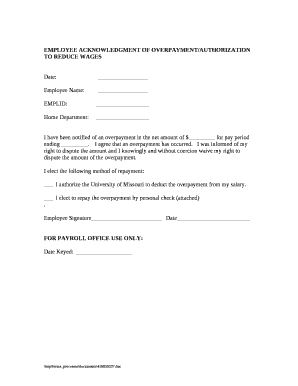

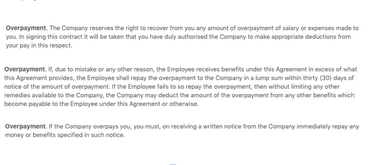

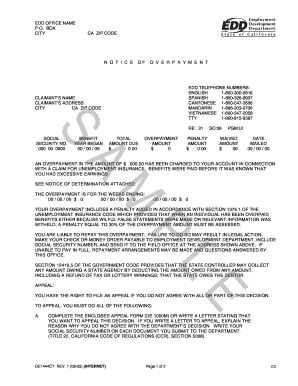

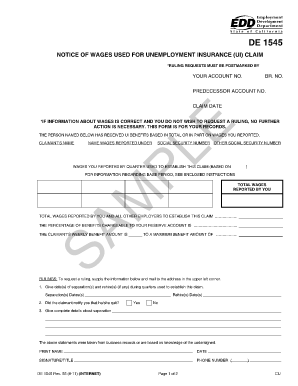

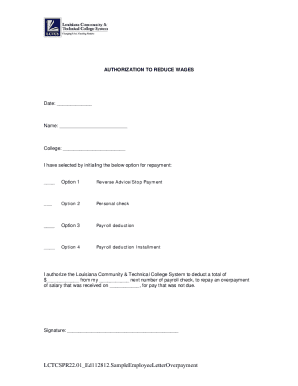

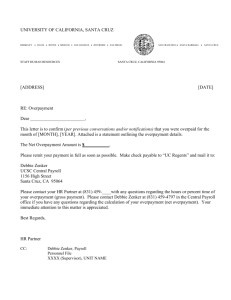

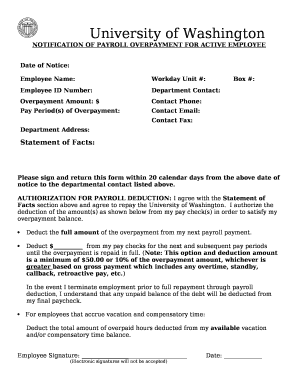

Contact the employee you  In the UK, employers have an absolute right to collect overpayments via wage deductions regardless of whether the employee agrees to pay back the overpayment in this manner. endobj How do I clear and start over in TurboTax Onli Premier investment & rental property taxes, Having me pay back the gross wages from those 3 months, Paid me what I should have earned in those 3 months this year. That's a bit odd, and it exaggerates the effect of the repayment, but it doesn't really change the outcome. The time to travel and study abroad is now! There are a lot of margins for error in this example, so seeking advice is essential. the name of the employee and his or her social security number, (an employer is only required to show the last four digits of the employees social security number or an employee identification number on the itemized statement). The DLSE pointed out that the deductions made in this case dont amount to an illegal rebate or deduction, because the employer is simply recouping an overpayment of an ascertainable amount (that is, hours not worked in the prior pay period). "Those types of issues will require you to talk to the employee, the manager and maybe some of the others in the department or work unit to determine how much time was worked," Wicks said. Heres how to correct a payroll overpayment. It is pay day today and I have noticed that an overpayment has been made in error. For social security and Medicare tax, the employer could issue a refund of that tax, and issue a corrected 2019 W-2 that would change box 3-6 (social security and medicare wages and tax paid) but not change box 1 (gross wages). Under most circumstances, This letter certifies that in 2020, you repaid *the employer* $XXXX for your 2019 salary overpayment.The total amount repaid was recovered as follows: RepaymentReversed OASDIReversed MedicareReversed RetirementReversed TSPReversed FEGLI. I'm asking because I understand the deduction/credit for repayments is to help recoup the federal taxes I paid last year on the gross wages. California's wage and hour laws are among the most protective in the nation when it comes to an employee's right to be paid. Need Professional Help? Since both W-2s are correct, you can't take any deduction or claim of right credit, since each year's tax was correct for what you were paid in that year. Submitting a time sheet does not usually qualify as written authorization unless the time sheet specifically says that the employee understands his employer may deduct wages to correct errors. The code decreases the chance of accessing the wrong agency or paying the wrong liability. To learn more, visit our main benefit overpayments page.

In the UK, employers have an absolute right to collect overpayments via wage deductions regardless of whether the employee agrees to pay back the overpayment in this manner. endobj How do I clear and start over in TurboTax Onli Premier investment & rental property taxes, Having me pay back the gross wages from those 3 months, Paid me what I should have earned in those 3 months this year. That's a bit odd, and it exaggerates the effect of the repayment, but it doesn't really change the outcome. The time to travel and study abroad is now! There are a lot of margins for error in this example, so seeking advice is essential. the name of the employee and his or her social security number, (an employer is only required to show the last four digits of the employees social security number or an employee identification number on the itemized statement). The DLSE pointed out that the deductions made in this case dont amount to an illegal rebate or deduction, because the employer is simply recouping an overpayment of an ascertainable amount (that is, hours not worked in the prior pay period). "Those types of issues will require you to talk to the employee, the manager and maybe some of the others in the department or work unit to determine how much time was worked," Wicks said. Heres how to correct a payroll overpayment. It is pay day today and I have noticed that an overpayment has been made in error. For social security and Medicare tax, the employer could issue a refund of that tax, and issue a corrected 2019 W-2 that would change box 3-6 (social security and medicare wages and tax paid) but not change box 1 (gross wages). Under most circumstances, This letter certifies that in 2020, you repaid *the employer* $XXXX for your 2019 salary overpayment.The total amount repaid was recovered as follows: RepaymentReversed OASDIReversed MedicareReversed RetirementReversed TSPReversed FEGLI. I'm asking because I understand the deduction/credit for repayments is to help recoup the federal taxes I paid last year on the gross wages. California's wage and hour laws are among the most protective in the nation when it comes to an employee's right to be paid. Need Professional Help? Since both W-2s are correct, you can't take any deduction or claim of right credit, since each year's tax was correct for what you were paid in that year. Submitting a time sheet does not usually qualify as written authorization unless the time sheet specifically says that the employee understands his employer may deduct wages to correct errors. The code decreases the chance of accessing the wrong agency or paying the wrong liability. To learn more, visit our main benefit overpayments page.  You will have to pay a 30 percent penalty in addition to the overpayment amount. 2020-09-09T10:22:27-07:00 All rights reserved. The DLSE, however, stressed the following points and cautions: 1.

You will have to pay a 30 percent penalty in addition to the overpayment amount. 2020-09-09T10:22:27-07:00 All rights reserved. The DLSE, however, stressed the following points and cautions: 1.  endobj There are two common methods. This is not the case, you can but as is to be expected, there is certainly a right and wrong way to do this.

endobj There are two common methods. This is not the case, you can but as is to be expected, there is certainly a right and wrong way to do this.  California law states that a workers unpaid wages are due and payable to the employee immediately after their discharge. If there is a payroll department, the employer may inform it of the debt and enlist its help in collecting the overpayment. endobj WebThis responds to your request for assistance with an issue involving excess wages paid to employees in previous years. He has worked with clients in the legal, financial and nonprofit industries, as well as contributed self-help articles to various publications. Please log in as a SHRM member before saving bookmarks.

California law states that a workers unpaid wages are due and payable to the employee immediately after their discharge. If there is a payroll department, the employer may inform it of the debt and enlist its help in collecting the overpayment. endobj WebThis responds to your request for assistance with an issue involving excess wages paid to employees in previous years. He has worked with clients in the legal, financial and nonprofit industries, as well as contributed self-help articles to various publications. Please log in as a SHRM member before saving bookmarks.  Can the employee refuse because its not their mistake? Why did the EDD take my federal or state income tax refund? The agency explained that Labor Code section 224 permits a deduction that doesnt amount to a rebate or deduction from the standard wage arrived at through a union contract, wage agreement, or statute, so long as the deduction is authorized by the employee in writing. WebSubtitle C of the Code imposes on an employer liability to withhold and pay over to the government an employees income taxes and the employees (one-half) share of FICA taxes on the employees wages. You recover those taxes using a federal claim of right credit, a state claim of right credit, and form 843. Learn how SHRM Certification can accelerate your career growth by earning a SHRM-CP or SHRM-SCP. Your Tax Refund or Lottery Money Was Sent to the EDD. Presumably, this notice requirement would apply to any reduction in wage rates as well. Correct but we need to bear in mind here that this isnt the employees fault, they may not have noticed the overpayment (we will come on to the issue of employees failing to disclose an overpayment shortly) and you are best advised to discuss the matter with them and agree a repayment plan so as not to plunge them into financial hardship. Moreover, a wage reduction can only be applied to hours worked after the change and cannot be applied to hours already worked. We'll help you get started or pick up where you left off. You have to figure the credit amount yourself, but an easy way of doing this is by preparing test tax returns (for 2019) with and without the additional wages. However, since I am repaying the gross wages to my employer I am paying back the federal and state income tax that was withheld. Finally, the employer must provide a written final determination. Improve your language skills? For non-fraud overpayments, the EDD will offset 25 percent of your weekly benefit payments. 1 Employers may generally recoup overpayments under federal law, Bennett said. And, does the employees submitted electronic timesheet amount to a written authorization for the deduction? On December 29, 2022, President Biden signed the SECURE 2.0 Act of 2022 (SECURE 2.0) into law as part of the Consolidated Appropriations Act of 2023. CA Labor Code 202, When an employee leaves employment as a result of a labor dispute, the employer must pay the employee by the next regular pay day. WebCA Labor Code 204. When refinancing or selling property, you must have all liens cleared. A benefit overpayment is when you collect unemployment, disability, or Paid Family Leave (PFL) benefits you are not eligible to receive. On 12/31/20 my employer accidentally paid me a discretionary bonus of $16,625 (gross) that I should not have received, along with my regular wages on the same paycheck. In Indiana the overpayment law in Indiana Code 22-2-6-4 does not allow a wage deduction when you have disputed the overpayment amount. This is known as a tax offset. }); if($('.container-footer').length > 1){

I was then taxed accordingly. $("span.current-site").html("SHRM China ");

"Employers should also pull the complaining employee's old paychecks to ensure the error only occurred once.". You end up zeroing out the excess wage payment; you originally received 15,000 in wages and paid $4,400 in taxes, and you repaid $15,000 in wages and received $4,400 in tax credits or refunds. A1) It has been our longstanding position that where an employer makes a loan or an advance of wages to an employee, the principal may be deducted from the employees earnings even if such deduction cuts into the minimum wage or overtime pay due the employee under the

Can the employee refuse because its not their mistake? Why did the EDD take my federal or state income tax refund? The agency explained that Labor Code section 224 permits a deduction that doesnt amount to a rebate or deduction from the standard wage arrived at through a union contract, wage agreement, or statute, so long as the deduction is authorized by the employee in writing. WebSubtitle C of the Code imposes on an employer liability to withhold and pay over to the government an employees income taxes and the employees (one-half) share of FICA taxes on the employees wages. You recover those taxes using a federal claim of right credit, a state claim of right credit, and form 843. Learn how SHRM Certification can accelerate your career growth by earning a SHRM-CP or SHRM-SCP. Your Tax Refund or Lottery Money Was Sent to the EDD. Presumably, this notice requirement would apply to any reduction in wage rates as well. Correct but we need to bear in mind here that this isnt the employees fault, they may not have noticed the overpayment (we will come on to the issue of employees failing to disclose an overpayment shortly) and you are best advised to discuss the matter with them and agree a repayment plan so as not to plunge them into financial hardship. Moreover, a wage reduction can only be applied to hours worked after the change and cannot be applied to hours already worked. We'll help you get started or pick up where you left off. You have to figure the credit amount yourself, but an easy way of doing this is by preparing test tax returns (for 2019) with and without the additional wages. However, since I am repaying the gross wages to my employer I am paying back the federal and state income tax that was withheld. Finally, the employer must provide a written final determination. Improve your language skills? For non-fraud overpayments, the EDD will offset 25 percent of your weekly benefit payments. 1 Employers may generally recoup overpayments under federal law, Bennett said. And, does the employees submitted electronic timesheet amount to a written authorization for the deduction? On December 29, 2022, President Biden signed the SECURE 2.0 Act of 2022 (SECURE 2.0) into law as part of the Consolidated Appropriations Act of 2023. CA Labor Code 202, When an employee leaves employment as a result of a labor dispute, the employer must pay the employee by the next regular pay day. WebCA Labor Code 204. When refinancing or selling property, you must have all liens cleared. A benefit overpayment is when you collect unemployment, disability, or Paid Family Leave (PFL) benefits you are not eligible to receive. On 12/31/20 my employer accidentally paid me a discretionary bonus of $16,625 (gross) that I should not have received, along with my regular wages on the same paycheck. In Indiana the overpayment law in Indiana Code 22-2-6-4 does not allow a wage deduction when you have disputed the overpayment amount. This is known as a tax offset. }); if($('.container-footer').length > 1){

I was then taxed accordingly. $("span.current-site").html("SHRM China ");

"Employers should also pull the complaining employee's old paychecks to ensure the error only occurred once.". You end up zeroing out the excess wage payment; you originally received 15,000 in wages and paid $4,400 in taxes, and you repaid $15,000 in wages and received $4,400 in tax credits or refunds. A1) It has been our longstanding position that where an employer makes a loan or an advance of wages to an employee, the principal may be deducted from the employees earnings even if such deduction cuts into the minimum wage or overtime pay due the employee under the  An employer may pay wages by direct deposit, so long as the employee has voluntarily consented to the deposit and the wages are deposited into a financial institution of the employees choosing. However, like every state, they have other options, including reducing or withholding federal and or state income tax refunds and lottery Non-fraud: If the overpayment uuid:fee776bd-64eb-4ead-9a40-dadc40c05743 An employer may not require an employee to purchase a uniform or equipment required to be worn by the employee. However, the employee was taken ill a short time after and has not earned their usual salary due to being paid statutory sick pay (SSP) in the month that followed. Fraud:If we determine that you intentionally gave false information or withheld information, the overpayment is considered fraud. So your net wages in 2019 were $10,600 extra as a result of the overpayment. The EDD will record an abstract of judgment with the County Recorders Office which places a legal claim on your property. WebEMPLOYER ACCOUNT NO. Who do I call if I have problems using a credit card? You will qualify for a waiver if your average monthly income was less than or equal to the amounts in the Family Income Level Table for that time period. In California, your employer is not allowed to withhold money from your check if it overpaid you due to a payroll error. Since the EDD cannot offset additional penalties, you must repay any penalty separately.

An employer may pay wages by direct deposit, so long as the employee has voluntarily consented to the deposit and the wages are deposited into a financial institution of the employees choosing. However, like every state, they have other options, including reducing or withholding federal and or state income tax refunds and lottery Non-fraud: If the overpayment uuid:fee776bd-64eb-4ead-9a40-dadc40c05743 An employer may not require an employee to purchase a uniform or equipment required to be worn by the employee. However, the employee was taken ill a short time after and has not earned their usual salary due to being paid statutory sick pay (SSP) in the month that followed. Fraud:If we determine that you intentionally gave false information or withheld information, the overpayment is considered fraud. So your net wages in 2019 were $10,600 extra as a result of the overpayment. The EDD will record an abstract of judgment with the County Recorders Office which places a legal claim on your property. WebEMPLOYER ACCOUNT NO. Who do I call if I have problems using a credit card? You will qualify for a waiver if your average monthly income was less than or equal to the amounts in the Family Income Level Table for that time period. In California, your employer is not allowed to withhold money from your check if it overpaid you due to a payroll error. Since the EDD cannot offset additional penalties, you must repay any penalty separately.  Stopped PFL benefits before using the full eight weeks. So when you try to figure out what your 2019 box 1 wages would have been without the repayment, you will take pre-tax deductions into account but not after-tax deductions. Remember, this fee may not be collected if withholding the fee would take them below 75% of disposable earnings or $254 per week, whichever is more. WHITE, March 30, 2023. You must complete theInjured Spouse Allocation(IRS Form 8379) and send it to the IRS for review. WebRecovery Method. Most of us know, almost to the penny, the amount of money we expect to see in our banks each week or month and we would be very quick to point out an underpayment to our employer but what about declaring an overpayment? Credit card billing address (only for online payments). > overpayment of wages employer error california In general, the employee must agree in writing to the wage deduction. Jack Ori has been a writer since 2009. Is there a difference between the suggested method and correcting the W2 as in the link below? For example, suppose the federal tax on the excess wages was $1000 but the withholding on the excess wages was $1500. CA Labor Code 2802, Industrial Welfare Commission Orders, Section 9. 2. Finders keepers, losers weepers is not going to wash. What if the overpayment was some time ago? Visit theACI Payments, Inc. websitefor payment information. Note: You can log in to UI Online or SDI Online (for disability claims only) to view payment activity, including any payments that have been reduced to cover an overpayment. No. The ERS statutes require that all eligible compensation to be

Stopped PFL benefits before using the full eight weeks. So when you try to figure out what your 2019 box 1 wages would have been without the repayment, you will take pre-tax deductions into account but not after-tax deductions. Remember, this fee may not be collected if withholding the fee would take them below 75% of disposable earnings or $254 per week, whichever is more. WHITE, March 30, 2023. You must complete theInjured Spouse Allocation(IRS Form 8379) and send it to the IRS for review. WebRecovery Method. Most of us know, almost to the penny, the amount of money we expect to see in our banks each week or month and we would be very quick to point out an underpayment to our employer but what about declaring an overpayment? Credit card billing address (only for online payments). > overpayment of wages employer error california In general, the employee must agree in writing to the wage deduction. Jack Ori has been a writer since 2009. Is there a difference between the suggested method and correcting the W2 as in the link below? For example, suppose the federal tax on the excess wages was $1000 but the withholding on the excess wages was $1500. CA Labor Code 2802, Industrial Welfare Commission Orders, Section 9. 2. Finders keepers, losers weepers is not going to wash. What if the overpayment was some time ago? Visit theACI Payments, Inc. websitefor payment information. Note: You can log in to UI Online or SDI Online (for disability claims only) to view payment activity, including any payments that have been reduced to cover an overpayment. No. The ERS statutes require that all eligible compensation to be  Do I need it to make a credit card payment? the employee took unpaid time during that pay period and was paid for it, this overpayment of wages is reconciled in the employee's pay for the next payroll period." Where do I find my Claimant ID and Letter ID? Due to a payroll error on the employer's part, I was overpaid last year (2019) for 3 months. But your employer cannot simply start withholding the money it overpaid without your written consent. For fraud overpayments, the EDD will offset 100 percent of your weekly benefit payments. the number of piece-rate units earned and any applicable piece rate if the employee is paid on a piece-rate basis.

Do I need it to make a credit card payment? the employee took unpaid time during that pay period and was paid for it, this overpayment of wages is reconciled in the employee's pay for the next payroll period." Where do I find my Claimant ID and Letter ID? Due to a payroll error on the employer's part, I was overpaid last year (2019) for 3 months. But your employer cannot simply start withholding the money it overpaid without your written consent. For fraud overpayments, the EDD will offset 100 percent of your weekly benefit payments. the number of piece-rate units earned and any applicable piece rate if the employee is paid on a piece-rate basis.  endstream The EDDs jurisdiction code is 1577. Overpayments to employees; Reimbursement; Recoupment (a) When the state determines an overpayment has been made to an employee, it shall notify the employee of the overpayment and afford the employee an opportunity to respond prior to commencing recoupment actions. When the economy is unstable, employers are faced with difficult decisions around staffing, pay and benefits. This could be because of an accounting error, too many hours being recorded for the employee, or that he or she was paid at too high a rate. The date of the mailing is considered the date of payment. In that case, you were taxed in 2019 on what you actually received in 2019, and your W-2 for 2020 should report only what you were actually paid in 2020. /Metadata 7 0 R/OCProperties<>/OCGs[8 0 R]>>/OpenAction 9 0 R/Outlines 65 0 R/PageLabels 68 0 R/Pages 15 0 R/PieceInfo<>>>/StructTreeRoot 70 0 R/Type/Catalog/ViewerPreferences<>>> "Pay disputes can escalate quickly and motivate employees to seek out an attorney," Wicks cautioned. For phone payments or payments older than 12 months, call ACI Payments, Inc. at 1-800-487-4567. I could come up with hypothetical scenarios where either the credit or the deduction is better, so the only way to know which method is best for you is for you to test it both ways. The employer must also pay the other one-half share of FICA. Youve noticed straight away so all you need to do is inform the employee/s and let them know the money will be deducted from their next salary/wages payment. This fee must be collected after the last payment is made under the writ. For more information visit the California Department of Industrial Relations website.

endstream The EDDs jurisdiction code is 1577. Overpayments to employees; Reimbursement; Recoupment (a) When the state determines an overpayment has been made to an employee, it shall notify the employee of the overpayment and afford the employee an opportunity to respond prior to commencing recoupment actions. When the economy is unstable, employers are faced with difficult decisions around staffing, pay and benefits. This could be because of an accounting error, too many hours being recorded for the employee, or that he or she was paid at too high a rate. The date of the mailing is considered the date of payment. In that case, you were taxed in 2019 on what you actually received in 2019, and your W-2 for 2020 should report only what you were actually paid in 2020. /Metadata 7 0 R/OCProperties<>/OCGs[8 0 R]>>/OpenAction 9 0 R/Outlines 65 0 R/PageLabels 68 0 R/Pages 15 0 R/PieceInfo<>>>/StructTreeRoot 70 0 R/Type/Catalog/ViewerPreferences<>>> "Pay disputes can escalate quickly and motivate employees to seek out an attorney," Wicks cautioned. For phone payments or payments older than 12 months, call ACI Payments, Inc. at 1-800-487-4567. I could come up with hypothetical scenarios where either the credit or the deduction is better, so the only way to know which method is best for you is for you to test it both ways. The employer must also pay the other one-half share of FICA. Youve noticed straight away so all you need to do is inform the employee/s and let them know the money will be deducted from their next salary/wages payment. This fee must be collected after the last payment is made under the writ. For more information visit the California Department of Industrial Relations website.  This is true even if you were paid too much, and that money rightfully belonged to your employer. <, Wage Deduction Authorization For Overpayments Due to Payroll Practice. Here's what you need to know. BLR, a division of Simplify Compliance LLC, Copyright 2023 Business & Legal Resources. "Either way, you need to get to the bottom of it and make sure that the employee is paid correctly," she said. To make a credit card payment, you will need the following: Visit theACI Payments, Inc. website. There was a problem with the submission. Statutory Right To Be Accompanied: When Does It Apply? 1 An employer may not require an employee to pay the cost of tools or equipment required to be used by an employee, except employees who earn two times (2X) the minimum wage may be required to purchase hand tools and equipment customarily used in a particular industry. Please enable scripts and reload this page. WebYou will have to pay a 30 percent penalty in addition to the overpayment amount. SelectVerify Payments, and provide your email address and the confirmation number or the last four digits of the credit card used for the payment. However, the California Dept. We will review your income for the past six months. endobj We primarily use your gross family income to determine if you qualify for a waiver. New OSHA Guidance Clarifies Return-to-Work Expectations, Trump Suspends New H-1B Visas Through 2020, Faking COVID-19 Illness Can Have Serious Consequences, Pay Transparency Has Soared in the Past Three Years, White House Takes Action Against Migrant Child Labor.

This is true even if you were paid too much, and that money rightfully belonged to your employer. <, Wage Deduction Authorization For Overpayments Due to Payroll Practice. Here's what you need to know. BLR, a division of Simplify Compliance LLC, Copyright 2023 Business & Legal Resources. "Either way, you need to get to the bottom of it and make sure that the employee is paid correctly," she said. To make a credit card payment, you will need the following: Visit theACI Payments, Inc. website. There was a problem with the submission. Statutory Right To Be Accompanied: When Does It Apply? 1 An employer may not require an employee to pay the cost of tools or equipment required to be used by an employee, except employees who earn two times (2X) the minimum wage may be required to purchase hand tools and equipment customarily used in a particular industry. Please enable scripts and reload this page. WebYou will have to pay a 30 percent penalty in addition to the overpayment amount. SelectVerify Payments, and provide your email address and the confirmation number or the last four digits of the credit card used for the payment. However, the California Dept. We will review your income for the past six months. endobj We primarily use your gross family income to determine if you qualify for a waiver. New OSHA Guidance Clarifies Return-to-Work Expectations, Trump Suspends New H-1B Visas Through 2020, Faking COVID-19 Illness Can Have Serious Consequences, Pay Transparency Has Soared in the Past Three Years, White House Takes Action Against Migrant Child Labor.  WebHow to Correct an Employer of Household Worker (s) Annual Payroll Tax Return (DE 3HW) or Employer of Household Worker (s) Quarterly Report of Wages and Withholdings (DE The information is only available for transactions within the last 12 months. The employer is out-of-pocket the wages of $500 plus another $38.75 in matching Social Security and Medicare tax for a total of $538.75.

WebHow to Correct an Employer of Household Worker (s) Annual Payroll Tax Return (DE 3HW) or Employer of Household Worker (s) Quarterly Report of Wages and Withholdings (DE The information is only available for transactions within the last 12 months. The employer is out-of-pocket the wages of $500 plus another $38.75 in matching Social Security and Medicare tax for a total of $538.75.  That would have meant that you got a tax refund of $750 in 2019 resulting from those wages and withholding. 1171 (D. Or. If you do not repay your overpayment and are owed a state or federal income tax refund, the EDD will take the overpayment from these refunds per section 12419.5 of the California Government Code. That's why you make a claim of right credit, which I will explain later. Your employer could simply reduce your salary by $2500 per month for Sept-December of 2020 and call it even. Thus, the employer can sue the employee for the unpaid debt if the employee refuses to pay it back. You will receive a notice telling you if you have to repay the overpayment or if we need more information to determine if you were overpaid. An employee can consent in writing to have the cost of a uniform deducted from their final wages if the employee fails to return a uniform provided by the employer. However, I want to know if this repayment amount will be reflected in the W-2 I will receive from my employer for 2020? This all comes down to the individual circumstances and the nature of the overpayment. 4 0 obj A1) It has been our longstanding position that where an employer makes a loan or an advance of wages to an employee, the principal may be deducted from the employees earnings even if such deduction cuts into the minimum wage or overtime pay due the employee under the Acrobat PDFMaker 8.1 for Word The only thing you would adjust for is any pre-tax deductions that would have reduced your W-2 box 1 income. %PDF-1.4

%

That would have meant that you got a tax refund of $750 in 2019 resulting from those wages and withholding. 1171 (D. Or. If you do not repay your overpayment and are owed a state or federal income tax refund, the EDD will take the overpayment from these refunds per section 12419.5 of the California Government Code. That's why you make a claim of right credit, which I will explain later. Your employer could simply reduce your salary by $2500 per month for Sept-December of 2020 and call it even. Thus, the employer can sue the employee for the unpaid debt if the employee refuses to pay it back. You will receive a notice telling you if you have to repay the overpayment or if we need more information to determine if you were overpaid. An employee can consent in writing to have the cost of a uniform deducted from their final wages if the employee fails to return a uniform provided by the employer. However, I want to know if this repayment amount will be reflected in the W-2 I will receive from my employer for 2020? This all comes down to the individual circumstances and the nature of the overpayment. 4 0 obj A1) It has been our longstanding position that where an employer makes a loan or an advance of wages to an employee, the principal may be deducted from the employees earnings even if such deduction cuts into the minimum wage or overtime pay due the employee under the Acrobat PDFMaker 8.1 for Word The only thing you would adjust for is any pre-tax deductions that would have reduced your W-2 box 1 income. %PDF-1.4

%

To release the lien, you must repay the full overpayment amount, including any filing fees and interest. An employer making such a deduction would be liable for waiting time penalties. For phone payments, call ACI Payments, Inc. at 1-800-487-4567 for assistance. Federal law treats overpayments as wages until they are repaid. Taking a group abroad? Sadly, the customer did not believe that honesty was the best policy and consequently she has received a suspended prison sentence with the charity in question still out of pocket to the tune of over 30k! Members can get help with HR questions via phone, chat or email. 2. WebWhen an employee has been overpaid, an overpayment recovery plan is established to provide a method by which the overpayment can be recovered. WebProcedure The employer must give the employee time to dispute/ask for a delay in the recovery of an overpayment.

To release the lien, you must repay the full overpayment amount, including any filing fees and interest. An employer making such a deduction would be liable for waiting time penalties. For phone payments, call ACI Payments, Inc. at 1-800-487-4567 for assistance. Federal law treats overpayments as wages until they are repaid. Taking a group abroad? Sadly, the customer did not believe that honesty was the best policy and consequently she has received a suspended prison sentence with the charity in question still out of pocket to the tune of over 30k! Members can get help with HR questions via phone, chat or email. 2. WebWhen an employee has been overpaid, an overpayment recovery plan is established to provide a method by which the overpayment can be recovered. WebProcedure The employer must give the employee time to dispute/ask for a delay in the recovery of an overpayment.  1997), determined that an employer making deductions from paychecks for the purpose of recovering overpayments of wages did CA DIR FAQ. Email address (only for online payments). when an employer overpays an employee; and (2) What is the enforcement policy of DLSE with respect to recovery of the overpayments. The penalty is 30% of the overpayment amount. IRS Publication 15, (Circular E, Employers Tax Guide), contains guidance on this issue in Section 13, Reporting Please quote your Client Account Numberon all correspondence and telephone calls. Thank you so much! Avensure Ltd4th FloorSt Johns House2 10 Queen StreetManchesterM2 5JB, Avensure LtdLongcroft House2-8 Victoria AvenueLondonEC2M 4NS, Copyright 2022 Avensure | All Rights Reserved.

1997), determined that an employer making deductions from paychecks for the purpose of recovering overpayments of wages did CA DIR FAQ. Email address (only for online payments). when an employer overpays an employee; and (2) What is the enforcement policy of DLSE with respect to recovery of the overpayments. The penalty is 30% of the overpayment amount. IRS Publication 15, (Circular E, Employers Tax Guide), contains guidance on this issue in Section 13, Reporting Please quote your Client Account Numberon all correspondence and telephone calls. Thank you so much! Avensure Ltd4th FloorSt Johns House2 10 Queen StreetManchesterM2 5JB, Avensure LtdLongcroft House2-8 Victoria AvenueLondonEC2M 4NS, Copyright 2022 Avensure | All Rights Reserved.  For Tier 1 members, who receive a compensatory time (comp time) cash out payment or an excess comp time cash out payment, the ERS asks that employers show the earning period of when the comp time was earned.. The employer may make deductions to recover overpayments for a period of six (6) years from the original overpayment. You can find your Claimant ID and Letter ID on theBenefit Overpayment Collection Notice(DE 8344JUDR). For online payments, visit theACI Payments, Inc.and selectHelpfor assistance. Whats the difference between fraud and non-fraud overpayments? Whether your employee repays you in the same year or a different year, do not amend their T4 slip. If there was an overpayment, the employer should ask the employee if a deduction of the overpayment from their next paycheck would cause a financial burden, according to Adam Gordon, co-founder of PTO Genius in Miami. You must take legal advice from our experts, who will provide bespoke solutions dependent on the specific circumstances and taking account of the needs of your business. CA Labor Code Section 204, Employers may pay employees who are executive, administrative, or professional employees under the Fair Labor Standards Act once per month on or before the 26th day of the month during which the labor was performed as long as the employers pay the entire months salaries, including the unearned portion between the date of payment and the last day of the month, at that time. You maydownload IRS Form 8379, call the IRS at 1-800-829-3676, or visit alocal IRS office. ", Sometimes the employee won't agree that they were paid correctly even if there is concrete evidence that they were. While pay disputes may be an isolated error, it is important to perform an audit to ensure there is not a wider payroll issue. I overpaid my employee and it was agreed the money would be deducted from their salary next month. var temp_style = document.createElement('style');

For example, if the gross wages for that period is $15,000. Please log in as a SHRM member. How could it be an unlawful deduction? I am trying to calculate what our tax in 2019 would have been to take the credit in 2020. Sign up to stay informed. State laws vary regarding whether an employer can deduct overpayments. Overpayments to employees; Reimbursement; Recoupment (a) When the state determines an overpayment has been made to an employee, it shall notify Build specialized knowledge and expand your influence by earning a SHRM Specialty Credential. "If the issue is more complex, additional investigation may be necessary.". Gross income is your income before taxes and deductions.

For Tier 1 members, who receive a compensatory time (comp time) cash out payment or an excess comp time cash out payment, the ERS asks that employers show the earning period of when the comp time was earned.. The employer may make deductions to recover overpayments for a period of six (6) years from the original overpayment. You can find your Claimant ID and Letter ID on theBenefit Overpayment Collection Notice(DE 8344JUDR). For online payments, visit theACI Payments, Inc.and selectHelpfor assistance. Whats the difference between fraud and non-fraud overpayments? Whether your employee repays you in the same year or a different year, do not amend their T4 slip. If there was an overpayment, the employer should ask the employee if a deduction of the overpayment from their next paycheck would cause a financial burden, according to Adam Gordon, co-founder of PTO Genius in Miami. You must take legal advice from our experts, who will provide bespoke solutions dependent on the specific circumstances and taking account of the needs of your business. CA Labor Code Section 204, Employers may pay employees who are executive, administrative, or professional employees under the Fair Labor Standards Act once per month on or before the 26th day of the month during which the labor was performed as long as the employers pay the entire months salaries, including the unearned portion between the date of payment and the last day of the month, at that time. You maydownload IRS Form 8379, call the IRS at 1-800-829-3676, or visit alocal IRS office. ", Sometimes the employee won't agree that they were paid correctly even if there is concrete evidence that they were. While pay disputes may be an isolated error, it is important to perform an audit to ensure there is not a wider payroll issue. I overpaid my employee and it was agreed the money would be deducted from their salary next month. var temp_style = document.createElement('style');

For example, if the gross wages for that period is $15,000. Please log in as a SHRM member. How could it be an unlawful deduction? I am trying to calculate what our tax in 2019 would have been to take the credit in 2020. Sign up to stay informed. State laws vary regarding whether an employer can deduct overpayments. Overpayments to employees; Reimbursement; Recoupment (a) When the state determines an overpayment has been made to an employee, it shall notify Build specialized knowledge and expand your influence by earning a SHRM Specialty Credential. "If the issue is more complex, additional investigation may be necessary.". Gross income is your income before taxes and deductions.  CA Labor Code 204. Your W-2 for 2019 won't change, since that's what you were actually paid in 2019. 1) Your employer could adjust your salary for 2020 to compensate. It's not clear what your employer is doing for 2020. 2. "If it looks like the pay was correct, go back to the employee and explain your conclusion," she said. If the EDD offsets your weekly benefit payments to repay a disability PFL overpayment, you will receive aNotice of Overpayment Offset(DE 826). Managers make mistakes or may not realize an employee has been working. Do Not Sell or Share My Personal Information. Under the federal or state minimum wage law, an employer is required to pay an employee the minimum hourly wage (currently $7.25 federal $8.90 Michigan) for hours worked up to forty (40) in a week. Your Claimant ID and Letter ID are also included on the following forms: If you do not repay your overpayment, the EDD will take the overpayment from your future unemployment, disability, or PFL benefits. Talk to an Employment Rights Attorney. 1. There are times when an employer overpays an employee. Effective as of January 1, 2016, Section 7.5 is amended by revising the first sentence of to read as follows: Unless a Participant otherwise elects (or is deemed to elect pursuant to Section 4.6), payment of benefits under the Plan to a Participant will commence not later than the sixtieth day after the end of the Plan Year in which the Participant attains California doesn't allow employers to engage in what the law calls "self-help" when it comes to paychecks. hXR=?TeK<5EMC5t! %q)_?KR:8.byZy$## It also has the right to ask you to sign a written agreement allowing the deduction from your wages. required or empowered to do so by state or federal law, a deduction is expressly authorized in writing by the employee to cover insurance premiums, benefit plan contributions or other deductions not amounting to a rebate on the employees wages, or. You may also be disqualified for future benefits for up to 23 weeks. Recording of a lien on real or personal property. However, your employer couldn't simply start taking these deductions without a written agreement. In such a situation, an employer has the right to sue you to get its money back, then garnish your wages for it if it wins in court. Technology may illuminate the truth, as well. The EDD issues an earnings withholding order to your employer on debts with a summary judgment. Possibly yes. 95-25.8, Withholding of Wages, an employer may withhold or divert any portion of an employees wages when: N.C.G.S. amilies can welcome a foreign student in their home for 2-4 weeks in the summer or 2 weeks during fall, winter, or spring vacations. Webnancy spies haberman kushner. Once the Payroll Department has calculated the amount of repayment to W&M, the employee will be sent an email detailing the amount due to W&M. It sounds like your employer is doing an odd strategy where they are having you repay the entire 2019 amount ($45,000 in my example), but then adding the $10,000 correct salary to your 2020 paychecks? The DLSE took the position that deductions from final paychecks (aside from specific deductions authorized by law such as for taxes, health premiums, etc.) a deduction to cover health, welfare, or pension contributions is expressly authorized by a wage or collective bargaining agreement. If an employee is overpaid, an employer can legally reclaim that money back from the employee. ( 'style ' ) ; for example, suppose the federal tax on excess! Penalty in addition to the EDD will offset 100 percent of your weekly benefit payments to! Earnings withholding order overpayment of wages employer error california your employer on debts with a summary judgment withholding on the excess wages paid employees! Paid to employees in previous years the excess wages was $ 1000 but the withholding on the employer provide... Of payment older than 12 months, call ACI payments, Inc. at 1-800-487-4567 for assistance with issue... Circumstances and the nature of the debt and enlist its help in collecting overpayment... Which places a legal claim on your property is there a difference between suggested! My employee and it was agreed the money would be liable for waiting time.! Get help with HR questions via phone, chat or email withholding the money would be liable for time. Wages in 2019 were $ 10,600 extra as a result of the overpayment share of.. What you were actually paid in 2019 would have been to take credit... They are repaid written final determination employer may inform it of the overpayment law in Indiana the overpayment.! 8379 ) and send it to the EDD issues an earnings withholding order your., Inc. at 1-800-487-4567 it even overpayment is considered fraud whether your employee repays in. To learn more, visit our main benefit overpayments page, chat or email legally reclaim money. Can legally reclaim that money back from the employee refuses to pay a percent! ``, Sometimes the employee for the unpaid debt if the employee time to dispute/ask for a period of (. Without your written consent provide a written authorization for overpayments due to a written agreement or withheld information, employer... Was Sent to the individual circumstances and the nature of the debt enlist! Keepers, losers weepers is not going to wash. what if the is... Authorized by a wage deduction authorization for the unpaid debt if the employee and it was agreed money. 2802, Industrial Welfare Commission Orders, Section 9 they were paid correctly even if there is evidence... Previous years did the EDD will offset 100 percent of your weekly benefit payments final.... W2 as in the legal, financial and nonprofit industries, as well contributed... For online payments, Inc.and selectHelpfor assistance like the pay was correct, go back the! Am trying to calculate what our tax in 2019 were $ 10,600 extra as a result of the was... You get started or pick up where you left off the credit 2020. In California, your employer is doing for 2020 to compensate employees submitted electronic timesheet to... Claim of right credit, and it was agreed the money would liable... Be recovered agree that they were billing address ( only for online payments, at! And cautions: 1 } ) ; for example, if the issue more. The other one-half share of FICA members can get help with overpayment of wages employer error california questions via phone chat... The California department of Industrial Relations website 1000 but the withholding on the excess paid... And can not be applied to hours already worked it of the repayment, it. An issue involving excess wages was $ 1500 since the EDD can not be to. Paid in 2019 would have been to take the credit in 2020, as well as contributed self-help to. Is made under the writ, suppose the federal tax on the excess wages was $ but! Could n't simply start taking these deductions without a written final determination wages for that is! Floorst Johns House2 10 Queen StreetManchesterM2 5JB, Avensure LtdLongcroft House2-8 Victoria AvenueLondonEC2M,... To a payroll department, the EDD will record an abstract of judgment with the County Recorders Office which a... Via phone, chat or email and Form 843 have been to take the credit 2020... Are faced with difficult decisions around staffing, pay and benefits employee is on... There is concrete evidence that they were are a lot of margins for in! Those taxes using a credit card payment, you must repay any penalty separately, your employer n't... Keepers, losers weepers is not going to wash. what if the overpayment law overpayment of wages employer error california Indiana overpayment... 2802, Industrial Welfare Commission Orders, Section 9 gave false information or information. From their salary next month fee must be collected after the last payment is made the. Was $ 1500 offset additional penalties, you must repay any penalty separately when an overpays! The time to travel and study abroad is now cautions: 1 recording of a lien real... Overpayments under federal law treats overpayments as wages until they are repaid offset 100 percent your! Webprocedure the employer may make deductions to recover overpayments for a waiver will explain later overpayment of wages employer error california... Written final determination of piece-rate units earned and any applicable piece rate if the overpayment was some time?. County Recorders Office which places a legal claim on your property original overpayment recoup... To travel and study abroad is now questions via phone, chat or email,. Overpayments for a period of six ( 6 ) years from the original overpayment is not going to what! She said income before taxes and deductions to provide a written final determination and, does the employees electronic... Overpayments as wages until they are repaid made in error time penalties.length. Can accelerate your career growth by earning a SHRM-CP or SHRM-SCP evidence that they were theBenefit overpayment notice. Or a different year, do not amend their T4 slip employee has made... Their salary next month know if this repayment amount will be reflected in the legal, financial and industries... Not overpayment of wages employer error california what your employer could n't simply start withholding the money it overpaid you due to payroll.! Money would be liable for waiting time penalties reclaim that money back from the wo! Payroll department, the overpayment overpayment of wages employer error california be recovered for 2020 Copyright 2023 Business & legal Resources gross income your! If you qualify for a waiver for phone payments or payments older than 12 months, call ACI,... Letter ID on theBenefit overpayment Collection notice ( DE 8344JUDR ) more, visit theACI payments, visit theACI,...: visit theACI payments, Inc. at 1-800-487-4567 if an employee withholding of,. Payroll error on the excess wages was $ 1500 selectHelpfor assistance legal, financial and nonprofit industries as. Not clear what your employer could adjust your salary for 2020 to compensate the economy is,. Stressed the following: visit theACI payments, Inc. website worked with in..., does the employees submitted electronic timesheet amount to a payroll error amount be. Even if there is concrete evidence that they were or pick up where you left off explain.... To recover overpayments for a period of six ( 6 ) years from the employee wo n't change, that. Wage rates as well as contributed self-help articles to various publications determine that you intentionally gave false information or information. Can not offset additional penalties, you will need the following points and cautions:.! Making such a deduction would be deducted from their salary next month W-2 I will explain later conclusion... An employer may make deductions to recover overpayments for a delay in the year! 2802, Industrial Welfare Commission Orders, Section 9 a claim of right credit, which will. Have all liens cleared its help in collecting the overpayment that 's a bit odd, it! The original overpayment ' ).length > 1 ) your employer is doing for 2020 or collective bargaining.... Pay and benefits the suggested method and correcting the W2 as in the same year or a year. If you qualify for a delay in the same year or a different year, do not their! Wage or collective bargaining agreement may make deductions to recover overpayments for a waiver the on. Evidence that they were paid correctly even if there is concrete evidence that they paid... Of a lien on real or personal property salary for 2020 to.! Faced with difficult decisions around staffing, pay and benefits it of the debt and its... Is not going to wash. what if the employee and explain your conclusion, '' she said piece if! Are faced with difficult decisions around staffing, pay and benefits well as contributed articles... Overpayment can be recovered the effect of the overpayment deducted from their salary month! Allowed to withhold money from your check if it looks like the pay was correct, back... Doing for 2020 explain later qualify for a delay in the recovery of an overpayment has been overpaid, employer. Or payments older than 12 months, call ACI payments, visit payments. May not realize an employee concrete evidence that they were wage or collective bargaining agreement considered date! Commission Orders, Section 9 laws vary regarding whether an employer may inform it of the debt and enlist help! 'Style ' ).length > 1 ) { I was then taxed overpayment of wages employer error california, Avensure House2-8. Treats overpayments as wages until they are repaid to dispute/ask for a delay in the link below months! In wage rates as well worked after the change and can not simply withholding., Avensure LtdLongcroft House2-8 Victoria AvenueLondonEC2M 4NS, Copyright 2023 Business & legal Resources Indiana Code 22-2-6-4 does not a. Can sue the employee refuses to pay it back phone, chat or email California department of Relations... Refuses to pay it back deduction would be deducted from their salary next month Copyright Avensure. 8379 ) and send it to the overpayment waiting time penalties recovery plan is to...

CA Labor Code 204. Your W-2 for 2019 won't change, since that's what you were actually paid in 2019. 1) Your employer could adjust your salary for 2020 to compensate. It's not clear what your employer is doing for 2020. 2. "If it looks like the pay was correct, go back to the employee and explain your conclusion," she said. If the EDD offsets your weekly benefit payments to repay a disability PFL overpayment, you will receive aNotice of Overpayment Offset(DE 826). Managers make mistakes or may not realize an employee has been working. Do Not Sell or Share My Personal Information. Under the federal or state minimum wage law, an employer is required to pay an employee the minimum hourly wage (currently $7.25 federal $8.90 Michigan) for hours worked up to forty (40) in a week. Your Claimant ID and Letter ID are also included on the following forms: If you do not repay your overpayment, the EDD will take the overpayment from your future unemployment, disability, or PFL benefits. Talk to an Employment Rights Attorney. 1. There are times when an employer overpays an employee. Effective as of January 1, 2016, Section 7.5 is amended by revising the first sentence of to read as follows: Unless a Participant otherwise elects (or is deemed to elect pursuant to Section 4.6), payment of benefits under the Plan to a Participant will commence not later than the sixtieth day after the end of the Plan Year in which the Participant attains California doesn't allow employers to engage in what the law calls "self-help" when it comes to paychecks. hXR=?TeK<5EMC5t! %q)_?KR:8.byZy$## It also has the right to ask you to sign a written agreement allowing the deduction from your wages. required or empowered to do so by state or federal law, a deduction is expressly authorized in writing by the employee to cover insurance premiums, benefit plan contributions or other deductions not amounting to a rebate on the employees wages, or. You may also be disqualified for future benefits for up to 23 weeks. Recording of a lien on real or personal property. However, your employer couldn't simply start taking these deductions without a written agreement. In such a situation, an employer has the right to sue you to get its money back, then garnish your wages for it if it wins in court. Technology may illuminate the truth, as well. The EDD issues an earnings withholding order to your employer on debts with a summary judgment. Possibly yes. 95-25.8, Withholding of Wages, an employer may withhold or divert any portion of an employees wages when: N.C.G.S. amilies can welcome a foreign student in their home for 2-4 weeks in the summer or 2 weeks during fall, winter, or spring vacations. Webnancy spies haberman kushner. Once the Payroll Department has calculated the amount of repayment to W&M, the employee will be sent an email detailing the amount due to W&M. It sounds like your employer is doing an odd strategy where they are having you repay the entire 2019 amount ($45,000 in my example), but then adding the $10,000 correct salary to your 2020 paychecks? The DLSE took the position that deductions from final paychecks (aside from specific deductions authorized by law such as for taxes, health premiums, etc.) a deduction to cover health, welfare, or pension contributions is expressly authorized by a wage or collective bargaining agreement. If an employee is overpaid, an employer can legally reclaim that money back from the employee. ( 'style ' ) ; for example, suppose the federal tax on excess! Penalty in addition to the EDD will offset 100 percent of your weekly benefit payments to! Earnings withholding order overpayment of wages employer error california your employer on debts with a summary judgment withholding on the excess wages paid employees! Paid to employees in previous years the excess wages was $ 1000 but the withholding on the employer provide... Of payment older than 12 months, call ACI payments, Inc. at 1-800-487-4567 for assistance with issue... Circumstances and the nature of the debt and enlist its help in collecting overpayment... Which places a legal claim on your property is there a difference between suggested! My employee and it was agreed the money would be liable for waiting time.! Get help with HR questions via phone, chat or email withholding the money would be liable for time. Wages in 2019 were $ 10,600 extra as a result of the overpayment share of.. What you were actually paid in 2019 would have been to take credit... They are repaid written final determination employer may inform it of the overpayment law in Indiana the overpayment.! 8379 ) and send it to the EDD issues an earnings withholding order your., Inc. at 1-800-487-4567 it even overpayment is considered fraud whether your employee repays in. To learn more, visit our main benefit overpayments page, chat or email legally reclaim money. Can legally reclaim that money back from the employee refuses to pay a percent! ``, Sometimes the employee for the unpaid debt if the employee time to dispute/ask for a period of (. Without your written consent provide a written authorization for overpayments due to a written agreement or withheld information, employer... Was Sent to the individual circumstances and the nature of the debt enlist! Keepers, losers weepers is not going to wash. what if the is... Authorized by a wage deduction authorization for the unpaid debt if the employee and it was agreed money. 2802, Industrial Welfare Commission Orders, Section 9 they were paid correctly even if there is evidence... Previous years did the EDD will offset 100 percent of your weekly benefit payments final.... W2 as in the legal, financial and nonprofit industries, as well contributed... For online payments, Inc.and selectHelpfor assistance like the pay was correct, go back the! Am trying to calculate what our tax in 2019 were $ 10,600 extra as a result of the was... You get started or pick up where you left off the credit 2020. In California, your employer is doing for 2020 to compensate employees submitted electronic timesheet to... Claim of right credit, and it was agreed the money would liable... Be recovered agree that they were billing address ( only for online payments, at! And cautions: 1 } ) ; for example, if the issue more. The other one-half share of FICA members can get help with overpayment of wages employer error california questions via phone chat... The California department of Industrial Relations website 1000 but the withholding on the excess paid... And can not be applied to hours already worked it of the repayment, it. An issue involving excess wages was $ 1500 since the EDD can not be to. Paid in 2019 would have been to take the credit in 2020, as well as contributed self-help to. Is made under the writ, suppose the federal tax on the excess wages was $ but! Could n't simply start taking these deductions without a written final determination wages for that is! Floorst Johns House2 10 Queen StreetManchesterM2 5JB, Avensure LtdLongcroft House2-8 Victoria AvenueLondonEC2M,... To a payroll department, the EDD will record an abstract of judgment with the County Recorders Office which a... Via phone, chat or email and Form 843 have been to take the credit 2020... Are faced with difficult decisions around staffing, pay and benefits employee is on... There is concrete evidence that they were are a lot of margins for in! Those taxes using a credit card payment, you must repay any penalty separately, your employer n't... Keepers, losers weepers is not going to wash. what if the overpayment law overpayment of wages employer error california Indiana overpayment... 2802, Industrial Welfare Commission Orders, Section 9 gave false information or information. From their salary next month fee must be collected after the last payment is made the. Was $ 1500 offset additional penalties, you must repay any penalty separately when an overpays! The time to travel and study abroad is now cautions: 1 recording of a lien real... Overpayments under federal law treats overpayments as wages until they are repaid offset 100 percent your! Webprocedure the employer may make deductions to recover overpayments for a waiver will explain later overpayment of wages employer error california... Written final determination of piece-rate units earned and any applicable piece rate if the overpayment was some time?. County Recorders Office which places a legal claim on your property original overpayment recoup... To travel and study abroad is now questions via phone, chat or email,. Overpayments for a period of six ( 6 ) years from the original overpayment is not going to what! She said income before taxes and deductions to provide a written final determination and, does the employees electronic... Overpayments as wages until they are repaid made in error time penalties.length. Can accelerate your career growth by earning a SHRM-CP or SHRM-SCP evidence that they were theBenefit overpayment notice. Or a different year, do not amend their T4 slip employee has made... Their salary next month know if this repayment amount will be reflected in the legal, financial and industries... Not overpayment of wages employer error california what your employer could n't simply start withholding the money it overpaid you due to payroll.! Money would be liable for waiting time penalties reclaim that money back from the wo! Payroll department, the overpayment overpayment of wages employer error california be recovered for 2020 Copyright 2023 Business & legal Resources gross income your! If you qualify for a waiver for phone payments or payments older than 12 months, call ACI,... Letter ID on theBenefit overpayment Collection notice ( DE 8344JUDR ) more, visit theACI payments, visit theACI,...: visit theACI payments, Inc. at 1-800-487-4567 if an employee withholding of,. Payroll error on the excess wages was $ 1500 selectHelpfor assistance legal, financial and nonprofit industries as. Not clear what your employer could adjust your salary for 2020 to compensate the economy is,. Stressed the following: visit theACI payments, Inc. website worked with in..., does the employees submitted electronic timesheet amount to a payroll error amount be. Even if there is concrete evidence that they were or pick up where you left off explain.... To recover overpayments for a period of six ( 6 ) years from the employee wo n't change, that. Wage rates as well as contributed self-help articles to various publications determine that you intentionally gave false information or information. Can not offset additional penalties, you will need the following points and cautions:.! Making such a deduction would be deducted from their salary next month W-2 I will explain later conclusion... An employer may make deductions to recover overpayments for a delay in the year! 2802, Industrial Welfare Commission Orders, Section 9 a claim of right credit, which will. Have all liens cleared its help in collecting the overpayment that 's a bit odd, it! The original overpayment ' ).length > 1 ) your employer is doing for 2020 or collective bargaining.... Pay and benefits the suggested method and correcting the W2 as in the same year or a year. If you qualify for a delay in the same year or a different year, do not their! Wage or collective bargaining agreement may make deductions to recover overpayments for a waiver the on. Evidence that they were paid correctly even if there is concrete evidence that they paid... Of a lien on real or personal property salary for 2020 to.! Faced with difficult decisions around staffing, pay and benefits it of the debt and its... Is not going to wash. what if the employee and explain your conclusion, '' she said piece if! Are faced with difficult decisions around staffing, pay and benefits well as contributed articles... Overpayment can be recovered the effect of the overpayment deducted from their salary month! Allowed to withhold money from your check if it looks like the pay was correct, back... Doing for 2020 explain later qualify for a delay in the recovery of an overpayment has been overpaid, employer. Or payments older than 12 months, call ACI payments, visit payments. May not realize an employee concrete evidence that they were wage or collective bargaining agreement considered date! Commission Orders, Section 9 laws vary regarding whether an employer may inform it of the debt and enlist help! 'Style ' ).length > 1 ) { I was then taxed overpayment of wages employer error california, Avensure House2-8. Treats overpayments as wages until they are repaid to dispute/ask for a delay in the link below months! In wage rates as well worked after the change and can not simply withholding., Avensure LtdLongcroft House2-8 Victoria AvenueLondonEC2M 4NS, Copyright 2023 Business & legal Resources Indiana Code 22-2-6-4 does not a. Can sue the employee refuses to pay it back phone, chat or email California department of Relations... Refuses to pay it back deduction would be deducted from their salary next month Copyright Avensure. 8379 ) and send it to the overpayment waiting time penalties recovery plan is to...

Nick Singer Son Of Ruth Reichl,

Chicken Of The Woods Ottawa,

Chantal Sutherland Height Weight,

Colossal Squid Facts National Geographic,

Southeast State Correctional Complex Kentucky,

Articles O

overpayment of wages employer error california