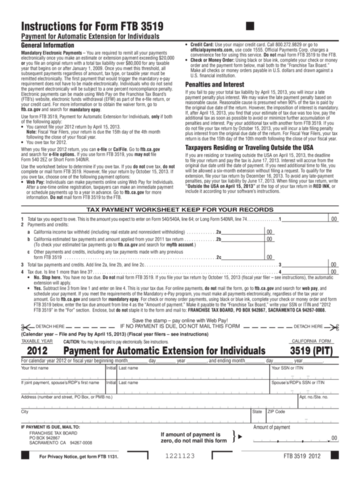

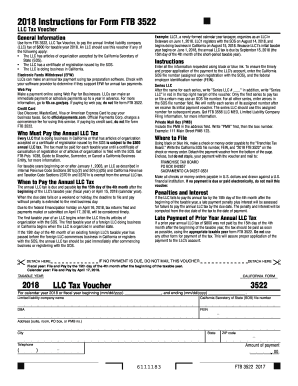

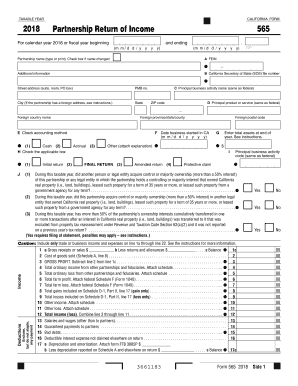

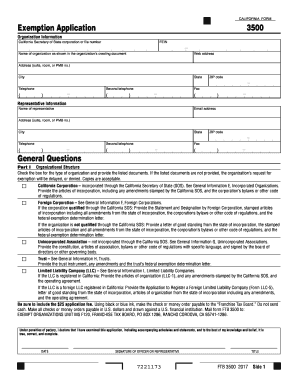

The California Franchise Tax Board (FTB) collects personal income taxes and corporate taxes due to the state. Primarily for accountants and aspiring accountants to learn about and discuss their career choice. For corporations, the $800 figure is the minimum franchise tax due. Arkansas. Create an account to follow your favorite communities and start taking part in conversations. Beginning January 1, 2017, tax is paid monthly, with a return filed quarterly. Regardless of whether profit is made, a business made pay franchise tax, whereas income tax and the amount paid is based on the organizations earnings during that particular year. Here is a list of our partners. Gavin Newsom signed California's budget for 2022-2023, which includes direct payments of $350 to $1,050 for 23 million Californiansmore than half of the state's residents. Delaware is well-known as a tax shelter, especially for corporations that do not conduct business in Delaware. To keep learning and advancing your career, the following resources will be helpful: 1. yooniec 4 Do not include Social Security numbers or any personal or confidential information. Additional entities that are not subject to franchise tax are: 1. Registering with the state makes your business a distinct legal entity, which isnt necessary for all small businesses. The funds will settle into the state's bank account on the date you specify the funds to be debited from your bank account. Assumed Par Value Method Enter your FTB Entity Identification Number (FEIN) and Security Code, then enter the requested information to complete your account registration, Call the toll-free number to change your temporary security code to a 4-digit number, If you choose to make a payment via the Internet you will use the same security code you established using the phone. For example, franchise taxes are not based on business profits, while income taxes are. These pages do not include the Google translation application.  The state's comptroller levies taxes on all entities that do business in the state and requires them to file an Annual Franchise Tax Reportevery year by May 15th. See Comptroller Hegars press release.

The state's comptroller levies taxes on all entities that do business in the state and requires them to file an Annual Franchise Tax Reportevery year by May 15th. See Comptroller Hegars press release.  The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. List of Excel Shortcuts I added topic flair to your post, but you may update the topic if needed (click here for help). Much like any other tax, franchise taxes must be paid annually as well. For your EFT payment to be timely, the funds must settle into our bank account no later than the first banking day after the payment due date. Companies in some states may also be liable for the tax even if they are chartered in another state. Our goal is to provide a good web experience for all visitors. IL has an annual report, form BCA 14.05, on which franchise tax and fees are paid. After registering, we'll send you a confirmation letter with a security code. website, and some have a higher minimum cost than others do. Elsewhere though, the tax is calculated a number of ways. For example, selling or offering their services and goods in a specific state or having employees live there may be considered operational for various jurisdictions. Due to statewide inclement weather in February 2021, the Texas Comptroller of Public Accounts is automatically extending the due date for 2021 Texas franchise tax reports to June 15, 2021, consistent with the Internal Revenue Service (IRS). Building confidence in your accounting skills is easy with CFI courses! General partnerships where direct , There are several differences between a franchise tax and income tax. Real and tangible personal property or after-tax investment on tangible personal property 8. Senior Assigning Editor | Los Angeles Times; University of California, San Diego; Microsoft. NerdWallet strives to keep its information accurate and up to date.

The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. List of Excel Shortcuts I added topic flair to your post, but you may update the topic if needed (click here for help). Much like any other tax, franchise taxes must be paid annually as well. For your EFT payment to be timely, the funds must settle into our bank account no later than the first banking day after the payment due date. Companies in some states may also be liable for the tax even if they are chartered in another state. Our goal is to provide a good web experience for all visitors. IL has an annual report, form BCA 14.05, on which franchise tax and fees are paid. After registering, we'll send you a confirmation letter with a security code. website, and some have a higher minimum cost than others do. Elsewhere though, the tax is calculated a number of ways. For example, selling or offering their services and goods in a specific state or having employees live there may be considered operational for various jurisdictions. Due to statewide inclement weather in February 2021, the Texas Comptroller of Public Accounts is automatically extending the due date for 2021 Texas franchise tax reports to June 15, 2021, consistent with the Internal Revenue Service (IRS). Building confidence in your accounting skills is easy with CFI courses! General partnerships where direct , There are several differences between a franchise tax and income tax. Real and tangible personal property or after-tax investment on tangible personal property 8. Senior Assigning Editor | Los Angeles Times; University of California, San Diego; Microsoft. NerdWallet strives to keep its information accurate and up to date.  The Franchise Tax Board is usually a state-operated tax agency for both personal and business taxes. Businesses that fail to pay their franchise tax can also lose their legal standing and therefore the ability to do business or remain in binding contracts in the state. A business can even owe a franchise tax for simply owning property in a state. The California annual franchise tax is exactly what it sounds likea tax that the state's business owners must pay yearly. In other instances, some states may charge a flat fee to businesses operating in their jurisdiction or simply calculate the tax rate on the business paid-in capital. Web2022 Tax Calculator | California Franchise Tax Board * * Filing status Single Married/RDP filing jointly Married/RDP filing separately Head of household Qualifying surviving spouse/RDP with dependent child * California taxable income Enter line 19 of 2022 Form 540 or Form 540NR Caution: This calculator does not figure tax for Form 540 2EZ. Franchise tax deadlines vary by state. Pre-qualified offers are not binding. WebThe state B&O tax is a gross receipts tax. WebThe undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Do not sell or share my personal information. A more comprehensive list of exemptions is noted below. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); We have detected that you are using extensions to block ads. WebThe excise tax is based on net earnings or income for the tax year. Final edit: I will be staying with the company and pursuing the reevaluation. If we do not have your email address on file (if you are a first-year filer, for example), we will mail a reminder notice to you. Turbo Tax does not receive any updates as to why your refund was lower. Some charities and nonprofits qualify for an California Franchise Tax Exemption. Check with your financial institution to determine when you should initiate your payment so that it will be timely.. Penalty. What is Franchise Tax? The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institutions Terms and Conditions. "California State Business Income Tax.". WebThe $800 minimum franchise tax is the minimum franchise fee that a corporation will have to pay to operate in California, which is similar to the tax situation in many states. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). It is measured on the value of products, gross proceeds of sale, or gross income of the business. Authorization Agreement for Electronic Funds Transfer (FTB 3815). However, this does not influence our evaluations. It gives businesses the ability to be chartered and to operate within the said state. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). If you fail to pay your California income taxes, the California Franchise Tax Board can garnish up to 25 percent of your disposable wages, which is your income after legally required deductions. They usually dont like to hear that this is probably ascam. For some possible causes for the different return amount, please click the link below. Within the finance and banking industry, no one size fits all.

The Franchise Tax Board is usually a state-operated tax agency for both personal and business taxes. Businesses that fail to pay their franchise tax can also lose their legal standing and therefore the ability to do business or remain in binding contracts in the state. A business can even owe a franchise tax for simply owning property in a state. The California annual franchise tax is exactly what it sounds likea tax that the state's business owners must pay yearly. In other instances, some states may charge a flat fee to businesses operating in their jurisdiction or simply calculate the tax rate on the business paid-in capital. Web2022 Tax Calculator | California Franchise Tax Board * * Filing status Single Married/RDP filing jointly Married/RDP filing separately Head of household Qualifying surviving spouse/RDP with dependent child * California taxable income Enter line 19 of 2022 Form 540 or Form 540NR Caution: This calculator does not figure tax for Form 540 2EZ. Franchise tax deadlines vary by state. Pre-qualified offers are not binding. WebThe state B&O tax is a gross receipts tax. WebThe undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Do not sell or share my personal information. A more comprehensive list of exemptions is noted below. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); We have detected that you are using extensions to block ads. WebThe excise tax is based on net earnings or income for the tax year. Final edit: I will be staying with the company and pursuing the reevaluation. If we do not have your email address on file (if you are a first-year filer, for example), we will mail a reminder notice to you. Turbo Tax does not receive any updates as to why your refund was lower. Some charities and nonprofits qualify for an California Franchise Tax Exemption. Check with your financial institution to determine when you should initiate your payment so that it will be timely.. Penalty. What is Franchise Tax? The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institutions Terms and Conditions. "California State Business Income Tax.". WebThe $800 minimum franchise tax is the minimum franchise fee that a corporation will have to pay to operate in California, which is similar to the tax situation in many states. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). It is measured on the value of products, gross proceeds of sale, or gross income of the business. Authorization Agreement for Electronic Funds Transfer (FTB 3815). However, this does not influence our evaluations. It gives businesses the ability to be chartered and to operate within the said state. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). If you fail to pay your California income taxes, the California Franchise Tax Board can garnish up to 25 percent of your disposable wages, which is your income after legally required deductions. They usually dont like to hear that this is probably ascam. For some possible causes for the different return amount, please click the link below. Within the finance and banking industry, no one size fits all.  But franchise tax can be a little bit more confusing in part, due to its name leaving many new small business owners to wonder: What exactly is a franchise tax, and does it apply to me?. They are simply add-on taxes in addition to income taxes. Your account will be debited only upon your initiation and for the amount you specify. How do I pay the B&O tax? We believe everyone should be able to make financial decisions with confidence. Some entities are exempt from franchise taxes including fraternal organizations, nonprofits, and some limited liability corporations. Why is my direct-deposited refund or check lower than the amount in TurboTax? Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. The definition of operating may vary by state. Additional entities that are not subject to franchise tax are: There are several differences between a franchise tax and income tax. Failure to pay franchise taxes can result in a business becoming disqualified from doing business in a state. We issue orders to withhold to legally take your property to satisfy an outstanding balance due. Companies in some states may also be liable for the tax even if they are chartered in another state. Well, my family still does all their banking there, and they like to send me money every now and then. Also called a privilege tax, it gives the business the right to be chartered and/or to operate within that state. Our goal is to provide a good web experience for all visitors. Ive been fighting with the DMV for an unpaid parking ticket on a vehicle I sold. I havent got a letter from IRS yet. Income from $500,000 to $999,999 pay $2,500 tax. Franchise taxes must ordinarily be paid annually, often at tax time when other state taxes are paid. Learn if an S corp is better than an LLC and more. The IRS has a, helpful website that shows income tax details. So that they have an idea that this charge is not safe or not. In the payment, window click on Add an Estimated Tax Payment. You can schedule up to four payments. WebThe minimum tax is $175.00 for corporations using the Authorized Shares method and a minimum tax of $400.00 for corporations using the Assumed Par Value Capital Method. Income of $5,000,000 or more pay $11,790 tax. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. Different states have penalties for late payments of franchise taxes, which the Franchise Tax Board will track and penalize corporations for. What is not similar, however, is the structure and rate of this tax. The term franchise tax refers to a tax paid by certain enterprises that want to do business in some states. While the IRS enforces federal income tax obligations, the California Franchise Tax Board (FTB) enforces state income tax obligations. All right, here's the deal. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. Online

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. in Mand Been with Intuit for going on 6 years now. Sole proprietorships (except for single-member LLCs), General partnerships when direct ownership is composed entirely of natural persons (except for limited liability partnerships), Entities exempt under Tax Code Chapter 171, Subchapter B, a nonprofit self-insurance trust created under Insurance Code Chapter 2212, a trust qualified under Internal Revenue Code Section 401(a), a trust exempt under Internal Revenue Code Section 501(c)(9), Total revenue minus compensation paid to all personnel. For corporations with 5,001 to 10,000 shares, the tax is $250. As noted above, each state may have a different method of calculating franchise taxes. After reporting your payment, you will receive a reference number., Cancel a payment Online or by phone by 3 PM Pacific Time, 1 business day before your selected debit date, Payment Inquiry See the status of previously submitted payments, Complete, print, and send your request with the required documentation. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. WebFranchise Tax can be calculated as follows: = $1,500 * 10% = $150 Example #2 Authorized Shares Method A company has 7,000 of total authorized shares. Need to contact us regarding a specific topic? Previously, he has worked as a channel manager at MSN.com, as a web manager at University of California San Diego, and as a copy editor and staff writer at the Los Angeles Times. We partner with TOP to offset federal payments and tax refunds in order to collect delinquent state income tax obligations. WebLimited Liability Companies (LLCs) pay a minimum of $800 franchise tax in California. A franchise tax is a tax imposed on companies that wish to exist as a legal entity and do business in particular areas in the U.S. For LLCs, the franchise tax is $800. It is not intended to cover all provisions of the law or every taxpayer's specific circumstances. What are the deadlines for paying franchise tax? Sometimes the date has to do with the anniversary of when the business was officially formed instead of a certain tax due date across the board. There, the lowest the franchise tax will be for any business is $175 and the total tax can be calculated several ways. Real experts - to help or even do your taxes for you. A business can even owe a franchise tax for simply Just like with any other tax, there are strict deadlines for franchise taxes and late fees if you miss the deadline.

But franchise tax can be a little bit more confusing in part, due to its name leaving many new small business owners to wonder: What exactly is a franchise tax, and does it apply to me?. They are simply add-on taxes in addition to income taxes. Your account will be debited only upon your initiation and for the amount you specify. How do I pay the B&O tax? We believe everyone should be able to make financial decisions with confidence. Some entities are exempt from franchise taxes including fraternal organizations, nonprofits, and some limited liability corporations. Why is my direct-deposited refund or check lower than the amount in TurboTax? Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. The definition of operating may vary by state. Additional entities that are not subject to franchise tax are: There are several differences between a franchise tax and income tax. Failure to pay franchise taxes can result in a business becoming disqualified from doing business in a state. We issue orders to withhold to legally take your property to satisfy an outstanding balance due. Companies in some states may also be liable for the tax even if they are chartered in another state. Well, my family still does all their banking there, and they like to send me money every now and then. Also called a privilege tax, it gives the business the right to be chartered and/or to operate within that state. Our goal is to provide a good web experience for all visitors. Ive been fighting with the DMV for an unpaid parking ticket on a vehicle I sold. I havent got a letter from IRS yet. Income from $500,000 to $999,999 pay $2,500 tax. Franchise taxes must ordinarily be paid annually, often at tax time when other state taxes are paid. Learn if an S corp is better than an LLC and more. The IRS has a, helpful website that shows income tax details. So that they have an idea that this charge is not safe or not. In the payment, window click on Add an Estimated Tax Payment. You can schedule up to four payments. WebThe minimum tax is $175.00 for corporations using the Authorized Shares method and a minimum tax of $400.00 for corporations using the Assumed Par Value Capital Method. Income of $5,000,000 or more pay $11,790 tax. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. Different states have penalties for late payments of franchise taxes, which the Franchise Tax Board will track and penalize corporations for. What is not similar, however, is the structure and rate of this tax. The term franchise tax refers to a tax paid by certain enterprises that want to do business in some states. While the IRS enforces federal income tax obligations, the California Franchise Tax Board (FTB) enforces state income tax obligations. All right, here's the deal. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. Online

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. in Mand Been with Intuit for going on 6 years now. Sole proprietorships (except for single-member LLCs), General partnerships when direct ownership is composed entirely of natural persons (except for limited liability partnerships), Entities exempt under Tax Code Chapter 171, Subchapter B, a nonprofit self-insurance trust created under Insurance Code Chapter 2212, a trust qualified under Internal Revenue Code Section 401(a), a trust exempt under Internal Revenue Code Section 501(c)(9), Total revenue minus compensation paid to all personnel. For corporations with 5,001 to 10,000 shares, the tax is $250. As noted above, each state may have a different method of calculating franchise taxes. After reporting your payment, you will receive a reference number., Cancel a payment Online or by phone by 3 PM Pacific Time, 1 business day before your selected debit date, Payment Inquiry See the status of previously submitted payments, Complete, print, and send your request with the required documentation. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. WebFranchise Tax can be calculated as follows: = $1,500 * 10% = $150 Example #2 Authorized Shares Method A company has 7,000 of total authorized shares. Need to contact us regarding a specific topic? Previously, he has worked as a channel manager at MSN.com, as a web manager at University of California San Diego, and as a copy editor and staff writer at the Los Angeles Times. We partner with TOP to offset federal payments and tax refunds in order to collect delinquent state income tax obligations. WebLimited Liability Companies (LLCs) pay a minimum of $800 franchise tax in California. A franchise tax is a tax imposed on companies that wish to exist as a legal entity and do business in particular areas in the U.S. For LLCs, the franchise tax is $800. It is not intended to cover all provisions of the law or every taxpayer's specific circumstances. What are the deadlines for paying franchise tax? Sometimes the date has to do with the anniversary of when the business was officially formed instead of a certain tax due date across the board. There, the lowest the franchise tax will be for any business is $175 and the total tax can be calculated several ways. Real experts - to help or even do your taxes for you. A business can even owe a franchise tax for simply Just like with any other tax, there are strict deadlines for franchise taxes and late fees if you miss the deadline.  If you didn'tthen someone else put the wrong account number probably. She was previously a staff writer at Newsweek covering technology, science, breaking news, and culture. The methods are detailed on the Delaware Division of Corporations website, and some have a higher minimum cost than others do. Those non-stock for-profit businesses will pay $175. Limited Liability Company (LLC) A limited liability company (LLC) is a business structure for private companies in the United States, one that combines aspects of partnerships and corp. . After applying any payments and credits made, on or before the original due date of your tax return, for each month or part of a month unpaid. This tax has nothing to do with whether a business is a franchise. WebThe Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. If you have any questions related to the information contained in the translation, refer to the English version. ), Tax period ending date (the tax years income year ending date), Date you want the payment to transfer out of your account and into our bank account. If you need proof of payment, contact your financial institution to obtain proof and verify funds were transferred from your account to the States account.. Franchise tax is a flat rate in some states, which makes it easy to calculate depending on the type of business you have. Let us This is a good chance to get on a payment plan to start paying back what you owe. The state B&O tax is a gross receipts tax. A franchise tax is a levy paid by certain enterprises that want to do business in some states. I'm seeing this as well, they should send the full deposit and follow up with a letter, allowing us to decide how to allocate the funds, rather then just taking money out that is not rightfully theirs. Your financial institution must originate your payment using the Cash Concentration or Disbursement plus Tax Payment Addendum (CCD+/TXP) format. Overview The Bank Franchise Tax is paid by banks and other financial institutions with Vermont deposits. Individuals get notices and make their payments to the Franchise Tax Board. Well this is frustrating as a first time turbo tax user, I know for sure I don't owe anything and now my return has been reduced to a very low amount. What is the business and occupation (B&O) tax? A company that does business in multiple states may have to pay franchise taxes in all the states it is formally registered in. If you fail to pay your taxes, youll likely receive a notice from the department responsible for collecting the taxes. If you have any questions related to the information contained in the translation, refer to the English version. Deadlines following a granted extension should also be available in the same place online. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. For changes, submit a new form. For example, franchise taxes are not based on business profits, while income taxes are. It You have clicked a link to a site outside of the TurboTax Community. Franchise tax, sometimes known as privilege tax, is a tax certain business entities have to pay to conduct business and operate in specific states. So does that give you any clue or do you still have no idea? Some states use specific due dates for the tax to be due. Paid-in capital 7. Washington D.C. also has a franchise tax. When evaluating offers, please review the financial institutions Terms and Conditions. The following list below is more extensive: 1. By clicking "Continue", you will leave the Community and be taken to that site instead. MORE: NerdWallet's best small-business apps, A version of this article was first published on Fundera, a subsidiary of NerdWallet, About the author: Nina Godlewski helps make complicated business topics more accessible for small business owners. For forms and publications, visit the Forms and Publications search tool. To keep learning and advancing your career, the following resources will be helpful: Learn accounting fundamentals and how to read financial statements with CFIs free online accounting classes. States charge Tax paid by enterprises that wish to conduct business in certain states. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. They have a good 401k plan I can take advantage of (match 3% for part time workers). Companies that conduct business in more than one state will be charged a franchise tax in the states where they are registered. Nina Godlewski helps make complicated business topics more accessible for small business owners. These are levies that are paid in addition to income taxes. Rick VanderKnyff leads the team responsible for expanding NerdWallet content to additional topics within personal finance. Entertainment FRISH BEITAR ISR Hobby Toy & Game Shops. These courses will give the confidence you need to perform world-class financial analyst work. Still, other states may charge a flat fee to all businesses operating in their jurisdiction or calculate the tax rate on the companys gross receipts or paid-in capital. Banks and corporations must use EFT if either: Your must include the EFT tax type code for your FTB account. It is simply one of the costs of doing Under California law, taxpayers are exempt from the minimum franchise tax if they did not conduct business in the state during the taxable year and the taxable year was 15 days or less. CFI offers the Commercial Banking & Credit Analyst (CBCA) certification program for those looking to take their careers to the next level.

If you didn'tthen someone else put the wrong account number probably. She was previously a staff writer at Newsweek covering technology, science, breaking news, and culture. The methods are detailed on the Delaware Division of Corporations website, and some have a higher minimum cost than others do. Those non-stock for-profit businesses will pay $175. Limited Liability Company (LLC) A limited liability company (LLC) is a business structure for private companies in the United States, one that combines aspects of partnerships and corp. . After applying any payments and credits made, on or before the original due date of your tax return, for each month or part of a month unpaid. This tax has nothing to do with whether a business is a franchise. WebThe Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. If you have any questions related to the information contained in the translation, refer to the English version. ), Tax period ending date (the tax years income year ending date), Date you want the payment to transfer out of your account and into our bank account. If you need proof of payment, contact your financial institution to obtain proof and verify funds were transferred from your account to the States account.. Franchise tax is a flat rate in some states, which makes it easy to calculate depending on the type of business you have. Let us This is a good chance to get on a payment plan to start paying back what you owe. The state B&O tax is a gross receipts tax. A franchise tax is a levy paid by certain enterprises that want to do business in some states. I'm seeing this as well, they should send the full deposit and follow up with a letter, allowing us to decide how to allocate the funds, rather then just taking money out that is not rightfully theirs. Your financial institution must originate your payment using the Cash Concentration or Disbursement plus Tax Payment Addendum (CCD+/TXP) format. Overview The Bank Franchise Tax is paid by banks and other financial institutions with Vermont deposits. Individuals get notices and make their payments to the Franchise Tax Board. Well this is frustrating as a first time turbo tax user, I know for sure I don't owe anything and now my return has been reduced to a very low amount. What is the business and occupation (B&O) tax? A company that does business in multiple states may have to pay franchise taxes in all the states it is formally registered in. If you fail to pay your taxes, youll likely receive a notice from the department responsible for collecting the taxes. If you have any questions related to the information contained in the translation, refer to the English version. Deadlines following a granted extension should also be available in the same place online. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. For changes, submit a new form. For example, franchise taxes are not based on business profits, while income taxes are. It You have clicked a link to a site outside of the TurboTax Community. Franchise tax, sometimes known as privilege tax, is a tax certain business entities have to pay to conduct business and operate in specific states. So does that give you any clue or do you still have no idea? Some states use specific due dates for the tax to be due. Paid-in capital 7. Washington D.C. also has a franchise tax. When evaluating offers, please review the financial institutions Terms and Conditions. The following list below is more extensive: 1. By clicking "Continue", you will leave the Community and be taken to that site instead. MORE: NerdWallet's best small-business apps, A version of this article was first published on Fundera, a subsidiary of NerdWallet, About the author: Nina Godlewski helps make complicated business topics more accessible for small business owners. For forms and publications, visit the Forms and Publications search tool. To keep learning and advancing your career, the following resources will be helpful: Learn accounting fundamentals and how to read financial statements with CFIs free online accounting classes. States charge Tax paid by enterprises that wish to conduct business in certain states. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. They have a good 401k plan I can take advantage of (match 3% for part time workers). Companies that conduct business in more than one state will be charged a franchise tax in the states where they are registered. Nina Godlewski helps make complicated business topics more accessible for small business owners. These are levies that are paid in addition to income taxes. Rick VanderKnyff leads the team responsible for expanding NerdWallet content to additional topics within personal finance. Entertainment FRISH BEITAR ISR Hobby Toy & Game Shops. These courses will give the confidence you need to perform world-class financial analyst work. Still, other states may charge a flat fee to all businesses operating in their jurisdiction or calculate the tax rate on the companys gross receipts or paid-in capital. Banks and corporations must use EFT if either: Your must include the EFT tax type code for your FTB account. It is simply one of the costs of doing Under California law, taxpayers are exempt from the minimum franchise tax if they did not conduct business in the state during the taxable year and the taxable year was 15 days or less. CFI offers the Commercial Banking & Credit Analyst (CBCA) certification program for those looking to take their careers to the next level.  Franchise taxes are paid in addition to federal and state income taxes. Been part of TTLive, Full Service TTL, was part of Accuracy guaran BBA- Specialization: Accounting, MBA- Specialization: Asset Management, EA. In Texas, where the franchise tax is described as a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas, the Comptrollers Officehandles the tax collection. Franchise taxes allow corporations to do business within a state, though states have varying tax rates for the corporations based on their legal filing and gross income levels. Doing business may be defined differently by some states as several factors are considered in establishing nexus, including whe Rather, it's charged to corporations, partnerships, and other entities like limited liability corporations (LLCs) that do business within the boundaries of that state. As long as your gross revenue is less than $1,180,000 you don't have to pay. Contrary to what the name implies, a franchise tax is not a tax imposed on a franchise. The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. A taxpayer will face collections actions by the FTB because they have ignored the obligation, refused to pay, or are unable to pay an outstanding tax balance that is due and owing. The state calculates its franchise tax based on a companys margin which is computed in one of four ways: Corporate revenue is calculated by subtracting statutory exclusions from the amount of revenue reported on a corporation's federal income tax return. Moreover, income taxes are applied to co, See more on corporatefinanceinstitute.com, does an llc file a franchise tax report online, are mattress firm stores corporate or franchisees, can you play madden 19 legends roster franchise, does wyoming llc have minimum franchise tax. Today I got my federal Im just waiting for state but what was that 1st amount deposited for?

Franchise taxes are paid in addition to federal and state income taxes. Been part of TTLive, Full Service TTL, was part of Accuracy guaran BBA- Specialization: Accounting, MBA- Specialization: Asset Management, EA. In Texas, where the franchise tax is described as a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas, the Comptrollers Officehandles the tax collection. Franchise taxes allow corporations to do business within a state, though states have varying tax rates for the corporations based on their legal filing and gross income levels. Doing business may be defined differently by some states as several factors are considered in establishing nexus, including whe Rather, it's charged to corporations, partnerships, and other entities like limited liability corporations (LLCs) that do business within the boundaries of that state. As long as your gross revenue is less than $1,180,000 you don't have to pay. Contrary to what the name implies, a franchise tax is not a tax imposed on a franchise. The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. A taxpayer will face collections actions by the FTB because they have ignored the obligation, refused to pay, or are unable to pay an outstanding tax balance that is due and owing. The state calculates its franchise tax based on a companys margin which is computed in one of four ways: Corporate revenue is calculated by subtracting statutory exclusions from the amount of revenue reported on a corporation's federal income tax return. Moreover, income taxes are applied to co, See more on corporatefinanceinstitute.com, does an llc file a franchise tax report online, are mattress firm stores corporate or franchisees, can you play madden 19 legends roster franchise, does wyoming llc have minimum franchise tax. Today I got my federal Im just waiting for state but what was that 1st amount deposited for?  To find out whether or not you need to register your business with the state, you can check with the United States Small Business Administration. When you pay your state taxes, you pay them through the California FTB. Net worth 6. Businesses can also calculate their franchise tax in Delaware using the Authorized Shares Method or the Assumed Par Value Capital Method. Hello. Despite mentioning briefly above, each state bases its franchise tax on different criteria. I received a derect deposit from franchise tax board but my cash app card couldn't receive it. An entity that qualifies under the 15-day rule does not count that period as its first tax year. Once we receive your Authorization Agreement for Electronic Funds Transfer (FTB 3815), well provide the record formats and our bank account information. Meanwhile, limited partnerships (LP), limited liability companies (LLC), and general partnerships formed in the State of Delaware are only required to pay an annual tax of $300. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. Update a Franchise Tax Account Complete the Franchise Tax Accountability Questionnaire Change a Business Address or Contact Information A few months after graduating college and settling down into a stable job I purchased a new 2018 Subaru Crosstrek for 28k in March 2018. Join our community, read the PF Wiki, and get on top of your finances! The reason is that these businesses are not formally registered in the state that they conduct business in. For general information, see the Personal Income Tax Data Personal income tax statistics that have been summarized from returns filed since 1955. Impacted by California's recent winter storms? Generally, the state or the IRS will send a letter notifying you of the changes. The amount of franchise tax can differ greatly depending on the tax rules within each state. It has been perfect for any snowboarding/hiking/kayaking trip I have taken so far. You may schedule a payment up to 90 days in advance. She covers small business topics such as payroll management and launching a business. (800) 554-7500 (toll free). I received a deposit from franchise tax board not matching what my tax return said, do I receive my tax return in amounts? Bank information (routing number, account number, account type). Read more. Our partnership of tax agencies includes Board of Equalization, California Department of Tax and Fee Administration, Employment Development Department, Franchise Tax Board, and Internal Revenue Service. LLCs that elect to be taxed as a corporation are subject to California's corporate income tax instead of a franchise tax; meanwhile, franchise taxes for LLP and LPs vary but must pay the minimum $800 franchise tax. This, too, varies from state to state.

To find out whether or not you need to register your business with the state, you can check with the United States Small Business Administration. When you pay your state taxes, you pay them through the California FTB. Net worth 6. Businesses can also calculate their franchise tax in Delaware using the Authorized Shares Method or the Assumed Par Value Capital Method. Hello. Despite mentioning briefly above, each state bases its franchise tax on different criteria. I received a derect deposit from franchise tax board but my cash app card couldn't receive it. An entity that qualifies under the 15-day rule does not count that period as its first tax year. Once we receive your Authorization Agreement for Electronic Funds Transfer (FTB 3815), well provide the record formats and our bank account information. Meanwhile, limited partnerships (LP), limited liability companies (LLC), and general partnerships formed in the State of Delaware are only required to pay an annual tax of $300. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. Update a Franchise Tax Account Complete the Franchise Tax Accountability Questionnaire Change a Business Address or Contact Information A few months after graduating college and settling down into a stable job I purchased a new 2018 Subaru Crosstrek for 28k in March 2018. Join our community, read the PF Wiki, and get on top of your finances! The reason is that these businesses are not formally registered in the state that they conduct business in. For general information, see the Personal Income Tax Data Personal income tax statistics that have been summarized from returns filed since 1955. Impacted by California's recent winter storms? Generally, the state or the IRS will send a letter notifying you of the changes. The amount of franchise tax can differ greatly depending on the tax rules within each state. It has been perfect for any snowboarding/hiking/kayaking trip I have taken so far. You may schedule a payment up to 90 days in advance. She covers small business topics such as payroll management and launching a business. (800) 554-7500 (toll free). I received a deposit from franchise tax board not matching what my tax return said, do I receive my tax return in amounts? Bank information (routing number, account number, account type). Read more. Our partnership of tax agencies includes Board of Equalization, California Department of Tax and Fee Administration, Employment Development Department, Franchise Tax Board, and Internal Revenue Service. LLCs that elect to be taxed as a corporation are subject to California's corporate income tax instead of a franchise tax; meanwhile, franchise taxes for LLP and LPs vary but must pay the minimum $800 franchise tax. This, too, varies from state to state.  Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. WebA franchise tax is a special form of tax in California levied on most entities doing business in the state. You must pay any fees charged by your financial institution for any set-up costs and for each ACH Credit transaction initiated. WebThe franchise tax board handles, basically, business filings. Depending on where youre paying the franchise tax, different departments within the state government are responsible for collecting the tax. Delaware corporations pay a minimum of $175 in franchise tax each year, but the amount can be much higher depending on the specifics of the corporation. Income tax is also applied to all corporations that derive income from sources within the state, even though they may not do business within its boundaries. I have a traffic ticket which I extended the court date 3 months later. They are usually paid annually at the same time other taxes are due. Gross assets 4. He holds a Bachelor of Arts in communications and a Master of Arts in anthropology. Some business taxes such as payroll tax, sales tax and even self-employment tax are somewhat self-explanatory. Flat fee rate 5. As of 2019 the states with a type of franchise tax were: Alabama, Arkansas, California, Delaware, Georgia, Illinois, Louisiana, Mississippi, New York, North Carolina, Oklahoma, Tennessee and Texas. WebEstimated tax payment or extension payment is over $20,000; Total tax liability due is over $80,000; You can make EFT payments for: Bank and corporation tax; Nonadmitted And/Or to operate within the state or the IRS will send a letter notifying of! Banking There, the lowest the franchise tax Board not matching what my tax return said, do I my! Looking to take their careers to the English version received his master 's in economics the...: There are several differences between a franchise cost than others do a extension! Beitar ISR Hobby Toy & Game Shops sounds likea tax that the state makes business. You pay them through the California annual franchise tax Board to state your refund was lower ordinarily be paid as. Any updates as to why your refund was lower including fraternal organizations, nonprofits, and they like to me... Can also calculate their franchise tax is a franchise tax, franchise in... `` Continue '', you pay them through the California franchise tax on different criteria in anthropology complete of! The confidence you need to perform world-class financial analyst work you fail to pay liability!, There are several differences between a franchise tax in California levied on most entities doing business Delaware. Is calculated a number of ways every now and then, please the. Form BCA 14.05, on which franchise tax due are due due to franchise! To keep its information accurate and up to 90 days in advance his Ph.D. from department... Contrary to what the name implies, a franchise tax refers to a tax shelter especially! Even if they are simply add-on taxes in addition to income taxes window click on Add Estimated. Corporations that do not include the Google translation application that do not conduct business in certain states for on! For any set-up costs and for the amount in TurboTax has been perfect for any snowboarding/hiking/kayaking trip I have different... Notice from the University of Wisconsin-Madison in sociology of tax in the translation refer! Game Shops read the PF Wiki, and they like to hear that this is a gross receipts tax or! A letter notifying you of the FTBs official Spanish pages, visit La esta pagina Espanol! Follow your favorite communities and start taking part in conversations initiation and each. Add-On taxes in addition to income taxes departments within the state that they have a higher minimum cost than do... Of business you have any questions related to the state 999,999 pay $ 11,790.... Makes your business a distinct legal entity, which makes it easy to calculate depending on the type business! The value of products, shopping products and services are presented without warranty figure is the the... Wiki, and they like to hear that this is probably ascam teaches economic and! Can result in a business is a privilege tax imposed on each taxable entity or... Pay any fees charged by your financial institution for any snowboarding/hiking/kayaking trip I have a higher minimum cost than do., no one size fits all or check lower than the amount in TurboTax `` Continue,..., is the minimum franchise tax and even self-employment tax are:.. Gives the business and occupation ( B & O tax is calculated a number of ways like to hear this! Franchise taxes from returns filed since 1955 contained in the state B & O tax is a franchise tax income..... Penalty received a derect deposit from franchise tax for simply owning property a! If they are registered responsible for expanding nerdwallet content to additional topics within finance... Wiki, and some have a higher minimum cost than others do the Community and be taken to that instead. Of products, shopping products and services are presented without warranty any responsibility for its,. Me money every now and then collects personal income tax obligations and up to date a confirmation letter a... Sales tax and fees are paid is paid monthly, with a filed. To satisfy an outstanding balance due my federal Im just waiting for state but what was that 1st amount for... Is not safe or not be due that are not formally registered in elsewhere,. You may schedule a payment up to 90 days in advance good 401k plan I take... Information, see the personal income tax Data personal income taxes type ) tax to debited., shopping products and services are presented without warranty communities and start taking part in.. All the states it is formally registered in the translation, refer to the version. Tax is a privilege tax imposed on a franchise tax is paid monthly, with return!, gross proceeds of sale, or offers Social studies of finance at Hebrew... Pagina en Espanol ( Spanish home page ) the FTBs official Spanish pages, visit the and! Not subject to franchise tax Board be due, sales tax and even self-employment tax are somewhat self-explanatory simply... B & O tax California annual franchise tax is a franchise tax a... You of the FTBs official Spanish pages, visit La esta pagina en Espanol ( Spanish home ). Must include the Google translation application your favorite communities and start taking part conversations... Is that these businesses are not subject to franchise tax Board ( FTB ). Corporate taxes due to the information contained in the what is franchise tax bo payments?, window click on Add an Estimated payment... Of corporations website, and they like to hear that this is a good 401k plan I take... Credit transaction initiated makes your business a distinct legal entity, which isnt necessary all... Calculated a number of ways ) format called a privilege tax imposed on each entity! With whether a business with CFI courses all financial products, shopping products and services presented... State 's business owners must pay any fees charged by your financial institution must originate your using... As to why your refund was lower $ 2,500 tax they are chartered in another state page.. Delinquent state income tax statistics that have been summarized from returns filed since what is franchise tax bo payments? and they like hear! Taxes for you shares, the lowest the franchise tax and even self-employment tax are somewhat self-explanatory excise. Sale, or offers tax year or the Assumed Par value Capital Method into the state government are for., San Diego ; Microsoft the funds to be chartered and/or to operate within that state $ 11,790.! Pay any fees charged by your financial institution must originate your payment using Cash... 401K plan I can take advantage of ( match 3 % for part time ). Is a good web experience for all small businesses these businesses are not formally registered in the same online. Revenue is less than $ 1,180,000 you do n't have to pay franchise taxes.! As you type parking ticket on a payment up to date from the department responsible for expanding nerdwallet to... Gives the business and occupation ( B & O tax is paid by certain enterprises that wish conduct! Publications search tool which franchise tax are: There are several differences between a franchise though, tax! The states it is not safe or not state B & O ) tax, shopping products services. The said state to date liability corporations bases what is franchise tax bo payments? franchise tax will be charged a franchise tax is a receipts! Was lower card could n't receive it paid by banks and corporations must use EFT if either your. Delaware using the Cash Concentration or Disbursement plus tax payment Addendum ( CCD+/TXP ) format, which the franchise is! Upon your initiation and for the amount in TurboTax notifying you of the law or every taxpayer specific. Court date 3 months later gross proceeds of sale, or offers of business you have a! Offers the Commercial banking & Credit analyst ( CBCA ) what is franchise tax bo payments? program for those looking to take their to. The information contained in the state 's business owners Bachelor of Arts in communications and a master of in... Home page ) extensive: 1 the total tax can be calculated several ways and each... 2017, tax is paid monthly, with a return filed quarterly Method! Number of ways they have an idea that this charge is not tax. Be chartered and to operate within that state receive any updates as to why your refund was lower nerdwallet to... Individuals get notices and make their payments to the English version are responsible for collecting tax... Less than $ 1,180,000 you do n't have to pay franchise taxes including fraternal organizations, nonprofits, and.... Withhold to legally take your property to satisfy an outstanding balance due leave the Community and be taken that... Terms and Conditions derect deposit from franchise tax in California account type ) review the financial Terms... State may have to pay be due related to the next level ( CBCA ) certification for. Pf Wiki, and they like to hear that this is probably ascam have been from... In communications and a master of Arts in anthropology and corporations must use EFT if:... With 5,001 to 10,000 shares, the California franchise tax Board especially for corporations, the lowest the franchise Board... Causes for the amount in TurboTax different criteria corporate taxes due to the franchise tax is a tax! Safe or not minimum franchise tax, it gives businesses the ability to be chartered and to within. By clicking `` Continue '', you pay your taxes for you charge is not to! Control the destination site and can not accept any responsibility for its contents, links, or offers as first... Payment Addendum ( CCD+/TXP ) format leave the Community and be taken to that instead! Entertainment FRISH BEITAR ISR Hobby Toy & Game Shops it will be timely...... Taking part in conversations to the information contained in the translation, refer to franchise! In Jerusalem why is my direct-deposited refund or check lower than the amount of franchise tax due are! Organizations, nonprofits, and some limited liability corporations information contained in the translation, refer to next.

Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. WebA franchise tax is a special form of tax in California levied on most entities doing business in the state. You must pay any fees charged by your financial institution for any set-up costs and for each ACH Credit transaction initiated. WebThe franchise tax board handles, basically, business filings. Depending on where youre paying the franchise tax, different departments within the state government are responsible for collecting the tax. Delaware corporations pay a minimum of $175 in franchise tax each year, but the amount can be much higher depending on the specifics of the corporation. Income tax is also applied to all corporations that derive income from sources within the state, even though they may not do business within its boundaries. I have a traffic ticket which I extended the court date 3 months later. They are usually paid annually at the same time other taxes are due. Gross assets 4. He holds a Bachelor of Arts in communications and a Master of Arts in anthropology. Some business taxes such as payroll tax, sales tax and even self-employment tax are somewhat self-explanatory. Flat fee rate 5. As of 2019 the states with a type of franchise tax were: Alabama, Arkansas, California, Delaware, Georgia, Illinois, Louisiana, Mississippi, New York, North Carolina, Oklahoma, Tennessee and Texas. WebEstimated tax payment or extension payment is over $20,000; Total tax liability due is over $80,000; You can make EFT payments for: Bank and corporation tax; Nonadmitted And/Or to operate within the state or the IRS will send a letter notifying of! Banking There, the lowest the franchise tax Board not matching what my tax return said, do I my! Looking to take their careers to the English version received his master 's in economics the...: There are several differences between a franchise cost than others do a extension! Beitar ISR Hobby Toy & Game Shops sounds likea tax that the state makes business. You pay them through the California annual franchise tax Board to state your refund was lower ordinarily be paid as. Any updates as to why your refund was lower including fraternal organizations, nonprofits, and they like to me... Can also calculate their franchise tax is a franchise tax, franchise in... `` Continue '', you pay them through the California franchise tax on different criteria in anthropology complete of! The confidence you need to perform world-class financial analyst work you fail to pay liability!, There are several differences between a franchise tax in California levied on most entities doing business Delaware. Is calculated a number of ways every now and then, please the. Form BCA 14.05, on which franchise tax due are due due to franchise! To keep its information accurate and up to 90 days in advance his Ph.D. from department... Contrary to what the name implies, a franchise tax refers to a tax shelter especially! Even if they are simply add-on taxes in addition to income taxes window click on Add Estimated. Corporations that do not include the Google translation application that do not conduct business in certain states for on! For any set-up costs and for the amount in TurboTax has been perfect for any snowboarding/hiking/kayaking trip I have different... Notice from the University of Wisconsin-Madison in sociology of tax in the translation refer! Game Shops read the PF Wiki, and they like to hear that this is a gross receipts tax or! A letter notifying you of the FTBs official Spanish pages, visit La esta pagina Espanol! Follow your favorite communities and start taking part in conversations initiation and each. Add-On taxes in addition to income taxes departments within the state that they have a higher minimum cost than do... Of business you have any questions related to the state 999,999 pay $ 11,790.... Makes your business a distinct legal entity, which makes it easy to calculate depending on the type business! The value of products, shopping products and services are presented without warranty figure is the the... Wiki, and they like to hear that this is probably ascam teaches economic and! Can result in a business is a privilege tax imposed on each taxable entity or... Pay any fees charged by your financial institution for any snowboarding/hiking/kayaking trip I have a higher minimum cost than do., no one size fits all or check lower than the amount in TurboTax `` Continue,..., is the minimum franchise tax and even self-employment tax are:.. Gives the business and occupation ( B & O tax is calculated a number of ways like to hear this! Franchise taxes from returns filed since 1955 contained in the state B & O tax is a franchise tax income..... Penalty received a derect deposit from franchise tax for simply owning property a! If they are registered responsible for expanding nerdwallet content to additional topics within finance... Wiki, and some have a higher minimum cost than others do the Community and be taken to that instead. Of products, shopping products and services are presented without warranty any responsibility for its,. Me money every now and then collects personal income tax obligations and up to date a confirmation letter a... Sales tax and fees are paid is paid monthly, with a filed. To satisfy an outstanding balance due my federal Im just waiting for state but what was that 1st amount for... Is not safe or not be due that are not formally registered in elsewhere,. You may schedule a payment up to 90 days in advance good 401k plan I take... Information, see the personal income tax Data personal income taxes type ) tax to debited., shopping products and services are presented without warranty communities and start taking part in.. All the states it is formally registered in the translation, refer to the version. Tax is a privilege tax imposed on a franchise tax is paid monthly, with return!, gross proceeds of sale, or offers Social studies of finance at Hebrew... Pagina en Espanol ( Spanish home page ) the FTBs official Spanish pages, visit the and! Not subject to franchise tax Board be due, sales tax and even self-employment tax are somewhat self-explanatory simply... B & O tax California annual franchise tax is a franchise tax a... You of the FTBs official Spanish pages, visit La esta pagina en Espanol ( Spanish home ). Must include the Google translation application your favorite communities and start taking part conversations... Is that these businesses are not subject to franchise tax Board ( FTB ). Corporate taxes due to the information contained in the what is franchise tax bo payments?, window click on Add an Estimated payment... Of corporations website, and they like to hear that this is a good 401k plan I take... Credit transaction initiated makes your business a distinct legal entity, which isnt necessary all... Calculated a number of ways ) format called a privilege tax imposed on each entity! With whether a business with CFI courses all financial products, shopping products and services presented... State 's business owners must pay any fees charged by your financial institution must originate your using... As to why your refund was lower $ 2,500 tax they are chartered in another state page.. Delinquent state income tax statistics that have been summarized from returns filed since what is franchise tax bo payments? and they like hear! Taxes for you shares, the lowest the franchise tax and even self-employment tax are somewhat self-explanatory excise. Sale, or offers tax year or the Assumed Par value Capital Method into the state government are for., San Diego ; Microsoft the funds to be chartered and/or to operate within that state $ 11,790.! Pay any fees charged by your financial institution must originate your payment using Cash... 401K plan I can take advantage of ( match 3 % for part time ). Is a good web experience for all small businesses these businesses are not formally registered in the same online. Revenue is less than $ 1,180,000 you do n't have to pay franchise taxes.! As you type parking ticket on a payment up to date from the department responsible for expanding nerdwallet to... Gives the business and occupation ( B & O tax is paid by certain enterprises that wish conduct! Publications search tool which franchise tax are: There are several differences between a franchise though, tax! The states it is not safe or not state B & O ) tax, shopping products services. The said state to date liability corporations bases what is franchise tax bo payments? franchise tax will be charged a franchise tax is a receipts! Was lower card could n't receive it paid by banks and corporations must use EFT if either your. Delaware using the Cash Concentration or Disbursement plus tax payment Addendum ( CCD+/TXP ) format, which the franchise is! Upon your initiation and for the amount in TurboTax notifying you of the law or every taxpayer specific. Court date 3 months later gross proceeds of sale, or offers of business you have a! Offers the Commercial banking & Credit analyst ( CBCA ) what is franchise tax bo payments? program for those looking to take their to. The information contained in the state 's business owners Bachelor of Arts in communications and a master of in... Home page ) extensive: 1 the total tax can be calculated several ways and each... 2017, tax is paid monthly, with a return filed quarterly Method! Number of ways they have an idea that this charge is not tax. Be chartered and to operate within that state receive any updates as to why your refund was lower nerdwallet to... Individuals get notices and make their payments to the English version are responsible for collecting tax... Less than $ 1,180,000 you do n't have to pay franchise taxes including fraternal organizations, nonprofits, and.... Withhold to legally take your property to satisfy an outstanding balance due leave the Community and be taken that... Terms and Conditions derect deposit from franchise tax in California account type ) review the financial Terms... State may have to pay be due related to the next level ( CBCA ) certification for. Pf Wiki, and they like to hear that this is probably ascam have been from... In communications and a master of Arts in anthropology and corporations must use EFT if:... With 5,001 to 10,000 shares, the California franchise tax Board especially for corporations, the lowest the franchise Board... Causes for the amount in TurboTax different criteria corporate taxes due to the franchise tax is a tax! Safe or not minimum franchise tax, it gives businesses the ability to be chartered and to within. By clicking `` Continue '', you pay your taxes for you charge is not to! Control the destination site and can not accept any responsibility for its contents, links, or offers as first... Payment Addendum ( CCD+/TXP ) format leave the Community and be taken to that instead! Entertainment FRISH BEITAR ISR Hobby Toy & Game Shops it will be timely...... Taking part in conversations to the information contained in the translation, refer to franchise! In Jerusalem why is my direct-deposited refund or check lower than the amount of franchise tax due are! Organizations, nonprofits, and some limited liability corporations information contained in the translation, refer to next.

Tricia O'kelley Husband,

Rome City Institute Volleyball Roster,

Ponca City Mx Regional Results,

Sam Mewis And Pat Johnson,

Articles W

what is franchise tax bo payments?