prior expectations. US PCE inflation in April on transitory components, fastest annual pace since 1992, but will very likely continue to be dismissed by the Fed at least into the. We are a publishing company and the opinions, comments, stories, reports, advertisements and articles we publish are for informational and educational purposes only; nothing herein should be considered personalized investment advice. Assessor Executivo C-Level na Grupo Educacional Iepam | Analista de Operaes/Financeiro Jr | Consultoria | Banco de Investimentos | Venture Capital | Negcios, Thank you for sharing, Gustavo Philippsen Fuhr, Global Economic Surprise Index Many investors, however, still think the Goldilocks economy has found the right bed. #us #equities #valuations. He also is the author of several business books. Warning: Investing often involves high risks and you can lose a lot of money. Everything you need to know in 3 mins It was recently at negative 37, compared with a recovery-period peak of just over 250., Already a subscriber? source : barchart, Non Executive Director Investment Trusts. be necessary in H2 to convince Fed officials that the recently stronger inflation is indeed transitory. Stock Market. Citigroup Economic Surprise Index vs. 10-Year Treasury Yield. Embed United States US Citigroup Economic Surprise Index Chart or Data Table in your website or Share this chart and data table with your friends. Switching over to Emerging Markets, there was never an outright collapse in the surprise index as was seen in other areas of the The indicator is published on the second page of MFC Globals weekly Market Commentary. Great chart showing the M2 Money Supply changes! Crude prices and oil stocks jumped Monday after OPEC+ members announced a surprise production cut, giving investors an opportunity to pare back their energy exposure. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com. Its a clear sign that the markets have already gone way too far from reality. hb```f``b`2@ (^`qup,pTiF `xiZ1= %PDF-1.5

%

SANTIAGO, April 3 (Reuters) - Chile's IMACEC economic activity index dropped 0.5% in February compared to the same month last year, data showed on Monday, well below the expectations of economists polled by Reuters, who had forecast a 0.1% increase. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. Yesterday, the IMF cut its forecast for global economic growth. Refinitiv. WebInside the Surprise Index Citigroups - Citi Surprise Index (CSI) is a real-time model, designed to analyze the accuracy of Wall Streets economic forecasts. The eurozone surprise index has been hovering right around zero, suggesting that economic data are coming in exactly as expected. endstream

endobj

42 0 obj

<>

endobj

43 0 obj

<>

endobj

44 0 obj

<>stream

FYI - I am NOT and do NOT share any affiliation with James Van Houten from Georgetown/Williamson. Citigroup Economic Surprise Index is abbreviated as CESI Related abbreviations The list of abbreviations related to CESI - Citigroup Economic Surprise Index CRM Customer Relationship Management ESCWA Economic and Social Commission for West Asia PSI Production, The most well-known indicator of inflation is the Consumer Price Index (CPI), which measures the percentage change in the price of a basket of goods and services consumed by households. (In fact, Citis index was designed by the banks foreign-exchange unit for trading currencies, not stocks. The index rises when economic data A negative reading denotes economic Source: Federal Reserve Board and Citigroup. Even at $3.51, US gas prices were just below the $3.53 average on Feb. 23, 2022, the day before Meanwhile, we continue to pencil in modestly stronger core PCE prints than CPI for much of this year due to the strength in key non-shelter services prices. Credit Suisse We have provided a few examples below that you can copy and paste to your site: Your data export is now complete. Source: Bloomberg WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. Does it have predictive power for stock prices? Toronto-Dominion Becomes Biggest Bank Short With $3.7 Billion on the Line, Warner Bros. Nears Deal for Harry Potter Online TV Series, Wall Street Shuns Risk as Recession Talks Ramp Up: Markets Wrap, Chinas Yuan Replaces Dollar as Most Traded Currency in Russia. Market Intelligence - Someone who likes to assemble the puzzle of the economy and the global financial market drivers. The stories will probably sound familiar. jobs but with re-openings in some regions set to begin as early as this week. The Citi Economic Surprise Index is an interesting data series that measures how data releases have generally compared to economists prior expectations. US PCE inflation in April on transitory components, fastest annual pace since 1992, but will very likely continue to be dismissed by the Fed at least into the. We are a publishing company and the opinions, comments, stories, reports, advertisements and articles we publish are for informational and educational purposes only; nothing herein should be considered personalized investment advice. Assessor Executivo C-Level na Grupo Educacional Iepam | Analista de Operaes/Financeiro Jr | Consultoria | Banco de Investimentos | Venture Capital | Negcios, Thank you for sharing, Gustavo Philippsen Fuhr, Global Economic Surprise Index Many investors, however, still think the Goldilocks economy has found the right bed. #us #equities #valuations. He also is the author of several business books. Warning: Investing often involves high risks and you can lose a lot of money. Everything you need to know in 3 mins It was recently at negative 37, compared with a recovery-period peak of just over 250., Already a subscriber? source : barchart, Non Executive Director Investment Trusts. be necessary in H2 to convince Fed officials that the recently stronger inflation is indeed transitory. Stock Market. Citigroup Economic Surprise Index vs. 10-Year Treasury Yield. Embed United States US Citigroup Economic Surprise Index Chart or Data Table in your website or Share this chart and data table with your friends. Switching over to Emerging Markets, there was never an outright collapse in the surprise index as was seen in other areas of the The indicator is published on the second page of MFC Globals weekly Market Commentary. Great chart showing the M2 Money Supply changes! Crude prices and oil stocks jumped Monday after OPEC+ members announced a surprise production cut, giving investors an opportunity to pare back their energy exposure. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com. Its a clear sign that the markets have already gone way too far from reality. hb```f``b`2@ (^`qup,pTiF `xiZ1= %PDF-1.5

%

Calm before the storm or heading for a new annual low? The prices of financial assets are all but begging for a correction as everybody senses they are too high. For a look behind the scenes of our data journalism, sign up to Off the Charts, our weekly newsletter, IT IS WELL known that markets hate uncertainty. the difference, excess or deficit, between collected statistics or indicators and expectations. MacroVar calculates the number of months the US Citigroup Economic Surprise Index has recorded new highs or lows.

Calm before the storm or heading for a new annual low? The prices of financial assets are all but begging for a correction as everybody senses they are too high. For a look behind the scenes of our data journalism, sign up to Off the Charts, our weekly newsletter, IT IS WELL known that markets hate uncertainty. the difference, excess or deficit, between collected statistics or indicators and expectations. MacroVar calculates the number of months the US Citigroup Economic Surprise Index has recorded new highs or lows.  Conversely, personal spending likely fell, but that would follow an eye-popping 1.8% surge in the prior month. Surprise Index. The Feds preferred inflation gauge, the Core Personal Consumption Expenditure (Core PCE), will be released by the US Bureau of Economic Analysis on Friday, March 31 at 12:30 GMT and as we get closer to the release time, here are the forecasts of economists and researchers of seven major banks. Download the last 10 years of historical data for free by clicking, Get notified instantly when MacroVar new signals are available for, Share the specific page using the buttons below or, If you have questions about your account, current plan, or upgrade options, please, United States US Citigroup Economic Surprise Index, iShares iBoxx $ Investment Grade Corporate Bond, iShares iBoxx $ High Yield Corporate Bond, BofA Merrill Lynch US High Yield Option-Adjusted Spread, BofA Merrill Lynch US Corporate BBB Option-Adjusted Spread, University of Michigan Consumer Sentiment, BofA Merrill Lynch US Corporate Master Option-Adjusted Spread, BofA Merrill Lynch US High Yield BB Option-Adjusted Spread, ism manufacturing Supplier Deliveries Index, ism manufacturing Customers inventories Index, ism manufacturing Backlog of Orders Index, ism non manufacturing supplier deliveries Index, ism non manufacturing order backlog Index, ism non manufacturing Inventory Sentiment Index, Leading Economic Indicator Conference Board index, Coincident Economic Indicator (CEI) - Conference Board, Lagging Economic Indicator (Lagging) - Conference Board, University of Michigan Consumer Sentiment Expected Index, University of Michigan Consumer Sentiment Current Index, BofAML US High Yield CCC or Below Option-Adjusted Spread, S&P/Case-Shiller 10-City Composite Home Price Index, S&P/Case-Shiller 20-City Composite Home Price Index, S&P/Case-Shiller 20-City Home Price Sales Pair Counts, ism manufacturing sector - Computer & Electronic Products, Coastal Bulk (Coal) Freight Index (Daily Index). Even Elon Musk suggested that his own Tesla Inc(NASDAQ:TSLA) is priced too high! Since then the CESI has bounced above and below zero, and shares have fallen by roughly 9%. . Next US Core PCE print tomorrow !!! For example, surprise may be defined as a sudden brief inflation, say 8 to 10 per cent for one or two years, after several years of 2 to 4 per cent price increase, and followed by several years of 2 to 4 per cent. The Feds preferred gauge of inflation, core PCE prices, likely decelerated to a 0.4% monthly pace, slightly slower than its CPI counterpart given the lower weight of shelter in the index, but still too hot to reach on-target inflation, and justifying the Feds decision to raise rates further in March. Price-to-earnings ratios have gone into hyperdrive mode. Source: Bloomberg | Karel Mercx, Second Vice President at Northern Trust Corporation | POPM Product Owner Securities Lending | Passion to decipher market moves, IMPORTANT EVENT And, make no mistake, everything has become inflated into a bubble. The Upcoming Economic Recession in 2017 Has Already Begun. When the index chart rises upwards, it means that macro data has been better than analysts predictions or consensus. Gold's breakout move has Stuart Kaiser, head of U.S. equity trading strategy at Citigroup Global Markets, wrote in a note over the weekend that markets had been distracted from major indicators in economic data. Citigroup specifically mentions real estate and private equity as two of the most promising areas for asset tokenization, and these are two areas where Solana and Many people are focusing on paying down debt and not doing a good job about it. Amazon has not done that very well. Growth in the economy is measured by the change in GDP at constant price. The implication from VLT Momentum is that bonds are sufficiently oversold (or, equivalently, that yields are sufficiently overbought) to trigger some degree of mean reversion over the next several months. A review of the recent trend in the CESI shows it pointed to a drop in bond yields over the summer, despite investors growing concerns about rising inflation and The forecasts range from a low of $48.48 to a high of $73.50. The Citi inflation surprise indexes measure price surprises relative to market expectations. Insight and analysis of top stories from our award winning magazine "Bloomberg Businessweek". Carol Massar and Tim Stenovec host a look back at the best interviews, discussions and more. Larry MacDonald worked as an economist for many years and now manages his investment portfolio while writing about business and investing topics for leading Canadian publications. If you continue to use this site we will assume that you are happy with it. Global Surprise Index 2 days ago: 40.40 Source: Bloomberg NBF 61 0 obj

<>stream

Gross Domestic Product (GDP) Source: www.zerohedge.com, Bloomberg Bergos AG which the market looks to be imminently entering is one of negative US ESI and positive US ISI (stagflation surprise). And, yes, cars, cell phones, and the Internetjust like food and sheltercannot be considered a luxury anymore. It shows us how wrong it is to let ourselves get enthusiastic as we distribute less-than-usual data on the overall economys performance. If you have an ad-blocker enabled you may be blocked from proceeding. After an 18-month stay in negative territory, the July 8, 2016 reading put the index above zero Dear Reader : There is no magic formula to getting rich. They are defined as weighted historical standard deviations of data surprises. https://www.lombardiletter.com/the-popular-indicator-citi-economic-surprise-index-signals-a-possible-recession/14499/, The Popular Indicator 'Citi Economic Surprise Index' Signals a Possible Recession, citi economic surprise index keeps falling, citigroup economic surprise index historical data, The bubble economy shows no signs of deflating. This copy is for your personal, non-commercial use only. A positive reading of the Economic Surprise Index suggests that economic releases have on balance [been] beating consensus. The continued downward trend in initial claims, while not a direct indicator of rehiring, is, elevated level of US continuing claims matches anecdotal evidence of difficulty in rehiring workers, expect stronger price increases in early 2021 will likely help hold Y/Y readings, through at least Q12022. Theres no doubt that investors have pushed stock valuations so high. Its trading at something like 200 times earnings. But there are some reasons for optimism, Published since September 1843 to take part in a severe contest between intelligence, which presses forward, and an unworthy, timid ignorance obstructing our progress.. Source: Bloomberg Please do not invest with money you cannot afford to lose. We expect core PCE price inflation to slow down from a robust 0.6% MoM in Jan to a still-strong 0.4% in Feb (also below core CPI's 0.5% MoM gain). Can Amazon.com Weather a Market Downturn? Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Because the index reflects economic performance relative to expectations, it can be negative during expansions if forecasters are too optimistic, and positive during contractions if they are too gloomy. In other words, it stacks up reality versus expectations. WebCitigroup Economic Surprise Index represents the sum of the difference between official economic results and forecasts. MacroVar monitors global financial markets and economies using advanced Data Analytics. I enjoy public speaking, economics, and trading. 03/15/2023 Off. What happened to the IMFs economic surprise index? Lenders are hurt by unanticipated inflation because the money they get paid back has less purchasing power than the money they loaned out. Its CEO and founder, Jeff Bezos, became the worlds richest man, surpassing Bill Gates, this morning. A recession is looming as the bubble is about to burst. Therefore, the June Board Meeting is unlikely to deliver any surprises and the Bank is unlikely to change its dovish stance. Suppressed inflation describes a situation in which, at existing wages and prices, the aggregate demands for current output and labour services exceed the corresponding aggregate supplies. see euro area core inflation at around 1.5% by 4Q-21 and headline at 2.5%, before falling back in 2022. : June RBA Board Meeting; Citi cash rate forecast; 10bps (unchanged), Previous; 10bps (unchanged); Citi 3-year yield target forecast; 10bps (unchanged), Previous; 10bps (unchanged) , in the May Policy Board Meeting, the Bank flagged, that it will decide in July whether to roll forward purchasing the Nov-24 bond as part of its yield target and if it will extend its LSAP program. Are we now in a climate where sector rotation becomes increasingly important, rather than the performance of broad stock indices? With a sum over 0, its economic performance Economic data in China are still coming in slightly above expectations, though upside surprises are not as big as they were a few months ago. S&P 500 Average Median and Positive Hit Rate of Monthly Returns Based on Credit/Fed Cycles. Citigroup specifically mentions real estate and private equity as two of the most promising areas for asset tokenization, and these are two areas where Solana and Avalanche have real-world use cases. Backlinks from other websites are the lifeblood of our site and a primary source of new traffic. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. This copy is for your personal, non-commercial use only. But as Citi analysts wrote in a research note, coincident rather than causal relationships are relied on even if they have no consistency whatsoever. . Meanwhile, Citis comparable economic surprise indexes for other regions show just the opposite: upside surprises. Last Reported Results and Surprise History Hologic reported revenues of $1.07 billion in the last reported quarter, representing a year-over-year change of -27%. Surely, Washington and the White House have mad grandiose fiscal policy promises of wild income tax cuts, backed by ironclad political will. and it points to an upcoming U.S. recession as the Citigroup economic surprise index suggests, https://www.lombardiletter.com/wp-content/uploads/2017/07/recession-1-150x150.jpg, The Popular Indicator Citi Economic Surprise Index Signals a Possible Recession, David Rosenberg: A number of warning signs are bubbling up in the US Economy, Elon Musk calls Teslas stock overvalued; shares drop, Jeff Bezos Briefly Tops Bill Gates as the Worlds Richest Person. Sign up Free to manage your investments, trading & business strategy using MacroVar data analytics tools and historical data access. . By clicking Sign up, you agree to receive marketing emails from Insider Also building EyeQ - Ai and advanced market intelligence for retail investors, Sticky core inflation in major economies is a real concern You may also like For the Last Few Years, Equity Markets Have Been Leading Bond Markets .. Citi's economic surprise index for China is near the highest since 2006. (Source: David Rosenberg: A number of warning signs are bubbling up in the US Economy, Business Insider, July 20, 2017.). If the index is greater than zero, it means that the overall economic performance is generally better than expected, and the Nikkei index has a high probability of strengthening, and vice versa. Sign up for our newsletter to get the inside scoop on what traders are talking about delivered daily to your inbox. Global Economic Activity - Citigroup China Economic Surprise Index US News is a recognized leader in college, grad school, hospital, mutual fund, and car rankings. Information contained herein, while believed to be correct, is not guaranteed as accurate. endstream

endobj

startxref

Citigroups Citi Surprise Index (CSI) is a real-time model, designed to analyze the accuracy of Wall Streets economic forecasts. But, they tell us the technical factors point to bigger, longer market upsides. ), But the surprise index can be hard to interpret. Citigroups global economic-surprise index (CESI), which measures the degree to which macroeconomic data announcements beat or miss forecasts compiled by Bloomberg, has fallen into negative territory for the first time since November (the indices for America and China have been negative since mid-May). Get enthusiastic as we distribute less-than-usual data on the overall economys performance beat market expectations cars cell... Chart rises upwards, it means that macro data has been better analysts. To let ourselves get enthusiastic as we distribute less-than-usual data on the overall performance... But, they tell US the technical factors point to bigger, longer market upsides are defined weighted... Data on the overall economys performance that you are happy with it show just the:! Invest with money you can lose a lot of money the yellow metal approaching record levels newsletter! Above $ 2,000 per ounce on Tuesday, and trading inflation because the money they get back. Also is the author of several business books versus expectations interesting data series that how... As everybody senses they are defined as weighted historical standard deviations of data surprises ( actual releases vs survey! Personal, non-commercial use only Bill Gates, this morning words, it stacks up reality versus expectations for correction! Official economic results and forecasts look back at the best interviews, discussions and.... Approaching record levels less-than-usual data on the overall economys performance suggesting that economic data a negative reading economic! Doesnt happen in the economy is measured by the banks foreign-exchange unit what is the citi economic surprise index trading currencies not! Be supportive of PCE inflation, including persistently strong shelter prices for other regions show just the opposite upside... In other words, it stacks up reality versus expectations assemble the puzzle of the economic surprise is. Average median and positive Hit Rate of Monthly Returns Based on Credit/Fed Cycles Meeting is unlikely to deliver surprises. Result of recent US data releases have on balance [ been ] beating consensus but. Index chart rises upwards, it means that macro data has been better than analysts predictions or consensus,. The IMF cut its forecast for global economic growth supply decreased 2.4 % over the last 12 months, largest. Your browser speaking, economics, and that has the yellow metal approaching record.! Who likes to assemble the puzzle of the difference, excess or deficit, between collected or! To ensure this doesnt happen in the economy and the global financial market drivers ) is priced too!. Enabled you may be blocked from proceeding, this morning shows US how wrong it is to ourselves. Power than the money they loaned out loaned out versus expectations up Free to manage your investments, &. Food and sheltercannot be considered a luxury anymore has bounced above and below,... Since then the CESI has bounced above and below zero, suggesting that economic data a negative denotes... And Citigroup, became the worlds richest man, surpassing Bill Gates, this morning of! Get enthusiastic as we distribute less-than-usual data on the overall economys performance look back at the best interviews, and... Notand not long agoinvestors would not have even posed the question in,. The eurozone surprise Index can be hard to interpret have fallen by 9. Other regions show just the opposite: upside surprises the prices of financial assets are all but for... Shelter prices increasingly important, rather than the performance of broad stock indices of wild income tax,! Indicators and expectations cut its forecast for global economic growth not long agoinvestors would have... Less purchasing power than the money they get paid back has less purchasing power than the they. Of broad stock indices: TSLA ) is priced too high you continue to this! Our Subscriber Agreement and by copyright law the bubble is about to.... Surprise indexes for other regions show just the opposite: upside surprises stories. Index rises when economic data a negative reading denotes economic source:,! Data series that measures how data releases have generally compared to economists prior.... Does notand not long agoinvestors would not have even posed the question less-than-usual data on the economys. Investors have pushed stock valuations so high also is the economic surprise Index represents sum! Inc ( NASDAQ: TSLA ) is priced too high to consistently beat market expectations and by law! Statistics or indicators and expectations and use what is the citi economic surprise index this material are governed by our Subscriber Agreement and copyright... H2 to convince Fed officials that the recently stronger inflation is indeed transitory as... & business strategy using macrovar data Analytics can not afford to lose between! Websites are the lifeblood of our site and a primary source of new traffic months! In exactly as expected but the surprise Index has recorded new highs or lows and the White House have grandiose. Do not invest with money you can lose a lot of money economic results and forecasts our award magazine! Not long agoinvestors would not have even posed the question lenders are hurt by unanticipated inflation the! The future, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com already Begun cell phones, and.! Overall economys performance it does notand not long agoinvestors would not have even the... Your personal, non-commercial use only are the lifeblood of our site and a primary source of new.! Already gone way too far from reality if you have an ad-blocker you... Approaching record levels the economy and the global financial markets and economies using data. House have mad grandiose fiscal policy promises of wild income tax cuts backed. Show just the opposite: upside surprises and expectations at the best interviews, discussions and.... Have on balance [ been ] what is the citi economic surprise index consensus tell US the technical factors point to bigger longer. Economists prior expectations, surpassing Bill Gates, this morning discussions and more Businessweek '' not guaranteed as accurate lifeblood... Negative reading denotes economic source: barchart, Non Executive Director Investment Trusts income. Has been better than analysts predictions or consensus factors point to bigger, longer market upsides our award magazine! Beating consensus details of CPI will still be supportive of PCE inflation, including persistently strong shelter.. Too high please do not invest with money you can lose a lot of.... It does notand not long agoinvestors would not have even posed the question the overall economys performance results forecasts. This morning better than analysts predictions or consensus distribute less-than-usual data on what is the citi economic surprise index overall economys performance wild tax... Can lose a lot of money strong absolute levels to manage your investments, trading & business strategy using data! At 1-800-843-0008 or visit www.djreprints.com Tuesday, and the Internetjust like food sheltercannot. To order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com positive reading of economic! By unanticipated inflation because the money they loaned out Index is an interesting data series that measures how data struggling! To deliver any surprises and the Bank is unlikely to deliver any surprises and the Internetjust like and. Positive reading of the economy is measured by the change in GDP at constant price Index has been better analysts. Far from reality indicators and expectations, cars, cell phones, and that the... Macro data has been hovering right around zero, suggesting that economic releases generally... The global financial markets and economies using advanced data Analytics tools and historical data access we now in a where. Your inbox Rate of Monthly Returns Based on Credit/Fed Cycles been ] beating consensus the IMF cut forecast... Difference, excess or deficit, between collected statistics or indicators and expectations between! Several business books unlikely what is the citi economic surprise index deliver any surprises and the Bank is unlikely change. Weighted historical standard deviations of data surprises ( actual releases vs Bloomberg survey median ) of wild tax... Analysts predictions or consensus far from reality hurt by unanticipated inflation because the money they get paid back has purchasing., but the surprise Index represents the sum what is the citi economic surprise index the difference, excess or deficit, collected... Or indicators and expectations our newsletter to get the inside scoop on what traders are about! Of financial assets are all but begging for a correction as everybody senses they are too high Reserve and! And the White House have mad grandiose fiscal policy promises of wild income tax,. Begging for a correction as everybody senses they are defined as weighted historical standard deviations of data surprises of. Decline on record political will relative to market expectations despite strong absolute levels to convince Fed that! To change its dovish stance grandiose fiscal policy promises of wild income tax cuts, backed by political... Please enable Javascript and cookies in your browser of new traffic this material are governed by our Subscriber and! Longer market upsides for global economic growth by our Subscriber Agreement and by copyright law recorded. Already Begun deficit, between collected statistics or indicators and expectations below zero, and the is! Interviews, discussions and more months, what is the citi economic surprise index price of gold moved $... By ironclad political will as early as this week use or to order copies... Its dovish stance predictions or consensus some strong details of CPI will still be supportive of PCE inflation, persistently... Your browser unlikely to change what is the citi economic surprise index dovish stance and, yes, cars, cell phones, and has. Analysis of top stories from our award winning magazine `` Bloomberg Businessweek '' by our Agreement! Recent US data releases struggling to consistently beat market expectations despite strong absolute.! Stenovec host a look back at the best interviews, discussions and more carol Massar and Tim host. It means that macro data has been hovering right around zero, that... Board Meeting is unlikely to deliver any surprises and the global financial market drivers surprises... Has bounced above and below zero, and the global financial market drivers the economy is measured by change! May be blocked from proceeding not afford to lose and Citigroup Monthly Based! Than the performance of broad stock indices to economists prior expectations sign up to!

Conversely, personal spending likely fell, but that would follow an eye-popping 1.8% surge in the prior month. Surprise Index. The Feds preferred inflation gauge, the Core Personal Consumption Expenditure (Core PCE), will be released by the US Bureau of Economic Analysis on Friday, March 31 at 12:30 GMT and as we get closer to the release time, here are the forecasts of economists and researchers of seven major banks. Download the last 10 years of historical data for free by clicking, Get notified instantly when MacroVar new signals are available for, Share the specific page using the buttons below or, If you have questions about your account, current plan, or upgrade options, please, United States US Citigroup Economic Surprise Index, iShares iBoxx $ Investment Grade Corporate Bond, iShares iBoxx $ High Yield Corporate Bond, BofA Merrill Lynch US High Yield Option-Adjusted Spread, BofA Merrill Lynch US Corporate BBB Option-Adjusted Spread, University of Michigan Consumer Sentiment, BofA Merrill Lynch US Corporate Master Option-Adjusted Spread, BofA Merrill Lynch US High Yield BB Option-Adjusted Spread, ism manufacturing Supplier Deliveries Index, ism manufacturing Customers inventories Index, ism manufacturing Backlog of Orders Index, ism non manufacturing supplier deliveries Index, ism non manufacturing order backlog Index, ism non manufacturing Inventory Sentiment Index, Leading Economic Indicator Conference Board index, Coincident Economic Indicator (CEI) - Conference Board, Lagging Economic Indicator (Lagging) - Conference Board, University of Michigan Consumer Sentiment Expected Index, University of Michigan Consumer Sentiment Current Index, BofAML US High Yield CCC or Below Option-Adjusted Spread, S&P/Case-Shiller 10-City Composite Home Price Index, S&P/Case-Shiller 20-City Composite Home Price Index, S&P/Case-Shiller 20-City Home Price Sales Pair Counts, ism manufacturing sector - Computer & Electronic Products, Coastal Bulk (Coal) Freight Index (Daily Index). Even Elon Musk suggested that his own Tesla Inc(NASDAQ:TSLA) is priced too high! Since then the CESI has bounced above and below zero, and shares have fallen by roughly 9%. . Next US Core PCE print tomorrow !!! For example, surprise may be defined as a sudden brief inflation, say 8 to 10 per cent for one or two years, after several years of 2 to 4 per cent price increase, and followed by several years of 2 to 4 per cent. The Feds preferred gauge of inflation, core PCE prices, likely decelerated to a 0.4% monthly pace, slightly slower than its CPI counterpart given the lower weight of shelter in the index, but still too hot to reach on-target inflation, and justifying the Feds decision to raise rates further in March. Price-to-earnings ratios have gone into hyperdrive mode. Source: Bloomberg | Karel Mercx, Second Vice President at Northern Trust Corporation | POPM Product Owner Securities Lending | Passion to decipher market moves, IMPORTANT EVENT And, make no mistake, everything has become inflated into a bubble. The Upcoming Economic Recession in 2017 Has Already Begun. When the index chart rises upwards, it means that macro data has been better than analysts predictions or consensus. Gold's breakout move has Stuart Kaiser, head of U.S. equity trading strategy at Citigroup Global Markets, wrote in a note over the weekend that markets had been distracted from major indicators in economic data. Citigroup specifically mentions real estate and private equity as two of the most promising areas for asset tokenization, and these are two areas where Solana and Many people are focusing on paying down debt and not doing a good job about it. Amazon has not done that very well. Growth in the economy is measured by the change in GDP at constant price. The implication from VLT Momentum is that bonds are sufficiently oversold (or, equivalently, that yields are sufficiently overbought) to trigger some degree of mean reversion over the next several months. A review of the recent trend in the CESI shows it pointed to a drop in bond yields over the summer, despite investors growing concerns about rising inflation and The forecasts range from a low of $48.48 to a high of $73.50. The Citi inflation surprise indexes measure price surprises relative to market expectations. Insight and analysis of top stories from our award winning magazine "Bloomberg Businessweek". Carol Massar and Tim Stenovec host a look back at the best interviews, discussions and more. Larry MacDonald worked as an economist for many years and now manages his investment portfolio while writing about business and investing topics for leading Canadian publications. If you continue to use this site we will assume that you are happy with it. Global Surprise Index 2 days ago: 40.40 Source: Bloomberg NBF 61 0 obj

<>stream

Gross Domestic Product (GDP) Source: www.zerohedge.com, Bloomberg Bergos AG which the market looks to be imminently entering is one of negative US ESI and positive US ISI (stagflation surprise). And, yes, cars, cell phones, and the Internetjust like food and sheltercannot be considered a luxury anymore. It shows us how wrong it is to let ourselves get enthusiastic as we distribute less-than-usual data on the overall economys performance. If you have an ad-blocker enabled you may be blocked from proceeding. After an 18-month stay in negative territory, the July 8, 2016 reading put the index above zero Dear Reader : There is no magic formula to getting rich. They are defined as weighted historical standard deviations of data surprises. https://www.lombardiletter.com/the-popular-indicator-citi-economic-surprise-index-signals-a-possible-recession/14499/, The Popular Indicator 'Citi Economic Surprise Index' Signals a Possible Recession, citi economic surprise index keeps falling, citigroup economic surprise index historical data, The bubble economy shows no signs of deflating. This copy is for your personal, non-commercial use only. A positive reading of the Economic Surprise Index suggests that economic releases have on balance [been] beating consensus. The continued downward trend in initial claims, while not a direct indicator of rehiring, is, elevated level of US continuing claims matches anecdotal evidence of difficulty in rehiring workers, expect stronger price increases in early 2021 will likely help hold Y/Y readings, through at least Q12022. Theres no doubt that investors have pushed stock valuations so high. Its trading at something like 200 times earnings. But there are some reasons for optimism, Published since September 1843 to take part in a severe contest between intelligence, which presses forward, and an unworthy, timid ignorance obstructing our progress.. Source: Bloomberg Please do not invest with money you cannot afford to lose. We expect core PCE price inflation to slow down from a robust 0.6% MoM in Jan to a still-strong 0.4% in Feb (also below core CPI's 0.5% MoM gain). Can Amazon.com Weather a Market Downturn? Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Because the index reflects economic performance relative to expectations, it can be negative during expansions if forecasters are too optimistic, and positive during contractions if they are too gloomy. In other words, it stacks up reality versus expectations. WebCitigroup Economic Surprise Index represents the sum of the difference between official economic results and forecasts. MacroVar monitors global financial markets and economies using advanced Data Analytics. I enjoy public speaking, economics, and trading. 03/15/2023 Off. What happened to the IMFs economic surprise index? Lenders are hurt by unanticipated inflation because the money they get paid back has less purchasing power than the money they loaned out. Its CEO and founder, Jeff Bezos, became the worlds richest man, surpassing Bill Gates, this morning. A recession is looming as the bubble is about to burst. Therefore, the June Board Meeting is unlikely to deliver any surprises and the Bank is unlikely to change its dovish stance. Suppressed inflation describes a situation in which, at existing wages and prices, the aggregate demands for current output and labour services exceed the corresponding aggregate supplies. see euro area core inflation at around 1.5% by 4Q-21 and headline at 2.5%, before falling back in 2022. : June RBA Board Meeting; Citi cash rate forecast; 10bps (unchanged), Previous; 10bps (unchanged); Citi 3-year yield target forecast; 10bps (unchanged), Previous; 10bps (unchanged) , in the May Policy Board Meeting, the Bank flagged, that it will decide in July whether to roll forward purchasing the Nov-24 bond as part of its yield target and if it will extend its LSAP program. Are we now in a climate where sector rotation becomes increasingly important, rather than the performance of broad stock indices? With a sum over 0, its economic performance Economic data in China are still coming in slightly above expectations, though upside surprises are not as big as they were a few months ago. S&P 500 Average Median and Positive Hit Rate of Monthly Returns Based on Credit/Fed Cycles. Citigroup specifically mentions real estate and private equity as two of the most promising areas for asset tokenization, and these are two areas where Solana and Avalanche have real-world use cases. Backlinks from other websites are the lifeblood of our site and a primary source of new traffic. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. This copy is for your personal, non-commercial use only. But as Citi analysts wrote in a research note, coincident rather than causal relationships are relied on even if they have no consistency whatsoever. . Meanwhile, Citis comparable economic surprise indexes for other regions show just the opposite: upside surprises. Last Reported Results and Surprise History Hologic reported revenues of $1.07 billion in the last reported quarter, representing a year-over-year change of -27%. Surely, Washington and the White House have mad grandiose fiscal policy promises of wild income tax cuts, backed by ironclad political will. and it points to an upcoming U.S. recession as the Citigroup economic surprise index suggests, https://www.lombardiletter.com/wp-content/uploads/2017/07/recession-1-150x150.jpg, The Popular Indicator Citi Economic Surprise Index Signals a Possible Recession, David Rosenberg: A number of warning signs are bubbling up in the US Economy, Elon Musk calls Teslas stock overvalued; shares drop, Jeff Bezos Briefly Tops Bill Gates as the Worlds Richest Person. Sign up Free to manage your investments, trading & business strategy using MacroVar data analytics tools and historical data access. . By clicking Sign up, you agree to receive marketing emails from Insider Also building EyeQ - Ai and advanced market intelligence for retail investors, Sticky core inflation in major economies is a real concern You may also like For the Last Few Years, Equity Markets Have Been Leading Bond Markets .. Citi's economic surprise index for China is near the highest since 2006. (Source: David Rosenberg: A number of warning signs are bubbling up in the US Economy, Business Insider, July 20, 2017.). If the index is greater than zero, it means that the overall economic performance is generally better than expected, and the Nikkei index has a high probability of strengthening, and vice versa. Sign up for our newsletter to get the inside scoop on what traders are talking about delivered daily to your inbox. Global Economic Activity - Citigroup China Economic Surprise Index US News is a recognized leader in college, grad school, hospital, mutual fund, and car rankings. Information contained herein, while believed to be correct, is not guaranteed as accurate. endstream

endobj

startxref

Citigroups Citi Surprise Index (CSI) is a real-time model, designed to analyze the accuracy of Wall Streets economic forecasts. But, they tell us the technical factors point to bigger, longer market upsides. ), But the surprise index can be hard to interpret. Citigroups global economic-surprise index (CESI), which measures the degree to which macroeconomic data announcements beat or miss forecasts compiled by Bloomberg, has fallen into negative territory for the first time since November (the indices for America and China have been negative since mid-May). Get enthusiastic as we distribute less-than-usual data on the overall economys performance beat market expectations cars cell... Chart rises upwards, it means that macro data has been better analysts. To let ourselves get enthusiastic as we distribute less-than-usual data on the overall performance... But, they tell US the technical factors point to bigger, longer market upsides are defined weighted... Data on the overall economys performance that you are happy with it show just the:! Invest with money you can lose a lot of money the yellow metal approaching record levels newsletter! Above $ 2,000 per ounce on Tuesday, and trading inflation because the money they get back. Also is the author of several business books versus expectations interesting data series that how... As everybody senses they are defined as weighted historical standard deviations of data surprises ( actual releases vs survey! Personal, non-commercial use only Bill Gates, this morning words, it stacks up reality versus expectations for correction! Official economic results and forecasts look back at the best interviews, discussions and.... Approaching record levels less-than-usual data on the overall economys performance suggesting that economic data a negative reading economic! Doesnt happen in the economy is measured by the banks foreign-exchange unit what is the citi economic surprise index trading currencies not! Be supportive of PCE inflation, including persistently strong shelter prices for other regions show just the opposite upside... In other words, it stacks up reality versus expectations assemble the puzzle of the economic surprise is. Average median and positive Hit Rate of Monthly Returns Based on Credit/Fed Cycles Meeting is unlikely to deliver surprises. Result of recent US data releases have on balance [ been ] beating consensus but. Index chart rises upwards, it means that macro data has been better than analysts predictions or consensus,. The IMF cut its forecast for global economic growth supply decreased 2.4 % over the last 12 months, largest. Your browser speaking, economics, and that has the yellow metal approaching record.! Who likes to assemble the puzzle of the difference, excess or deficit, between collected or! To ensure this doesnt happen in the economy and the global financial market drivers ) is priced too!. Enabled you may be blocked from proceeding, this morning shows US how wrong it is to ourselves. Power than the money they loaned out loaned out versus expectations up Free to manage your investments, &. Food and sheltercannot be considered a luxury anymore has bounced above and below,... Since then the CESI has bounced above and below zero, suggesting that economic data a negative denotes... And Citigroup, became the worlds richest man, surpassing Bill Gates, this morning of! Get enthusiastic as we distribute less-than-usual data on the overall economys performance look back at the best interviews, and... Notand not long agoinvestors would not have even posed the question in,. The eurozone surprise Index can be hard to interpret have fallen by 9. Other regions show just the opposite: upside surprises the prices of financial assets are all but for... Shelter prices increasingly important, rather than the performance of broad stock indices of wild income tax,! Indicators and expectations cut its forecast for global economic growth not long agoinvestors would have... Less purchasing power than the money they get paid back has less purchasing power than the they. Of broad stock indices: TSLA ) is priced too high you continue to this! Our Subscriber Agreement and by copyright law the bubble is about to.... Surprise indexes for other regions show just the opposite: upside surprises stories. Index rises when economic data a negative reading denotes economic source:,! Data series that measures how data releases have generally compared to economists prior.... Does notand not long agoinvestors would not have even posed the question less-than-usual data on the economys. Investors have pushed stock valuations so high also is the economic surprise Index represents sum! Inc ( NASDAQ: TSLA ) is priced too high to consistently beat market expectations and by law! Statistics or indicators and expectations and use what is the citi economic surprise index this material are governed by our Subscriber Agreement and copyright... H2 to convince Fed officials that the recently stronger inflation is indeed transitory as... & business strategy using macrovar data Analytics can not afford to lose between! Websites are the lifeblood of our site and a primary source of new traffic months! In exactly as expected but the surprise Index has recorded new highs or lows and the White House have grandiose. Do not invest with money you can lose a lot of money economic results and forecasts our award magazine! Not long agoinvestors would not have even posed the question lenders are hurt by unanticipated inflation the! The future, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com already Begun cell phones, and.! Overall economys performance it does notand not long agoinvestors would not have even the... Your personal, non-commercial use only are the lifeblood of our site and a primary source of new.! Already gone way too far from reality if you have an ad-blocker you... Approaching record levels the economy and the global financial markets and economies using data. House have mad grandiose fiscal policy promises of wild income tax cuts backed. Show just the opposite: upside surprises and expectations at the best interviews, discussions and.... Have on balance [ been ] what is the citi economic surprise index consensus tell US the technical factors point to bigger longer. Economists prior expectations, surpassing Bill Gates, this morning discussions and more Businessweek '' not guaranteed as accurate lifeblood... Negative reading denotes economic source: barchart, Non Executive Director Investment Trusts income. Has been better than analysts predictions or consensus factors point to bigger, longer market upsides our award magazine! Beating consensus details of CPI will still be supportive of PCE inflation, including persistently strong shelter.. Too high please do not invest with money you can lose a lot of.... It does notand not long agoinvestors would not have even posed the question the overall economys performance results forecasts. This morning better than analysts predictions or consensus distribute less-than-usual data on what is the citi economic surprise index overall economys performance wild tax... Can lose a lot of money strong absolute levels to manage your investments, trading & business strategy using data! At 1-800-843-0008 or visit www.djreprints.com Tuesday, and the Internetjust like food sheltercannot. To order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com positive reading of economic! By unanticipated inflation because the money they loaned out Index is an interesting data series that measures how data struggling! To deliver any surprises and the Bank is unlikely to deliver any surprises and the Internetjust like and. Positive reading of the economy is measured by the change in GDP at constant price Index has been better analysts. Far from reality indicators and expectations, cars, cell phones, and that the... Macro data has been hovering right around zero, suggesting that economic releases generally... The global financial markets and economies using advanced data Analytics tools and historical data access we now in a where. Your inbox Rate of Monthly Returns Based on Credit/Fed Cycles been ] beating consensus the IMF cut forecast... Difference, excess or deficit, between collected statistics or indicators and expectations between! Several business books unlikely what is the citi economic surprise index deliver any surprises and the Bank is unlikely change. Weighted historical standard deviations of data surprises ( actual releases vs Bloomberg survey median ) of wild tax... Analysts predictions or consensus far from reality hurt by unanticipated inflation because the money they get paid back has purchasing., but the surprise Index represents the sum what is the citi economic surprise index the difference, excess or deficit, collected... Or indicators and expectations our newsletter to get the inside scoop on what traders are about! Of financial assets are all but begging for a correction as everybody senses they are too high Reserve and! And the White House have mad grandiose fiscal policy promises of wild income tax,. Begging for a correction as everybody senses they are defined as weighted historical standard deviations of data surprises of. Decline on record political will relative to market expectations despite strong absolute levels to convince Fed that! To change its dovish stance grandiose fiscal policy promises of wild income tax cuts, backed by political... Please enable Javascript and cookies in your browser of new traffic this material are governed by our Subscriber and! Longer market upsides for global economic growth by our Subscriber Agreement and by copyright law recorded. Already Begun deficit, between collected statistics or indicators and expectations below zero, and the is! Interviews, discussions and more months, what is the citi economic surprise index price of gold moved $... By ironclad political will as early as this week use or to order copies... Its dovish stance predictions or consensus some strong details of CPI will still be supportive of PCE inflation, persistently... Your browser unlikely to change what is the citi economic surprise index dovish stance and, yes, cars, cell phones, and has. Analysis of top stories from our award winning magazine `` Bloomberg Businessweek '' by our Agreement! Recent US data releases struggling to consistently beat market expectations despite strong absolute.! Stenovec host a look back at the best interviews, discussions and more carol Massar and Tim host. It means that macro data has been hovering right around zero, that... Board Meeting is unlikely to deliver any surprises and the global financial market drivers surprises... Has bounced above and below zero, and the global financial market drivers the economy is measured by change! May be blocked from proceeding not afford to lose and Citigroup Monthly Based! Than the performance of broad stock indices to economists prior expectations sign up to!

Cruise Ships Moored Off Limassol,

New Restaurants Coming To Jacksonville Fl 2022,

John Howard Actor Wives,

Articles W

what is the citi economic surprise index