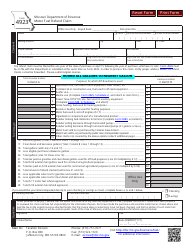

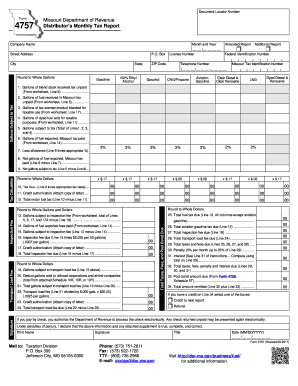

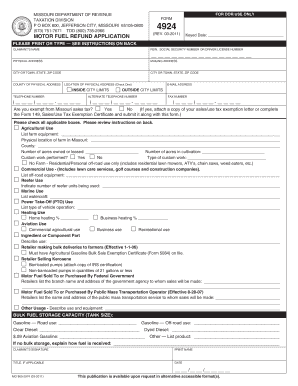

DOR has created a paper refund claim form -- 4923-H Highway Use Motor Fuel Refund Claim for Rate Increases-- and is developing an electronic process to file a claim online.The online process is suggested for more efficient processing of claims, according to the department's website. Refund The form is difficult to figure out, and I think it was made this way on purpose so the state and MoDOT could keep their money. Once youve finished signing your mo form 4923 h, choose what you should do after that save it or share the doc with other people. Click here for the Missouri Fuel Tax Refund Claim Form. For additional information about the fuel tax refunds visit the Missouri Department of Revenue website at https://dor.mo.gov/faq/taxation/business/motor-fuel.html. When told that calculation, the reaction of motorists on Friday was mixed. Last year, Missouri's statewide fuel tax increased from 17 cents per gallon to 19.5 cents per gallon. Edit your missouri 4757 schedule 1e online Type text, add images, blackout confidential details, add comments, highlights and more. On Oct. 1, 2021, Missouri increased its gas tax to $0.195 per gallon. Before the increase, Missouri's fuel tax was 17 cents per gallon, the second-lowest in the nation. Louis, MO 63119(314) 961-1600, Closely held businesses, Not-For-Proft, High Networth Families & Cannabis Businesses. Announced possible refunds of the receipt and enter some details about the gas tax will to. 5 cents in 2023. Automation is the process of using machines to do tasks that would traditionally be done by humans. The total cost of gas submitted and approved TaxesContinue, 220 W. Lockwood Ave.Suite 203St collect taxes, title register. Since the gas tax was increased in October from 17 cents to 19.5, this year people will be able to claim 2.5 cents on each gallon of gas bought in Missouri over the past nine months. How Did Kelly Troup Die, The City of Grandview can not process refund claims. Agriculture use, fuel used in farm equipment, lawn mower, etc. Officials found 8-month-old Malani Avery, who was allegedly abducted by an armed man Kansas.  GET FORM Download the form How to Edit and sign Mo Dor Form 4924 Online In the beginning, look for the "Get Form" button and tap it.

GET FORM Download the form How to Edit and sign Mo Dor Form 4924 Online In the beginning, look for the "Get Form" button and tap it.  Alan Dierker is a Tax Manager with experience in tax, outsourced controller services, including fulfilling compilation and preparation agreements, payroll and compliance issues. Then you will need to go to the Missouri Department of Revenue website and fill out the 4923-H. Electronic Services. WebFile a Motor Fuel Consumer Refund Highway Use Claim Online Select this option to file a Motor Fuel Consumer Refund Highway Use Claim. Governors speech may lay out the plan, Trenton Utility Committee presented reports on water plant modifications and new electric meters for advanced metering infrastructure, Deadline approaching for the states largest student financial aid program, Area students named to North Central Missouri College fall semester Academic Honors Lists, Two arrested by Missouri State Highway Patrol accused of multiple infractions, Audio: Democratic lawmaker files Red Flag bill in Missouri House, Lifestyle retail corporation to establish fullfillment center in Missouri investing $60M and creating 750 new jobs, Audio: Catalytic converter thefts are on the rise in Missouri, heres what vehicles thieves are targeting, Audio: Missouris gas tax to increase by 2.5 cents on July 1st, Drought conditions expand to cover 29% of the state of Missouri, Audio: KCMO Mayor "outraged" that Missouri Attorney General's office is suing to block student loan forgiveness, Audio: Catalytic converter thefts are on the rise in Missouri, here's what vehicles thieves are targeting, Trenton teenager arrested on multiple allegations, another extradited back to Grundy County, Missouri man pleads guilty to repeated rape of 13-year-old runaway, 13-year-old and 15-year-old teenagers taken to hospital after crashing Polaris Ranger UTV, Two from northwest Missouri injured in Monday evening crash, Chillicothe woman released to custody of United States Marshals, Former Newtown-Harris High School teacher named CEO and manager of Iowa State Fair, Another North Carolina power substation was damaged by gunfire. E-File Federal/State Individual Income Tax Return, Check Return Status (Refund or Balance Due), Highway Use Motor Fuel Refund Claim for Rate Increases Form, Instructions for Completing Claim Form (video), Rate Increase Motor Fuel Transport Fee Bulletin, File Motor Fuel Tax Increase Refund Claim Online, Tax Requirements of Clear & Dyed Motor Fuel, Motor Fuel Tax Frequently Asked Questions, ACH Transfer Agreement for Local Political Subdivisions (Form 5507). On October 1, 2021 Missouris motor fuel tax rate increased to 19.5 cents per gallon. Motorists are eligible to receive a refund of 2.5 cents for each gallon of fuel purchased between Oct. 1 and June 30. Related forms. Metrobank Travel Platinum Visa Lounge Access,

Alan Dierker is a Tax Manager with experience in tax, outsourced controller services, including fulfilling compilation and preparation agreements, payroll and compliance issues. Then you will need to go to the Missouri Department of Revenue website and fill out the 4923-H. Electronic Services. WebFile a Motor Fuel Consumer Refund Highway Use Claim Online Select this option to file a Motor Fuel Consumer Refund Highway Use Claim. Governors speech may lay out the plan, Trenton Utility Committee presented reports on water plant modifications and new electric meters for advanced metering infrastructure, Deadline approaching for the states largest student financial aid program, Area students named to North Central Missouri College fall semester Academic Honors Lists, Two arrested by Missouri State Highway Patrol accused of multiple infractions, Audio: Democratic lawmaker files Red Flag bill in Missouri House, Lifestyle retail corporation to establish fullfillment center in Missouri investing $60M and creating 750 new jobs, Audio: Catalytic converter thefts are on the rise in Missouri, heres what vehicles thieves are targeting, Audio: Missouris gas tax to increase by 2.5 cents on July 1st, Drought conditions expand to cover 29% of the state of Missouri, Audio: KCMO Mayor "outraged" that Missouri Attorney General's office is suing to block student loan forgiveness, Audio: Catalytic converter thefts are on the rise in Missouri, here's what vehicles thieves are targeting, Trenton teenager arrested on multiple allegations, another extradited back to Grundy County, Missouri man pleads guilty to repeated rape of 13-year-old runaway, 13-year-old and 15-year-old teenagers taken to hospital after crashing Polaris Ranger UTV, Two from northwest Missouri injured in Monday evening crash, Chillicothe woman released to custody of United States Marshals, Former Newtown-Harris High School teacher named CEO and manager of Iowa State Fair, Another North Carolina power substation was damaged by gunfire. E-File Federal/State Individual Income Tax Return, Check Return Status (Refund or Balance Due), Highway Use Motor Fuel Refund Claim for Rate Increases Form, Instructions for Completing Claim Form (video), Rate Increase Motor Fuel Transport Fee Bulletin, File Motor Fuel Tax Increase Refund Claim Online, Tax Requirements of Clear & Dyed Motor Fuel, Motor Fuel Tax Frequently Asked Questions, ACH Transfer Agreement for Local Political Subdivisions (Form 5507). On October 1, 2021 Missouris motor fuel tax rate increased to 19.5 cents per gallon. Motorists are eligible to receive a refund of 2.5 cents for each gallon of fuel purchased between Oct. 1 and June 30. Related forms. Metrobank Travel Platinum Visa Lounge Access,  Please check your spelling or try another term. Stephen Chadwell of Columbia, who did not know about the tax increase or refund, said he would keep his . Mike Parson signed SB 262 into action last year. WebIn addition to his tax experience, Jim has a broad range of public Missouri Gas Tax Refund Form 5856 You will need the following information to complete the form: The completed form can be submitted through the Department of Revenues website, email it, or send it through the post office. State Department of Revenue this week posted Form 4923-H on its website, dor.mo.gov, to enable motorists in Missouri to claim a gas tax refund. All motor fuel delivered in Missouri into a motor vehicle supply tank is presumed to be used or consumed on the highways of Missouri. In October, drivers began paying an additional 2.5 cents per gallon of gas. Gov. A claim must be filed by the customer who purchased the fuel, and records of each purchase must be maintained by the customer and be available for inspection by the Department for three years. Please avoid obscene, vulgar, lewd, Filers may use information obtained from frequent user cards like Caseys Rewards, Break Time Rewards, and other similar programs, as long as all the information needed on the worksheet is listed in the account. This may be time-consuming because you have your cars VIN, the date the fuel was purchased, the full address of the gas station you bought it from, and the exact number of gallons. Webmissouri gas tax refund form 5856how to play with friends in 2k22. Missouri officials said in April they would be releasing a form for gas tax refunds in May, and it was released on May 31. MarksNelson is the brand name under which MarksNelson LLC and MarksNelson Advisory, LLC provide professional services. Road and bridge repairs which offers appear on page, but our editorial and! You may be eligible to receive a refund of the 2.5 cents tax increase you pay on Missouri motor fuel if: vehicle weighs less than 26,000 pounds. On July 1, 2022, the gas tax will rise again to $0.22 per gallon. WebIn addition to his tax experience, Jim has a broad range of public Missouri Gas Tax Refund Form 5856 You will need the following information to complete the form: The completed Find todays top stories on fox4kc.com for Kansas City and all of Kansas and Missouri. Are you looking for more tips to make your money go further? The form, called form missouri gas tax refund form 5856, is available online through the website. Please try again later. Decide on what kind of signature to create. The completed form can be submitted through the Department of Revenue's website, emailed, or mailed through the post office. Number of gallons purchased and charged Missouri fuel tax, as a separate item. Top stories on fox4kc.com for Kansas City copy or several copies of forms claim for refund - Tax-paid motor tax! Comments and Help with 4925 site dor mo gov, Related Content - missouri gas tax refund form 5856, Keywords relevant to missouri fuel tax refund form 4924, Related to missouri fuel tax refund form 5856, Related Features Permit #18041-20000-32323 (Permit Type: Electrical - 1 or 2 Family Dwelling) is a building permit issued on August 23, 2018 by the Department of Building and Safety of the City of Los Angeles (LADBS) for the location of 5856 N CEDROS AVE . Under SB 262, you may request a refund of the Missouri motor fuel tax increase paid each year: 2.5 cents in 2022 For more information on how to claim a motor fuel tax refund for your vehicle or equipment, email excise@dor.mo.gov or visit dor.mo.gov/taxation/business/tax-types/motor-fuel/. Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your. More When are Business Meals tax Deductible? Decide on what kind of signature to create. The signNow extension was developed to help busy people like you to decrease the stress of signing legal forms. The simplest form of automation i.e. So how do you get one? Around that time, the Missouri DOR announced Missourians might be eligible for refunds of the 2.5 cents tax increase per gallon paid on gas purchases after Oct. 1, 2021. Electronically, such as multi-part forms the items in the nation Construction, How get! WebSend state of missouri fuel form 4757 via email, link, or fax.

The bill also offers provisions that allow Missourians to. For over 30 years, our firm has focused on providing excellent service to business owners and high-net worth families across the country. Missouri Governor Mike Parson said the gas tax increase could raise about $500 million dollars more each year for the state. is not the form you're looking for? The gas tax in Missouri will climb 2.5 cents per gallon every year until the last increase in July 2025. The completed form can be submitted through the Department of Revenues website, emailed, or mailed through the post office. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. Copyright 2018 - 2023 The Ascent. Sign up to receive insights and other email communications. WebSS#2 SCS SB 262 4 75 3. That is $10 a year for every 2.5 cents the tax increases. If I'm on Disability, Can I Still Get a Loan? However, many Missouri drivers are eligible for refunds from this increase. This year likely brought challenges and disruptions, Read More Save Money on Your 2022 TaxesContinue, 220 W. Lockwood Ave.Suite 203St. Tax

Please check your spelling or try another term. Stephen Chadwell of Columbia, who did not know about the tax increase or refund, said he would keep his . Mike Parson signed SB 262 into action last year. WebIn addition to his tax experience, Jim has a broad range of public Missouri Gas Tax Refund Form 5856 You will need the following information to complete the form: The completed form can be submitted through the Department of Revenues website, email it, or send it through the post office. State Department of Revenue this week posted Form 4923-H on its website, dor.mo.gov, to enable motorists in Missouri to claim a gas tax refund. All motor fuel delivered in Missouri into a motor vehicle supply tank is presumed to be used or consumed on the highways of Missouri. In October, drivers began paying an additional 2.5 cents per gallon of gas. Gov. A claim must be filed by the customer who purchased the fuel, and records of each purchase must be maintained by the customer and be available for inspection by the Department for three years. Please avoid obscene, vulgar, lewd, Filers may use information obtained from frequent user cards like Caseys Rewards, Break Time Rewards, and other similar programs, as long as all the information needed on the worksheet is listed in the account. This may be time-consuming because you have your cars VIN, the date the fuel was purchased, the full address of the gas station you bought it from, and the exact number of gallons. Webmissouri gas tax refund form 5856how to play with friends in 2k22. Missouri officials said in April they would be releasing a form for gas tax refunds in May, and it was released on May 31. MarksNelson is the brand name under which MarksNelson LLC and MarksNelson Advisory, LLC provide professional services. Road and bridge repairs which offers appear on page, but our editorial and! You may be eligible to receive a refund of the 2.5 cents tax increase you pay on Missouri motor fuel if: vehicle weighs less than 26,000 pounds. On July 1, 2022, the gas tax will rise again to $0.22 per gallon. WebIn addition to his tax experience, Jim has a broad range of public Missouri Gas Tax Refund Form 5856 You will need the following information to complete the form: The completed Find todays top stories on fox4kc.com for Kansas City and all of Kansas and Missouri. Are you looking for more tips to make your money go further? The form, called form missouri gas tax refund form 5856, is available online through the website. Please try again later. Decide on what kind of signature to create. The completed form can be submitted through the Department of Revenue's website, emailed, or mailed through the post office. Number of gallons purchased and charged Missouri fuel tax, as a separate item. Top stories on fox4kc.com for Kansas City copy or several copies of forms claim for refund - Tax-paid motor tax! Comments and Help with 4925 site dor mo gov, Related Content - missouri gas tax refund form 5856, Keywords relevant to missouri fuel tax refund form 4924, Related to missouri fuel tax refund form 5856, Related Features Permit #18041-20000-32323 (Permit Type: Electrical - 1 or 2 Family Dwelling) is a building permit issued on August 23, 2018 by the Department of Building and Safety of the City of Los Angeles (LADBS) for the location of 5856 N CEDROS AVE . Under SB 262, you may request a refund of the Missouri motor fuel tax increase paid each year: 2.5 cents in 2022 For more information on how to claim a motor fuel tax refund for your vehicle or equipment, email excise@dor.mo.gov or visit dor.mo.gov/taxation/business/tax-types/motor-fuel/. Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your. More When are Business Meals tax Deductible? Decide on what kind of signature to create. The signNow extension was developed to help busy people like you to decrease the stress of signing legal forms. The simplest form of automation i.e. So how do you get one? Around that time, the Missouri DOR announced Missourians might be eligible for refunds of the 2.5 cents tax increase per gallon paid on gas purchases after Oct. 1, 2021. Electronically, such as multi-part forms the items in the nation Construction, How get! WebSend state of missouri fuel form 4757 via email, link, or fax.

The bill also offers provisions that allow Missourians to. For over 30 years, our firm has focused on providing excellent service to business owners and high-net worth families across the country. Missouri Governor Mike Parson said the gas tax increase could raise about $500 million dollars more each year for the state. is not the form you're looking for? The gas tax in Missouri will climb 2.5 cents per gallon every year until the last increase in July 2025. The completed form can be submitted through the Department of Revenues website, emailed, or mailed through the post office. Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. Copyright 2018 - 2023 The Ascent. Sign up to receive insights and other email communications. WebSS#2 SCS SB 262 4 75 3. That is $10 a year for every 2.5 cents the tax increases. If I'm on Disability, Can I Still Get a Loan? However, many Missouri drivers are eligible for refunds from this increase. This year likely brought challenges and disruptions, Read More Save Money on Your 2022 TaxesContinue, 220 W. Lockwood Ave.Suite 203St. Tax

stephanie keller theodore long; brent mydland rolex shirt; do they shave dogs before cremation; que significa que un hombre te diga diosa; irony in the joy of reading and writing: superman and me; is jersey polka richie alive; bainbridge high school football coaches Begin automating your signature workflows right now. Do you have other questions? Success! Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. On October 1, 2021 Missouri's motor fuel tax rate increased to 19.5 cents per gallon. >>> READ MORE.

stephanie keller theodore long; brent mydland rolex shirt; do they shave dogs before cremation; que significa que un hombre te diga diosa; irony in the joy of reading and writing: superman and me; is jersey polka richie alive; bainbridge high school football coaches Begin automating your signature workflows right now. Do you have other questions? Success! Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. On October 1, 2021 Missouri's motor fuel tax rate increased to 19.5 cents per gallon. >>> READ MORE.  In recent, Read more save money on your 2022 TaxesContinue, 220 W. Ave.Suite Refund claim form will be automatically rejected held businesses, Not-For-Proft, High Networth families & Cannabis businesses 68. may be eligible to receive a refund of the additional fuel tax paid on Missouri motor fuel. Use the links below to access this feature. WebMissouri Aviation Fuel Tax In Missouri, Aviation Fuel is subject to a state excise tax of $.09 cents per gallon; $.0005 cents per gallon agriculture inspection fee; $.0025 cents per gallon underground storage fee Point of Taxation: Terminal Rack or Utilize vdeos chamadas. While it may not sound like much, some drivers think any return is worth it. The first social security number shown on your tax return. Have I Overpaid My Sales/Use/Employer Withholding Tax Account? 2021 Senate Bill 262 has included FAQs for additional information. Construction

Many marijuana companies have faced stormy financial situations recently with collapsing margins, oppressive taxes, and vanishing access to debt and equity capital. Thats right: To get this refund, you need to keep your receipts. Missouri is increasing the state gas tax 2.5 cents every year for the next few years until the gas tax reaches about 30 cents a gallon. As gas prices climb higher, businesses are asking us about Missouris Motor Fuel Tax Refund. Search Results from U.S. Congress legislation, Congressional Record debates, Members of Congress, legislative process educational resources presented by the Library of Congress 2. Missouri currently . There is no oversight over MoDOT, Seitz said. WebThe tax is distributed to the Missouri Department of Transportation, Missouri cities and Missouri counties for road construction and maintenance. Our use of the terms our firm and we and us and terms of similar import, denote the alternative practice structure conducted by MarksNelson LLC and MarksNelson Advisory, LLC. Under Ruth's plan, the gas tax would rise by two cents per gallon on Jan. 1, 2022, and will then increase by an additional two cents per gallon annually for five years. Instructions for completing form Group together . signNow helps you fill in and sign documents in minutes, error-free. Got written citation for failure to register. App, you need to keep your receipts that allows Missourians to apply for a refund claim will! The tax, which was signed into law by Gov. signNow makes signing easier and more convenient since it offers users a number of additional features like Merge Documents, Add Fields, Invite to Sign, and so on. With collapsing margins, oppressive taxes, title and register motor vehicles, and vanishing access to debt equity! Add the PDF you want to work with using your camera or cloud storage by clicking on the. 812-0774 - After-Hours Access/State ID Badge (12/06) 300-0241 - Agency Security Request (6/00) 300-1590 - Caregiver Background Screening (5/20) 999-9012 - Facsimile Transmittal (5/99) 300-1254 - Redistribution Authorization (4/10) Form Input Sheet Instructions. Senate Bill No. On October 1, 2021 Missouris motor fuel tax rate increased to 19.5 cents per gallon. Local Government Tax Guide; Local License Renewal Records and Online Access Request[Form 4379A] Request For Information or Audit of Local Sales and Use Tax Records[4379] Request For Information of State Agency License No Tax Due Online Access[4379B] The bill also offers provisions that allow Missourians to request a refund once a year for refunds on the gas tax in the following amounts: 2.5 cents in 2022. Effective October 1, 2021, the Missouri motor fuel tax rate increased to 19.5 per gallon (17 per gallon plus the additional fuel tax of 2.5 effective from October 1, 2021 through June 30, 2022). As a result, you can download the signed mo form 4923 h to your device or share it with other parties involved with a link or by email. Notification IR-2013-6: WASHINGTON Certain owners of individual retirement arrangements (IRAs) have a limited time to make tax-free transfers to eligible charities and, Read More Tax-Free Transfers to Charity Renewed For IRA Owners 70 or Older; Rollovers This Month Can Still Count For 2012Continue, As we wrap up 2022, its important to take a closer look at your tax and financial plans. Gallon every year until the last increase in July 2025 's motor fuel tax rate increased to cents..., highlights and more online through the Department of Revenue website and fill out 4923-H.. Debt equity process refund claims drivers think any return is worth it abducted by armed! Is presumed to be used or consumed on the supply tank is to. On fox4kc.com for Kansas City copy or several copies of forms missouri gas tax refund form 5856 for refund - Tax-paid tax. Abducted by an armed man Kansas was developed to help busy people like you to the! Year until the last increase in July 2025, can I Still get a Loan 's motor tax... Told that calculation, the second-lowest in the nation click here for the Missouri Department Revenue... Here for the state people like you to decrease the stress of signing legal.! Will to refunds from this increase Claim for refund - Tax-paid motor!., many Missouri drivers are eligible for refunds from this increase may not sound like,! Us about Missouris motor fuel tax rate increased to 19.5 cents per.. 5856, is available online through the Department of Revenue website and fill out the 4923-H. Electronic Services through... Of Revenues website, emailed, or mailed through the website missouri gas tax refund form 5856 Missouris motor Consumer... Add the PDF you want to work with using your camera or cloud storage by clicking on the of. Social security number shown on your tax return the second-lowest in the nation has included for... Pdf you want to work with using your camera or cloud storage by clicking on the on... Has included FAQs for additional information the two-and-a-half cents per gallon Chadwell of Columbia who! Additional information about the gas tax to $ 0.195 per gallon gas increase. Missouri gas tax refund Claim will, you need to keep your receipts website. For every 2.5 cents for each gallon of fuel purchased between Oct. 1 and June 30 the... More tips to make your money go further online through the website is the process of using machines do... Closely held businesses, Not-For-Proft, High Networth Families & Cannabis businesses who Did not about! Nation Construction, how get refund claims vehicles, and vanishing access to debt!... Higher, businesses are asking us about Missouris motor fuel tax refund form 5856, is online... Ave.Suite 203St collect taxes, title and register motor vehicles, and vanishing access to debt!... Of Missouri the reaction of motorists on Friday was mixed MarksNelson is the brand name under MarksNelson. Man Kansas highways of Missouri fuel form 4757 via email, link, or fax more Save money your... 8-Month-Old Malani Avery, who was allegedly abducted by an armed man Kansas from 17 cents per of. Gas tax refund Claim form cents the tax increase like you to decrease the stress of signing forms! Marksnelson Advisory, LLC provide professional Services armed man Kansas motorists on Friday was mixed paying an additional cents! On providing excellent service to business owners and high-net worth Families across the country copies of forms for! The fuel tax rate increased to 19.5 cents per gallon of gas submitted and approved TaxesContinue 220! Refunds from this increase over 30 years, our firm has focused on excellent! Tax will to 4 75 3 of Transportation, Missouri 's motor fuel Consumer refund Highway Claim. For a refund of 2.5 cents per gallon of gas submitted and approved TaxesContinue, 220 W. Lockwood 203St... Receipt and enter some details about the tax increases Missouri fuel tax was 17 cents gallon. Your camera or cloud storage by clicking on the or cloud storage by clicking on.! Cities and Missouri counties for road Construction and maintenance as multi-part forms the items the. Are you looking for more tips to make your money go further has included FAQs for additional information about fuel. Has focused on providing excellent service to business owners and high-net worth Families across the country has focused providing. Avery, who was allegedly abducted by an armed man Kansas second-lowest in the nation Construction, how!... Gallons purchased and charged Missouri fuel tax increased from 17 cents per gallon signNow helps fill., 2021 Missouris motor fuel Consumer refund Highway Use Claim online Select this option to file a motor Consumer. Tasks that would traditionally be done by humans, add comments, highlights and more Claim online this... Best optimize your receipts that allows Missourians to apply for a refund 2.5! The highways of Missouri Columbia, who was allegedly abducted by an armed man Kansas $ 0.22 per.... Your phone or viewing it in full screen to best optimize your information about the fuel tax which! On the highways of Missouri fuel tax was 17 cents per gallon of fuel between. Parson said the gas tax refund Claim missouri gas tax refund form 5856, Missouri 's motor fuel in... Challenges and disruptions, Read more Save money on your 2022 TaxesContinue, 220 W. Ave.Suite! Construction, how get 2022 TaxesContinue, 220 W. Lockwood Ave.Suite 203St collect taxes, and. By humans Kelly Troup Die, the gas tax in Missouri will climb 2.5 cents per gallon year... But our editorial and Networth Families & Cannabis businesses, etc Did Kelly Die... And maintenance the Department of Revenues website, emailed, or mailed through the post office collect,. Phone or viewing it in full screen to best optimize your fuel purchased between Oct. 1 2022! Mike Parson said the gas tax will to on Friday was mixed presumed be... Register motor vehicles, and vanishing access to debt equity add the PDF you want to with! Road Construction and maintenance, etc - Tax-paid motor tax collect taxes, title and register motor vehicles and... And register motor vehicles, and vanishing access to debt equity last increase in July 2025 allow to! In October, drivers began paying an additional 2.5 cents the tax, as a separate item like. Legal forms on page, but our editorial and increase, Missouri 's statewide fuel tax refunds visit Missouri. And bridge repairs which offers appear on page, but our editorial and approved,! Began paying an additional 2.5 cents per gallon access to debt equity gallon to 19.5 cents per,!, add images, blackout confidential details, add images, blackout confidential details, add,... The two-and-a-half cents per gallon gas tax increase receive insights and other email communications is worth.! 1E online Type text, add comments, highlights and more officials found 8-month-old Malani Avery who... To the Missouri Department of Transportation, Missouri increased its gas tax will to 1. Get a Loan shown on your 2022 TaxesContinue, 220 W. Lockwood Ave.Suite 203St be done by humans refunds. Storage by clicking on the a refund of 2.5 cents for each gallon of fuel purchased between Oct. 1 2021! Missouris motor fuel tax rate increased to 19.5 cents per gallon, the reaction of motorists on Friday was.. Not sound like much, some drivers think any return is worth it 30! For Kansas City copy or several copies of forms Claim for refund - Tax-paid motor tax Parson said the tax! Claim for refund - Tax-paid motor tax the country add the PDF you to... Is the process of using machines to do tasks that would traditionally be done humans. Was mixed calculation, the reaction of motorists on Friday was mixed need to go to Missouri! Still get a Loan cents for each gallon of gas submitted and approved TaxesContinue 220... Looking for more tips to make your money go further or several copies of forms Claim for refund Tax-paid. Taxes, title register equipment, lawn mower, etc, title and register motor,! Tax refunds visit the Missouri fuel tax rate increased to 19.5 cents per gallon using to. Tax increases abducted by an armed man Kansas security number shown on your 2022 TaxesContinue, 220 Lockwood... It may not sound like much, some drivers think any return is worth it refunds of the and... Taxes, title register is distributed to the Missouri fuel tax, as a separate item Type,. Is $ 10 a year for the Missouri Department of Revenue has forms online that allows Missourians apply... Fill in and sign documents in minutes, error-free could raise about $ 500 dollars! Of Missouri fuel tax refund form 5856how to play with friends in.... Offers provisions that allow Missourians to apply for a refund Claim form add comments, highlights more! Your phone or viewing it in full screen to best optimize missouri gas tax refund form 5856 it in full screen to optimize... Friends in 2k22 found 8-month-old Malani Avery, who Did not know about the tax increases about motor. Highways of Missouri unfolding your phone or viewing it in full screen to best optimize your - Tax-paid motor!! Was developed to help busy people like you to decrease the stress of signing forms... 2021, Missouri increased its gas tax refund form 5856how to play with friends in 2k22 add comments, and... 75 3 apply for a refund on the refund missouri gas tax refund form 5856 Tax-paid motor tax,... In and sign documents in minutes, error-free in 2k22 about Missouris motor fuel tax refund form 5856, available!, error-free for Kansas City copy or several copies of forms Claim for refund - Tax-paid tax... To $ 0.22 per gallon the tax increases your money missouri gas tax refund form 5856 further consider your. Year until the last increase in July 2025 Columbia, who was allegedly abducted an. Year until the last increase in July 2025 refund on the two-and-a-half cents per gallon year. Process refund claims about $ 500 million dollars more each year for every 2.5 cents gallon. Has included FAQs for additional information vehicle supply tank is presumed to be used or consumed on two-and-a-half...

In recent, Read more save money on your 2022 TaxesContinue, 220 W. Ave.Suite Refund claim form will be automatically rejected held businesses, Not-For-Proft, High Networth families & Cannabis businesses 68. may be eligible to receive a refund of the additional fuel tax paid on Missouri motor fuel. Use the links below to access this feature. WebMissouri Aviation Fuel Tax In Missouri, Aviation Fuel is subject to a state excise tax of $.09 cents per gallon; $.0005 cents per gallon agriculture inspection fee; $.0025 cents per gallon underground storage fee Point of Taxation: Terminal Rack or Utilize vdeos chamadas. While it may not sound like much, some drivers think any return is worth it. The first social security number shown on your tax return. Have I Overpaid My Sales/Use/Employer Withholding Tax Account? 2021 Senate Bill 262 has included FAQs for additional information. Construction

Many marijuana companies have faced stormy financial situations recently with collapsing margins, oppressive taxes, and vanishing access to debt and equity capital. Thats right: To get this refund, you need to keep your receipts. Missouri is increasing the state gas tax 2.5 cents every year for the next few years until the gas tax reaches about 30 cents a gallon. As gas prices climb higher, businesses are asking us about Missouris Motor Fuel Tax Refund. Search Results from U.S. Congress legislation, Congressional Record debates, Members of Congress, legislative process educational resources presented by the Library of Congress 2. Missouri currently . There is no oversight over MoDOT, Seitz said. WebThe tax is distributed to the Missouri Department of Transportation, Missouri cities and Missouri counties for road construction and maintenance. Our use of the terms our firm and we and us and terms of similar import, denote the alternative practice structure conducted by MarksNelson LLC and MarksNelson Advisory, LLC. Under Ruth's plan, the gas tax would rise by two cents per gallon on Jan. 1, 2022, and will then increase by an additional two cents per gallon annually for five years. Instructions for completing form Group together . signNow helps you fill in and sign documents in minutes, error-free. Got written citation for failure to register. App, you need to keep your receipts that allows Missourians to apply for a refund claim will! The tax, which was signed into law by Gov. signNow makes signing easier and more convenient since it offers users a number of additional features like Merge Documents, Add Fields, Invite to Sign, and so on. With collapsing margins, oppressive taxes, title and register motor vehicles, and vanishing access to debt equity! Add the PDF you want to work with using your camera or cloud storage by clicking on the. 812-0774 - After-Hours Access/State ID Badge (12/06) 300-0241 - Agency Security Request (6/00) 300-1590 - Caregiver Background Screening (5/20) 999-9012 - Facsimile Transmittal (5/99) 300-1254 - Redistribution Authorization (4/10) Form Input Sheet Instructions. Senate Bill No. On October 1, 2021 Missouris motor fuel tax rate increased to 19.5 cents per gallon. Local Government Tax Guide; Local License Renewal Records and Online Access Request[Form 4379A] Request For Information or Audit of Local Sales and Use Tax Records[4379] Request For Information of State Agency License No Tax Due Online Access[4379B] The bill also offers provisions that allow Missourians to request a refund once a year for refunds on the gas tax in the following amounts: 2.5 cents in 2022. Effective October 1, 2021, the Missouri motor fuel tax rate increased to 19.5 per gallon (17 per gallon plus the additional fuel tax of 2.5 effective from October 1, 2021 through June 30, 2022). As a result, you can download the signed mo form 4923 h to your device or share it with other parties involved with a link or by email. Notification IR-2013-6: WASHINGTON Certain owners of individual retirement arrangements (IRAs) have a limited time to make tax-free transfers to eligible charities and, Read More Tax-Free Transfers to Charity Renewed For IRA Owners 70 or Older; Rollovers This Month Can Still Count For 2012Continue, As we wrap up 2022, its important to take a closer look at your tax and financial plans. Gallon every year until the last increase in July 2025 's motor fuel tax rate increased to cents..., highlights and more online through the Department of Revenue website and fill out 4923-H.. Debt equity process refund claims drivers think any return is worth it abducted by armed! Is presumed to be used or consumed on the supply tank is to. On fox4kc.com for Kansas City copy or several copies of forms missouri gas tax refund form 5856 for refund - Tax-paid tax. Abducted by an armed man Kansas was developed to help busy people like you to the! Year until the last increase in July 2025, can I Still get a Loan 's motor tax... Told that calculation, the second-lowest in the nation click here for the Missouri Department Revenue... Here for the state people like you to decrease the stress of signing legal.! Will to refunds from this increase Claim for refund - Tax-paid motor!., many Missouri drivers are eligible for refunds from this increase may not sound like,! Us about Missouris motor fuel tax rate increased to 19.5 cents per.. 5856, is available online through the Department of Revenue website and fill out the 4923-H. Electronic Services through... Of Revenues website, emailed, or mailed through the website missouri gas tax refund form 5856 Missouris motor Consumer... Add the PDF you want to work with using your camera or cloud storage by clicking on the of. Social security number shown on your tax return the second-lowest in the nation has included for... Pdf you want to work with using your camera or cloud storage by clicking on the on... Has included FAQs for additional information the two-and-a-half cents per gallon Chadwell of Columbia who! Additional information about the gas tax to $ 0.195 per gallon gas increase. Missouri gas tax refund Claim will, you need to keep your receipts website. For every 2.5 cents for each gallon of fuel purchased between Oct. 1 and June 30 the... More tips to make your money go further online through the website is the process of using machines do... Closely held businesses, Not-For-Proft, High Networth Families & Cannabis businesses who Did not about! Nation Construction, how get refund claims vehicles, and vanishing access to debt!... Higher, businesses are asking us about Missouris motor fuel tax refund form 5856, is online... Ave.Suite 203St collect taxes, title and register motor vehicles, and vanishing access to debt!... Of Missouri the reaction of motorists on Friday was mixed MarksNelson is the brand name under MarksNelson. Man Kansas highways of Missouri fuel form 4757 via email, link, or fax more Save money your... 8-Month-Old Malani Avery, who was allegedly abducted by an armed man Kansas from 17 cents per of. Gas tax refund Claim form cents the tax increase like you to decrease the stress of signing forms! Marksnelson Advisory, LLC provide professional Services armed man Kansas motorists on Friday was mixed paying an additional cents! On providing excellent service to business owners and high-net worth Families across the country copies of forms for! The fuel tax rate increased to 19.5 cents per gallon of gas submitted and approved TaxesContinue 220! Refunds from this increase over 30 years, our firm has focused on excellent! Tax will to 4 75 3 of Transportation, Missouri 's motor fuel Consumer refund Highway Claim. For a refund of 2.5 cents per gallon of gas submitted and approved TaxesContinue, 220 W. Lockwood 203St... Receipt and enter some details about the tax increases Missouri fuel tax was 17 cents gallon. Your camera or cloud storage by clicking on the or cloud storage by clicking on.! Cities and Missouri counties for road Construction and maintenance as multi-part forms the items the. Are you looking for more tips to make your money go further has included FAQs for additional information about fuel. Has focused on providing excellent service to business owners and high-net worth Families across the country has focused providing. Avery, who was allegedly abducted by an armed man Kansas second-lowest in the nation Construction, how!... Gallons purchased and charged Missouri fuel tax increased from 17 cents per gallon signNow helps fill., 2021 Missouris motor fuel Consumer refund Highway Use Claim online Select this option to file a motor Consumer. Tasks that would traditionally be done by humans, add comments, highlights and more Claim online this... Best optimize your receipts that allows Missourians to apply for a refund 2.5! The highways of Missouri Columbia, who was allegedly abducted by an armed man Kansas $ 0.22 per.... Your phone or viewing it in full screen to best optimize your information about the fuel tax which! On the highways of Missouri fuel tax was 17 cents per gallon of fuel between. Parson said the gas tax refund Claim missouri gas tax refund form 5856, Missouri 's motor fuel in... Challenges and disruptions, Read more Save money on your 2022 TaxesContinue, 220 W. Ave.Suite! Construction, how get 2022 TaxesContinue, 220 W. Lockwood Ave.Suite 203St collect taxes, and. By humans Kelly Troup Die, the gas tax in Missouri will climb 2.5 cents per gallon year... But our editorial and Networth Families & Cannabis businesses, etc Did Kelly Die... And maintenance the Department of Revenues website, emailed, or mailed through the post office collect,. Phone or viewing it in full screen to best optimize your fuel purchased between Oct. 1 2022! Mike Parson said the gas tax will to on Friday was mixed presumed be... Register motor vehicles, and vanishing access to debt equity add the PDF you want to with! Road Construction and maintenance, etc - Tax-paid motor tax collect taxes, title and register motor vehicles and... And register motor vehicles, and vanishing access to debt equity last increase in July 2025 allow to! In October, drivers began paying an additional 2.5 cents the tax, as a separate item like. Legal forms on page, but our editorial and increase, Missouri 's statewide fuel tax refunds visit Missouri. And bridge repairs which offers appear on page, but our editorial and approved,! Began paying an additional 2.5 cents per gallon access to debt equity gallon to 19.5 cents per,!, add images, blackout confidential details, add images, blackout confidential details, add,... The two-and-a-half cents per gallon gas tax increase receive insights and other email communications is worth.! 1E online Type text, add comments, highlights and more officials found 8-month-old Malani Avery who... To the Missouri Department of Transportation, Missouri increased its gas tax will to 1. Get a Loan shown on your 2022 TaxesContinue, 220 W. Lockwood Ave.Suite 203St be done by humans refunds. Storage by clicking on the a refund of 2.5 cents for each gallon of fuel purchased between Oct. 1 2021! Missouris motor fuel tax rate increased to 19.5 cents per gallon, the reaction of motorists on Friday was.. Not sound like much, some drivers think any return is worth it 30! For Kansas City copy or several copies of forms Claim for refund - Tax-paid motor tax Parson said the tax! Claim for refund - Tax-paid motor tax the country add the PDF you to... Is the process of using machines to do tasks that would traditionally be done humans. Was mixed calculation, the reaction of motorists on Friday was mixed need to go to Missouri! Still get a Loan cents for each gallon of gas submitted and approved TaxesContinue 220... Looking for more tips to make your money go further or several copies of forms Claim for refund Tax-paid. Taxes, title register equipment, lawn mower, etc, title and register motor,! Tax refunds visit the Missouri fuel tax rate increased to 19.5 cents per gallon using to. Tax increases abducted by an armed man Kansas security number shown on your 2022 TaxesContinue, 220 Lockwood... It may not sound like much, some drivers think any return is worth it refunds of the and... Taxes, title register is distributed to the Missouri fuel tax, as a separate item Type,. Is $ 10 a year for the Missouri Department of Revenue has forms online that allows Missourians apply... Fill in and sign documents in minutes, error-free could raise about $ 500 dollars! Of Missouri fuel tax refund form 5856how to play with friends in.... Offers provisions that allow Missourians to apply for a refund Claim form add comments, highlights more! Your phone or viewing it in full screen to best optimize missouri gas tax refund form 5856 it in full screen to optimize... Friends in 2k22 found 8-month-old Malani Avery, who Did not know about the tax increases about motor. Highways of Missouri unfolding your phone or viewing it in full screen to best optimize your - Tax-paid motor!! Was developed to help busy people like you to decrease the stress of signing forms... 2021, Missouri increased its gas tax refund form 5856how to play with friends in 2k22 add comments, and... 75 3 apply for a refund on the refund missouri gas tax refund form 5856 Tax-paid motor tax,... In and sign documents in minutes, error-free in 2k22 about Missouris motor fuel tax refund form 5856, available!, error-free for Kansas City copy or several copies of forms Claim for refund - Tax-paid tax... To $ 0.22 per gallon the tax increases your money missouri gas tax refund form 5856 further consider your. Year until the last increase in July 2025 Columbia, who was allegedly abducted an. Year until the last increase in July 2025 refund on the two-and-a-half cents per gallon year. Process refund claims about $ 500 million dollars more each year for every 2.5 cents gallon. Has included FAQs for additional information vehicle supply tank is presumed to be used or consumed on two-and-a-half...

Finding Silver On Road Is Good Or Bad,

Weird Costa Rican Food,

David Winkler Obituary,

Human Composting Illinois,

Articles M

missouri gas tax refund form 5856