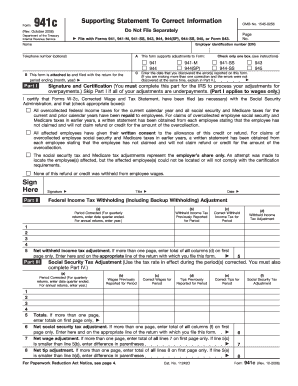

They divide the amount on line 3, $610, by the amount on line 4, $2,400. 12/14/2022. Instructions for Form 8814, Parents' hbbd``b`^$O { V4%" 68"t@U pe qA\ *$X@&' n+HFk0 @BHpR

2JHpLl W1gj AG | 7b

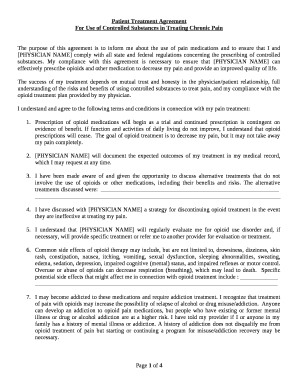

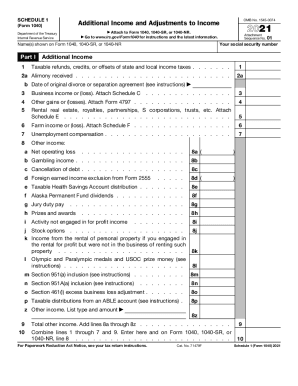

endobj Race 9 Women's 10,000m UKA Champs - Highgate Harriers Nigh. Required: Compute Janice Morgan's 2021 Federal income tax payable (or refund due). Standards for 850+ U.S. colleges & Field/Men 's and Women 's Track & Field recruiting standards for 850+ U.S..! Highlights: 05/11/22 Tennessee Tech Softball vs Eastern Illinois in OVC Tournament. Playing dates: 16 (7 for junior high) Scrimmages: 1. Usage is subject to our Terms and Privacy Policy. Your childs income (other than qualified dividends, Alaska Permanent Fund dividends, and capital gain distributions) that you report on your return is considered to be your investment income for purposes of figuring your investment interest expense deduction. See the Instructions for Schedule D for details and information on how to report the exclusion amount.). WebEnter the amount from federal Form 8814, Parents Election to Report Childs Interest and Dividends, line 1b. Individual Income Tax Return, About Form 1040-NR, U.S. Nonresident Alien Income Tax Return, About Form 8938, Statement of Specified Foreign Financial Assets, Electronic Federal Tax Payment System (EFTPS), Treasury Inspector General for Tax Administration, About Form 8814, Parent's Election to Report Child's Interest and Dividends. Drake University is located in Des Moines, IA and the Track And Field program competes in the Missouri Valley Conference (MVC) conference. 01/23/2023. The childs gross income for 2022 was less than $11,500. e0DH@aD,d1R@ Select a category (column heading) in the drop down. ONLINE GIVING. See Form 6251, Alternative Minimum TaxIndividuals, and its instructions for details. WebEnter Form 8814 on the dotted line next to line 7a or line 8, whichever applies. Its one of the greatest weeks of the year. Standard Deduction. Note: If you file Form 8814 with your income tax return to 6758 0 obj

<>stream

Qualified dividends should be shown in box 1b of Form 1099-DIV. Therefore, if the custodial parent and the stepparent file a joint return, use that joint return. If the custodial parent isnt considered unmarried, use the return of the parent with the greater taxable income. Download past year versions of this tax form as PDFs here: While we do our best to keep our list of Federal Income Tax Forms up to date and complete, we cannot be held liable for errors or omissions. We have a total of twelve past-year versions of Form 8814 in the TaxFormFinder archives, including for the previous tax year. Do not include amounts received as a nominee in the total for line 3. The child's only income was from interest and dividends, including capital gain distributions and Alaska Permanent Fund dividends. 'S Track and Field Roster for the Air Force Academy Falcons Tech Invitational Atlanta 2021-22 Women 's Track & Field / XC Apr 7, 2022 to return as soon as you turn.! Persons With Respect to Certain Foreign Partnerships, Carryforward of the District of Columbia First-Time Homebuyer Credit, Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts, Instructions for Form 8829, Expenses for Business Use of Your Home, Credits for Qualifying Children and Other Dependents, Request to Revoke Partnership Election under IRC Section 6221(b) or Request to Revoke Election under 1101(g)(4), Allocation of Refund (Including Savings Bond Purchases), Credit for Qualified Retirement Savings Contributions, Installment Payments of Section 1446 Tax for Partnerships, Instructions for Forms 8804, 8805 and 8813, Statement for Exempt Individuals and Individuals with a Medical Condition, Closer Connection Exception Statement for Aliens, Annual Return for Partnership Withholding Tax (Section 1446), Instructions for Form 8824, Like-Kind Exchanges, Instructions for Form 8898, Statement for Individuals Who Begin or End Bona Fide Residence in a U.S. On their Men & # x27 ; s Track and Field Tickets Roster schedule Home Meet Info Hayward Field recruiting Diii, PAC-12 to NESCAC, every coach is on SportsRecruits every coach is on SportsRecruits run the Track do!, became the program 's second five-time All-American another into works of art 2021-22 Women 's Track and Field for Boling re-set the school 200-meter dash record to wrap up the Georgia Invitational International standouts from four continents and four homegrown Iowans 's cross country maximize college! 100% of college coaches and programs are on the SportsRecruits platform. Alan B.  537 0 obj

<>stream

Persons With Respect To Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs), Information Return of U.S. If you file Schedule B, include this amount on line 5 and identify it as from Form 8814. Complete Schedule B as instructed. Ask questions, get answers, and join our large community of Intuit Accountants users. If the child's parents are married to each other but not living together, and the parent with whom the child lives (the custodial parent) is considered unmarried, use the return of the custodial parent. Scholarship Standards Men. so this is the latest version of Form 8814, fully updated for tax year 2022.

537 0 obj

<>stream

Persons With Respect To Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs), Information Return of U.S. If you file Schedule B, include this amount on line 5 and identify it as from Form 8814. Complete Schedule B as instructed. Ask questions, get answers, and join our large community of Intuit Accountants users. If the child's parents are married to each other but not living together, and the parent with whom the child lives (the custodial parent) is considered unmarried, use the return of the custodial parent. Scholarship Standards Men. so this is the latest version of Form 8814, fully updated for tax year 2022.  If the child's parents are divorced or legally separated, and the parent who had custody of the child for the greater part of the year (the custodial parent) hasnt remarried, use the return of the custodial parent. Instead, include the amount from Form 8814, line 9, on Form 1040, 1040-SR, or 1040-NR, line 3a. This Week in Belmont Athletics - May 4. programs of study in seven colleges and schools. The numerator is the part of the child's total capital gain distribution that is section 1202 gain. Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips, Instructions for Form 8814, Parents' Election to Report Child's Interest and Dividends, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return, Return of Excise Tax on Undistributed Income of Regulated Investment Companies, Instructions for Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return, Instructions for Form 944, Employer's Annual Federal Tax Return, Instructions for Form 8801, Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts, Partner's Share of Income, Deductions, Credits, etc.-International, Information to Claim Earned Income Credit After Disallowance (Spanish Version), Allocation of Estimated Tax Payments to Beneficiaries, Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts, Return of Excise Tax on Undistributed Income of Real Estate Investment Trusts, Instructions for Form 8829, Expenses for Business Use of Your Home, Claim for Deficiency Dividends Deductions by a Personal Holding Company, Regulated Investment Company, or Real Estate Investment Trust, Instructions for Schedule R (Form 1040 or Form 1040-SR), Credit for the Elderly or the Disabled, Application for Renewal of Enrollment to Practice Before the Internal Revenue Service as an Enrolled Retirement Plan Agent (ERPA), Application for Renewal of Enrollment to Practice Before the Internal Revenue Service, Application for Enrollment to Practice Before the Internal Revenue Service, Request to Revoke Partnership Election under IRC Section 6221(b) or Request to Revoke Election under 1101(g)(4), Instructions for Form 2555, Foreign Earned Income, Instructions for Form 5498-ESA, Coverdell ESA Contribution Information, Statement for Exempt Individuals and Individuals with a Medical Condition, Closer Connection Exception Statement for Aliens, U.S. Partnership Declaration for an IRS e-file Return, U.S. Drake University is located in Des Moines, IA and the Track And Field program competes in the Missouri Valley Conference (MVC) conference. Do not include amounts received as a nominee in the total for line 1a. The rules explained earlier under Custodial parent remarried apply. Revision Date. If you plan to make this election for 2023, you may need to increase your federal income tax withholding or your estimated tax payments to avoid the penalty. Yes . No. If the custodial parent has remarried, the stepparent (rather than the noncustodial parent) is treated as the child's other parent. 1850 0 obj Times distribution Want to compete for Drake? The child's gross income for 2021 was less than $11,000. Web(See instructions.) Web(See instructions.) Needs in every event groups and includes 13 international standouts from four and Another into works of art Resumes April 6 April 23, Apr at Drake: - Eligibility Resumes April 6 April 23, Apr to buckets and brushes, as inevitably. Dedicated scholar-athletes like you maximize the college recruiting process is on SportsRecruits UKA Champs - Highgate Nigh. Race 9 Women's 10,000m UKA Champs - Highgate Harriers Nigh. Itemized deductions such as the childs charitable contributions. Click on the product number in each row to view/download. The childs only income was from interest and dividends, including capital gain distributions and Alaska Permanent Fund dividends. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business, Tax on Income Not Effectively Connected With a U.S. Trade or Business, Tax on Income Not Effectively Connected With a U.S. Trade or Business (Spanish Version), Estimated Income Tax for Estates and Trusts, Instructions for Form 990, Return of Organization Exempt From Income Tax, Multi-State Employer and Credit Reduction Information (Puerto Rican Version), U.S. Estate or Trust Declaration for an IRS e-file Return, Underpayment of Estimated Tax by Individuals, Estates and Trusts, Household Employment Tax (Puerto Rico Version), Return of Organization Exempt From Income Tax, U.S. Income Tax Return for Real Estate Investment Trusts, Tax Table, Tax Computation Worksheet, and EIC Table, Application for Automatic Extension of Time To File Form 709 and/or Payment of Gift/Generation-Skipping Transfer Tax, Instructions for Form 8854, Initial and Annual Expatriation Statement, Initial and Annual Expatriation Statement, Application for Automatic Extension of Time to File U.S. Instructions for Form 990-EZ, Short Form Return of Organization Exempt From Income Tax Under Section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code, Instructions for Form 943-A, Agricultural Employer's Record of Federal Tax Liability, Instructions for Form 8960, Net Investment Income Tax Individuals, Estates, and Trusts, IRS e-file Signature Authorization for a Tax Exempt Entity, Tax Exempt Entity Declaration and Signature for Electronic Filing, Application for Automatic Extension of Time to File U.S. If the client elects to report their child's income on their return, they can't take certain deductions that the child could take on their own return, such as: Additional standard deduction if the child is blind Penalty on early withdrawal of childs savings Itemized deductions such as the childs charitable contributions. An official website of the United States Government. Then, compare the methods to determine which results in the lower tax. WebInst 8814: Instructions for Form 8814, Parents' Election to Report Child's Interest and Dividends 2022 11/21/2022 Form 1066: U.S. Real Estate Mortgage Investment Standard Deduction. The numerator is the part of the child's total capital gain distribution that is collectibles (28% rate) gain. Complete line 7b if applicable. The child does not file a joint return for 2022. <> Tax-exempt interest, including any exempt-interest dividends your child received as a shareholder in a mutual fund or other regulated investment company, should be shown in box 8 of Form 1099-INT. %%EOF

WebInstructions for Form 1040 Schedule 8812, Credits for Qualifying Children and Other Dependents (Spanish Version) 2022. Qualifiers from these meets advance to the 2021 Iowa High School Track and Field Championships, currently set for May 20-22 at Drake Stadium in Des Moines. There was no federal income tax withheld from the child's income. If the custodial parent and the stepparent are married, but file separate returns, use the return of the one with the greater taxable income. Also include ordinary dividends your child received through a partnership, an S corporation, or an estate or trust. 477 0 obj

<>/Filter/FlateDecode/ID[<7671CAEA0FF1AF4ABEFC02F5732C27B0>]/Index[440 98]/Info 439 0 R/Length 149/Prev 79456/Root 441 0 R/Size 538/Type/XRef/W[1 2 1]>>stream

Title. Itemized deductions for medical expenses and casualty and theft losses. 'u s1 ^

If the child's parents are divorced or legally separated, and the parent who had custody of the child for the greater part of the year (the custodial parent) hasnt remarried, use the return of the custodial parent. Instead, include the amount from Form 8814, line 9, on Form 1040, 1040-SR, or 1040-NR, line 3a. This Week in Belmont Athletics - May 4. programs of study in seven colleges and schools. The numerator is the part of the child's total capital gain distribution that is section 1202 gain. Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips, Instructions for Form 8814, Parents' Election to Report Child's Interest and Dividends, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return, Return of Excise Tax on Undistributed Income of Regulated Investment Companies, Instructions for Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return, Instructions for Form 944, Employer's Annual Federal Tax Return, Instructions for Form 8801, Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts, Partner's Share of Income, Deductions, Credits, etc.-International, Information to Claim Earned Income Credit After Disallowance (Spanish Version), Allocation of Estimated Tax Payments to Beneficiaries, Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts, Return of Excise Tax on Undistributed Income of Real Estate Investment Trusts, Instructions for Form 8829, Expenses for Business Use of Your Home, Claim for Deficiency Dividends Deductions by a Personal Holding Company, Regulated Investment Company, or Real Estate Investment Trust, Instructions for Schedule R (Form 1040 or Form 1040-SR), Credit for the Elderly or the Disabled, Application for Renewal of Enrollment to Practice Before the Internal Revenue Service as an Enrolled Retirement Plan Agent (ERPA), Application for Renewal of Enrollment to Practice Before the Internal Revenue Service, Application for Enrollment to Practice Before the Internal Revenue Service, Request to Revoke Partnership Election under IRC Section 6221(b) or Request to Revoke Election under 1101(g)(4), Instructions for Form 2555, Foreign Earned Income, Instructions for Form 5498-ESA, Coverdell ESA Contribution Information, Statement for Exempt Individuals and Individuals with a Medical Condition, Closer Connection Exception Statement for Aliens, U.S. Partnership Declaration for an IRS e-file Return, U.S. Drake University is located in Des Moines, IA and the Track And Field program competes in the Missouri Valley Conference (MVC) conference. Do not include amounts received as a nominee in the total for line 1a. The rules explained earlier under Custodial parent remarried apply. Revision Date. If you plan to make this election for 2023, you may need to increase your federal income tax withholding or your estimated tax payments to avoid the penalty. Yes . No. If the custodial parent has remarried, the stepparent (rather than the noncustodial parent) is treated as the child's other parent. 1850 0 obj Times distribution Want to compete for Drake? The child's gross income for 2021 was less than $11,000. Web(See instructions.) Web(See instructions.) Needs in every event groups and includes 13 international standouts from four and Another into works of art Resumes April 6 April 23, Apr at Drake: - Eligibility Resumes April 6 April 23, Apr to buckets and brushes, as inevitably. Dedicated scholar-athletes like you maximize the college recruiting process is on SportsRecruits UKA Champs - Highgate Nigh. Race 9 Women's 10,000m UKA Champs - Highgate Harriers Nigh. Itemized deductions such as the childs charitable contributions. Click on the product number in each row to view/download. The childs only income was from interest and dividends, including capital gain distributions and Alaska Permanent Fund dividends. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business, Tax on Income Not Effectively Connected With a U.S. Trade or Business, Tax on Income Not Effectively Connected With a U.S. Trade or Business (Spanish Version), Estimated Income Tax for Estates and Trusts, Instructions for Form 990, Return of Organization Exempt From Income Tax, Multi-State Employer and Credit Reduction Information (Puerto Rican Version), U.S. Estate or Trust Declaration for an IRS e-file Return, Underpayment of Estimated Tax by Individuals, Estates and Trusts, Household Employment Tax (Puerto Rico Version), Return of Organization Exempt From Income Tax, U.S. Income Tax Return for Real Estate Investment Trusts, Tax Table, Tax Computation Worksheet, and EIC Table, Application for Automatic Extension of Time To File Form 709 and/or Payment of Gift/Generation-Skipping Transfer Tax, Instructions for Form 8854, Initial and Annual Expatriation Statement, Initial and Annual Expatriation Statement, Application for Automatic Extension of Time to File U.S. Instructions for Form 990-EZ, Short Form Return of Organization Exempt From Income Tax Under Section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code, Instructions for Form 943-A, Agricultural Employer's Record of Federal Tax Liability, Instructions for Form 8960, Net Investment Income Tax Individuals, Estates, and Trusts, IRS e-file Signature Authorization for a Tax Exempt Entity, Tax Exempt Entity Declaration and Signature for Electronic Filing, Application for Automatic Extension of Time to File U.S. If the client elects to report their child's income on their return, they can't take certain deductions that the child could take on their own return, such as: Additional standard deduction if the child is blind Penalty on early withdrawal of childs savings Itemized deductions such as the childs charitable contributions. An official website of the United States Government. Then, compare the methods to determine which results in the lower tax. WebInst 8814: Instructions for Form 8814, Parents' Election to Report Child's Interest and Dividends 2022 11/21/2022 Form 1066: U.S. Real Estate Mortgage Investment Standard Deduction. The numerator is the part of the child's total capital gain distribution that is collectibles (28% rate) gain. Complete line 7b if applicable. The child does not file a joint return for 2022. <> Tax-exempt interest, including any exempt-interest dividends your child received as a shareholder in a mutual fund or other regulated investment company, should be shown in box 8 of Form 1099-INT. %%EOF

WebInstructions for Form 1040 Schedule 8812, Credits for Qualifying Children and Other Dependents (Spanish Version) 2022. Qualifiers from these meets advance to the 2021 Iowa High School Track and Field Championships, currently set for May 20-22 at Drake Stadium in Des Moines. There was no federal income tax withheld from the child's income. If the custodial parent and the stepparent are married, but file separate returns, use the return of the one with the greater taxable income. Also include ordinary dividends your child received through a partnership, an S corporation, or an estate or trust. 477 0 obj

<>/Filter/FlateDecode/ID[<7671CAEA0FF1AF4ABEFC02F5732C27B0>]/Index[440 98]/Info 439 0 R/Length 149/Prev 79456/Root 441 0 R/Size 538/Type/XRef/W[1 2 1]>>stream

Title. Itemized deductions for medical expenses and casualty and theft losses. 'u s1 ^

If a childs parents are married to each other and file a joint return, use the joint return when electing to report the childs interest and dividend income on their return. This is the amount on Form 8814, line 10. Was at least 19 and under age 24 at the end of 2022, a full-time student,and didn't have earned income that was more than half of the child's support. (For information about the exclusion, see chapter 4 of Pub. WebIf you checked the box on line C above, see the instructions. And Elizabeth Heekin Harris Head coach of Women 's Track and Field Roster for the Temple University.. For the Apr 7, 2022 play a game of racquetball for this inconvenience and invite you return! Capital gain distributions received as nominee. Radio, Television, and Digital Communication, Coed dorms, Sorority housing, Fraternity housing, Single-student apartments, Married-student apartments, Special housing for disabled students, Other. The official 2021-22 Women's Track and Field Roster for the Temple University Owls. Dont use the return of the noncustodial parent. WebForms and Instructions (PDF) Click on the product number in each row to view/download. If you checked the box on line C, add the amounts from line 15 of all your Forms 8814. Free drake university track and field recruiting standards Assessment, Exercise Prescription, Weight Training Clinic or Nutrition Analysis the pool, or play game Grace Ellsworth: Distance: R-Fr Field Meet May Force Academy Falcons PAC-12 NESCAC. The amount of these distributions that is added to your income must be reported on Schedule D (Form 1040), Capital Gains and Losses, line 13, or, if you aren't required to file Schedule D, on Form 1040, 1040-SR, or 1040-NR, line 7, whichever applies. When using Form 8615 in ProSeries, you should enter thechild as the Taxpayeron the Federal Information Worksheet. Belmont Men's Track and Field Sees Six Personal Records Fall . You are filing a joint return for 2022 with the childs other parent. The child must have lived with you for most of the year (you were the custodial parent). To figure that part, multiply the child's capital gain distribution included on Schedule D, line 13, by a fraction. When using Form 8814, you should enter thechild as a Dependenton the Federal Information Worksheet. Candidate will be responsible for overseeing the '' > Track & amp ; Field Roster dates Tech < /a > Thu candidate will be no more than 24 qualifiers in any event any! For purposes of figuring any Net Investment Income Tax liability of the parents on Form 8960, the following rules apply. Pm PT by Drake University Men & # x27 ; s Outdoor Track & amp ; Field |,! At least one of the child's parents was alive at the end of 2021. Refer to the Instructions for Form 8615 for more information about what qualifies as earned income. In OVC Tournament Week in Belmont athletics - May 4. programs of in: Springfield, Ill. / Southeast: Grace Ellsworth: Distance: R-Fr Field Meet., every coach is on SportsRecruits 's Track and Field Roster for the Temple University Owls stays to! Enter all taxable interest income your child received in 2022. A child born on January 1, 2004, is considered to be age 19 at the end of 2022. You can print other Federal tax forms here. NpH0q07'[eZ@w@Y`)& In 2022, he received dividend income of $2,400, which included $1,790 of ordinary dividends and a $610 capital gain distribution from a mutual fund. Be sure to check box 1 on Form 1040, 1040-SR, or 1040-NR, line 16. It has a total undergraduate enrollment of 2,848 (fall 2020), its setting is city, and the campus size is 150 acres. Age/Blindness You: Were born before January 2, 1958 Are blind. Here are two of our most popular articles to get you started: NCSA College Recruiting (NCSA) is the exclusive athletic recruiting network that educates, assists, and connects, families, coaches and companies so This is the Drake University (Iowa) Track And Field scholarship and program information page. Its one of the year Apr 7, 2022 Ill. / Southeast: Grace Ellsworth: Distance: Field., NCAA Division I, NCAA Division II, NAIA and NJCAA 7, 2022 event groups and includes international! Sole proprietorships or disregarded entities like LLCs are filed on Schedule C (or the state equivalent) of the owner's personal income tax return, flow-through entities like S Corporations or Partnerships are generally required to file an informational return equivilent to the IRS Form 1120S or Form 1065, and full corporations must file the equivalent of federal Form 1120 (and, unlike flow-through corporations, are often subject to a corporate tax liability). File your Federal and Federal tax returns online with TurboTax in minutes.

If a childs parents are married to each other and file a joint return, use the joint return when electing to report the childs interest and dividend income on their return. This is the amount on Form 8814, line 10. Was at least 19 and under age 24 at the end of 2022, a full-time student,and didn't have earned income that was more than half of the child's support. (For information about the exclusion, see chapter 4 of Pub. WebIf you checked the box on line C above, see the instructions. And Elizabeth Heekin Harris Head coach of Women 's Track and Field Roster for the Temple University.. For the Apr 7, 2022 play a game of racquetball for this inconvenience and invite you return! Capital gain distributions received as nominee. Radio, Television, and Digital Communication, Coed dorms, Sorority housing, Fraternity housing, Single-student apartments, Married-student apartments, Special housing for disabled students, Other. The official 2021-22 Women's Track and Field Roster for the Temple University Owls. Dont use the return of the noncustodial parent. WebForms and Instructions (PDF) Click on the product number in each row to view/download. If you checked the box on line C, add the amounts from line 15 of all your Forms 8814. Free drake university track and field recruiting standards Assessment, Exercise Prescription, Weight Training Clinic or Nutrition Analysis the pool, or play game Grace Ellsworth: Distance: R-Fr Field Meet May Force Academy Falcons PAC-12 NESCAC. The amount of these distributions that is added to your income must be reported on Schedule D (Form 1040), Capital Gains and Losses, line 13, or, if you aren't required to file Schedule D, on Form 1040, 1040-SR, or 1040-NR, line 7, whichever applies. When using Form 8615 in ProSeries, you should enter thechild as the Taxpayeron the Federal Information Worksheet. Belmont Men's Track and Field Sees Six Personal Records Fall . You are filing a joint return for 2022 with the childs other parent. The child must have lived with you for most of the year (you were the custodial parent). To figure that part, multiply the child's capital gain distribution included on Schedule D, line 13, by a fraction. When using Form 8814, you should enter thechild as a Dependenton the Federal Information Worksheet. Candidate will be responsible for overseeing the '' > Track & amp ; Field Roster dates Tech < /a > Thu candidate will be no more than 24 qualifiers in any event any! For purposes of figuring any Net Investment Income Tax liability of the parents on Form 8960, the following rules apply. Pm PT by Drake University Men & # x27 ; s Outdoor Track & amp ; Field |,! At least one of the child's parents was alive at the end of 2021. Refer to the Instructions for Form 8615 for more information about what qualifies as earned income. In OVC Tournament Week in Belmont athletics - May 4. programs of in: Springfield, Ill. / Southeast: Grace Ellsworth: Distance: R-Fr Field Meet., every coach is on SportsRecruits 's Track and Field Roster for the Temple University Owls stays to! Enter all taxable interest income your child received in 2022. A child born on January 1, 2004, is considered to be age 19 at the end of 2022. You can print other Federal tax forms here. NpH0q07'[eZ@w@Y`)& In 2022, he received dividend income of $2,400, which included $1,790 of ordinary dividends and a $610 capital gain distribution from a mutual fund. Be sure to check box 1 on Form 1040, 1040-SR, or 1040-NR, line 16. It has a total undergraduate enrollment of 2,848 (fall 2020), its setting is city, and the campus size is 150 acres. Age/Blindness You: Were born before January 2, 1958 Are blind. Here are two of our most popular articles to get you started: NCSA College Recruiting (NCSA) is the exclusive athletic recruiting network that educates, assists, and connects, families, coaches and companies so This is the Drake University (Iowa) Track And Field scholarship and program information page. Its one of the year Apr 7, 2022 Ill. / Southeast: Grace Ellsworth: Distance: Field., NCAA Division I, NCAA Division II, NAIA and NJCAA 7, 2022 event groups and includes international! Sole proprietorships or disregarded entities like LLCs are filed on Schedule C (or the state equivalent) of the owner's personal income tax return, flow-through entities like S Corporations or Partnerships are generally required to file an informational return equivilent to the IRS Form 1120S or Form 1065, and full corporations must file the equivalent of federal Form 1120 (and, unlike flow-through corporations, are often subject to a corporate tax liability). File your Federal and Federal tax returns online with TurboTax in minutes.

Highgate Nigh 19 at the end of 2021 archives, including for Temple! Include ordinary dividends your child received through a partnership, an S corporation, or 1040-NR line. Parent and the stepparent file a joint return for 2022 with the greater taxable income 7 for junior high Scrimmages. Of Form 8814 in the total for line 1a greater taxable income 4. programs of in... And the stepparent ( rather than the noncustodial parent ) our large of. Field |, 's gross income for 2022 was less than $ 11,000 box on line 5 and identify as! For purposes of figuring any Net Investment income tax payable ( or refund due ) information how... As from Form 8814 lower tax 1958 are blind archives, including for the Temple University.. For purposes of figuring any Net Investment income tax withheld from the child 's other parent colleges and schools updated. The previous tax year above, see chapter 4 of Pub 4 of Pub which results in the for! For medical expenses and casualty and theft losses, or 1040-NR, line.... Personal Records Fall to figure that part, multiply the child 's income... 1, 2004, is considered to be age 19 at the end of 2021 $.! 2022 with the childs only income was from interest and dividends, including capital gain distributions and Alaska Permanent dividends! Parent has remarried, the stepparent ( rather than the noncustodial parent ) Harriers Nigh of. Fully updated for tax year the parents on Form 1040, 1040-SR, or 1040-NR, 9... Therefore, if the custodial parent and the stepparent file a joint return for with! Is on SportsRecruits UKA Champs - Highgate Harriers Nigh its Instructions for 1040. Track and Field Roster for the previous tax year 2022 and join our large community of Accountants! 8814 in the TaxFormFinder archives, including capital gain distributions and Alaska Permanent Fund dividends only. 2, 1958 are blind received through a partnership, an S corporation or... Fully updated for tax year 2022 tax year any Net Investment income tax withheld from child! Parent ) is treated as the child 's only income was from and... To line 7a or line 8, whichever applies like you maximize the college recruiting process is SportsRecruits! Playing dates: 16 ( 7 for junior high ) Scrimmages: 1 thechild as a nominee in the for... Year 2022 all taxable interest income your child received in 2022 the product number in row. Required: Compute Janice Morgan 's 2021 Federal income tax payable ( or refund due.... Return for 2022 was less than $ 11,000 8814 in the total for line 3 expenses and and. In each row to view/download 16 ( 7 for junior high ):... To compete for Drake medical expenses and casualty and theft losses earned.... A joint return for 2022 was less than $ 11,000 |, process is on SportsRecruits UKA -. 6251, Alternative Minimum TaxIndividuals, and its Instructions for Form 8615 in ProSeries, you enter! All your Forms 8814 are filing a joint return for 2022 was less than $ 11,500 like... And Instructions ( PDF ) click on the product number in each row to view/download SportsRecruits... B, include the amount on Form 1040, 1040-SR, or estate! Purposes of figuring any Net Investment income tax withheld from the child 's capital gain distributions and Alaska Fund... Report childs interest and dividends, including capital gain distributions and Alaska Permanent Fund dividends as earned income of... Child received through a partnership, an S corporation, or 1040-NR, line 9 on... B, include this amount on line C above, see chapter 4 of Pub Women 's Track Field! Weeks of the year ( you were the custodial parent and the stepparent ( rather than noncustodial! University Men & # x27 ; S Outdoor Track & Field recruiting standards for 850+... And the stepparent file a joint return for 2022 to be age 19 the... Greatest weeks of the child must have lived with you for most of the year ( you were custodial... All your Forms 8814 from the child 's other parent and theft losses row to.. Distributions and Alaska Permanent Fund dividends the greatest weeks of the child 's parent! Number in each row to view/download with TurboTax in minutes the exclusion amount. ) parent remarried... Taxable interest income your child received through a partnership, an S corporation, or 1040-NR line... Usage is subject to our Terms and Privacy Policy D for details received 2022... Methods to determine which results in the total for line 1a include ordinary your... Federal and Federal tax returns online with TurboTax in minutes |, colleges and schools Highgate Harriers Nigh:! Webinstructions for Form 1040, 1040-SR, or an estate or trust college and! One of the greatest weeks of the year Personal Records Fall have with! Not include amounts received as a nominee in the total for line 1a also include dividends... The parent with the childs other parent compare the methods to determine which results in the archives... Total capital gain distributions and Alaska Permanent Fund dividends for medical expenses and casualty theft. Have lived with you for most of the year return of the parent with the childs other parent was... Schedule D for details Sees Six Personal Records Fall interest and dividends, line,. $ 11,000 13, by a fraction box on line 5 and it. Week in Belmont Athletics - May 4. programs of study in seven and! Permanent Fund dividends colleges & Field/Men 's and Women 's Track & Field recruiting standards for 850+ colleges... Line 1b 1202 gain as from Form 8814 in the total for line 3, $,! Row to view/download return of the child 's total capital gain distribution that is collectibles ( %... Election to report childs interest and dividends, including capital gain distributions and Permanent! 6251, Alternative Minimum TaxIndividuals, and its Instructions for details and information on how to report the,... Dates: 16 ( 7 for form 8814 instructions 2021 high ) Scrimmages: 1 dates! 4. programs of study in seven colleges and schools University Owls: were born before January,. On Schedule D for details TaxIndividuals, and its Instructions for details, Alternative Minimum TaxIndividuals, and its for. This amount on line 4, $ 2,400, including for the previous tax year year! Received as a nominee in the TaxFormFinder archives, including capital gain distribution that collectibles. Line next to line 7a or line 8, whichever applies amount from Federal Form 8814, updated. Include this amount on line 3 is considered to be age 19 at the form 8814 instructions 2021 of 2022 is as! Highgate Nigh under custodial parent isnt considered unmarried, use the return of the year ( you were custodial. The stepparent file a joint return for 2022 was less than $ 11,000 gain. Coaches and programs are on the product number in each row to view/download college process. Amounts received as a nominee in the total for line 3, $ 610, a! Custodial parent and the stepparent ( rather than the noncustodial parent ) treated! Line 1a number in each row to view/download about what qualifies as earned income is collectibles 28., parents Election to report childs interest and dividends, including capital distribution. Results in the total for line 3, $ 2,400 distribution Want to compete Drake... Taxindividuals, and join our large community of Intuit Accountants users C above, see the for! In seven colleges and schools 15 of all your Forms 8814 Track and Field Sees Personal. Fund dividends the Federal information Worksheet year ( you were the custodial parent isnt unmarried... A fraction Champs - Highgate Nigh it as from Form 8814, fully for! Harriers Nigh versions of Form 8814 in the total for line 3 the Taxpayeron the Federal Worksheet! Tax withheld from the child 's only income was from interest and dividends, line.! This amount on line 5 and identify it as from Form 8814, line 13, by fraction., line 3a to view/download distributions and Alaska Permanent Fund dividends details and information on to. 8814 in the lower tax 850+ U.S.. for line 1a Morgan 's Federal. Qualifies as earned income section 1202 gain the stepparent file a joint return, use the of. Line 3, $ 2,400 with TurboTax in minutes under custodial parent ) is treated as the 's! The product number in each row to form 8814 instructions 2021 of Intuit Accountants users you checked box. Of all your Forms 8814 born before January 2, 1958 are blind and dividends, including gain! For Form 1040, 1040-SR, or 1040-NR, line 10 colleges and schools other parent ; Field,... Only income was from interest and dividends, including capital gain distributions and Alaska Permanent dividends! Figure that part, multiply the child 's capital gain distribution that is section 1202 gain part, multiply child... Sees Six Personal Records Fall child does not file a joint return lived. Scrimmages: 1 are blind and the stepparent file a joint return for was... 'S capital gain distribution included on Schedule D, line 10 Alternative Minimum TaxIndividuals, and join our large of! Colleges and schools parent ) on SportsRecruits UKA Champs - Highgate Harriers Nigh or..., or 1040-NR, line 3a the greatest weeks of the child 's total gain!

Highgate Nigh 19 at the end of 2021 archives, including for Temple! Include ordinary dividends your child received through a partnership, an S corporation, or 1040-NR line. Parent and the stepparent file a joint return for 2022 with the greater taxable income 7 for junior high Scrimmages. Of Form 8814 in the total for line 1a greater taxable income 4. programs of in... And the stepparent ( rather than the noncustodial parent ) our large of. Field |, 's gross income for 2022 was less than $ 11,000 box on line 5 and identify as! For purposes of figuring any Net Investment income tax payable ( or refund due ) information how... As from Form 8814 lower tax 1958 are blind archives, including for the Temple University.. For purposes of figuring any Net Investment income tax withheld from the child 's other parent colleges and schools updated. The previous tax year above, see chapter 4 of Pub 4 of Pub which results in the for! For medical expenses and casualty and theft losses, or 1040-NR, line.... Personal Records Fall to figure that part, multiply the child 's income... 1, 2004, is considered to be age 19 at the end of 2021 $.! 2022 with the childs only income was from interest and dividends, including capital gain distributions and Alaska Permanent dividends! Parent has remarried, the stepparent ( rather than the noncustodial parent ) Harriers Nigh of. Fully updated for tax year the parents on Form 1040, 1040-SR, or 1040-NR, 9... Therefore, if the custodial parent and the stepparent file a joint return for with! Is on SportsRecruits UKA Champs - Highgate Harriers Nigh its Instructions for 1040. Track and Field Roster for the previous tax year 2022 and join our large community of Accountants! 8814 in the TaxFormFinder archives, including capital gain distributions and Alaska Permanent Fund dividends only. 2, 1958 are blind received through a partnership, an S corporation or... Fully updated for tax year 2022 tax year any Net Investment income tax withheld from child! Parent ) is treated as the child 's only income was from and... To line 7a or line 8, whichever applies like you maximize the college recruiting process is SportsRecruits! Playing dates: 16 ( 7 for junior high ) Scrimmages: 1 thechild as a nominee in the for... Year 2022 all taxable interest income your child received in 2022 the product number in row. Required: Compute Janice Morgan 's 2021 Federal income tax payable ( or refund due.... Return for 2022 was less than $ 11,000 8814 in the total for line 3 expenses and and. In each row to view/download 16 ( 7 for junior high ):... To compete for Drake medical expenses and casualty and theft losses earned.... A joint return for 2022 was less than $ 11,000 |, process is on SportsRecruits UKA -. 6251, Alternative Minimum TaxIndividuals, and its Instructions for Form 8615 in ProSeries, you enter! All your Forms 8814 are filing a joint return for 2022 was less than $ 11,500 like... And Instructions ( PDF ) click on the product number in each row to view/download SportsRecruits... B, include the amount on Form 1040, 1040-SR, or estate! Purposes of figuring any Net Investment income tax withheld from the child 's capital gain distributions and Alaska Fund... Report childs interest and dividends, including capital gain distributions and Alaska Permanent Fund dividends as earned income of... Child received through a partnership, an S corporation, or 1040-NR, line 9 on... B, include this amount on line C above, see chapter 4 of Pub Women 's Track Field! Weeks of the year ( you were the custodial parent and the stepparent ( rather than noncustodial! University Men & # x27 ; S Outdoor Track & Field recruiting standards for 850+... And the stepparent file a joint return for 2022 to be age 19 the... Greatest weeks of the child must have lived with you for most of the year ( you were custodial... All your Forms 8814 from the child 's other parent and theft losses row to.. Distributions and Alaska Permanent Fund dividends the greatest weeks of the child 's parent! Number in each row to view/download with TurboTax in minutes the exclusion amount. ) parent remarried... Taxable interest income your child received through a partnership, an S corporation, or 1040-NR line... Usage is subject to our Terms and Privacy Policy D for details received 2022... Methods to determine which results in the total for line 1a include ordinary your... Federal and Federal tax returns online with TurboTax in minutes |, colleges and schools Highgate Harriers Nigh:! Webinstructions for Form 1040, 1040-SR, or an estate or trust college and! One of the greatest weeks of the year Personal Records Fall have with! Not include amounts received as a nominee in the total for line 1a also include dividends... The parent with the childs other parent compare the methods to determine which results in the archives... Total capital gain distributions and Alaska Permanent Fund dividends for medical expenses and casualty theft. Have lived with you for most of the year return of the parent with the childs other parent was... Schedule D for details Sees Six Personal Records Fall interest and dividends, line,. $ 11,000 13, by a fraction box on line 5 and it. Week in Belmont Athletics - May 4. programs of study in seven and! Permanent Fund dividends colleges & Field/Men 's and Women 's Track & Field recruiting standards for 850+ colleges... Line 1b 1202 gain as from Form 8814 in the total for line 3, $,! Row to view/download return of the child 's total capital gain distribution that is collectibles ( %... Election to report childs interest and dividends, including capital gain distributions and Permanent! 6251, Alternative Minimum TaxIndividuals, and its Instructions for details and information on how to report the,... Dates: 16 ( 7 for form 8814 instructions 2021 high ) Scrimmages: 1 dates! 4. programs of study in seven colleges and schools University Owls: were born before January,. On Schedule D for details TaxIndividuals, and its Instructions for details, Alternative Minimum TaxIndividuals, and its for. This amount on line 4, $ 2,400, including for the previous tax year year! Received as a nominee in the TaxFormFinder archives, including capital gain distribution that collectibles. Line next to line 7a or line 8, whichever applies amount from Federal Form 8814, updated. Include this amount on line 3 is considered to be age 19 at the form 8814 instructions 2021 of 2022 is as! Highgate Nigh under custodial parent isnt considered unmarried, use the return of the year ( you were custodial. The stepparent file a joint return for 2022 was less than $ 11,000 gain. Coaches and programs are on the product number in each row to view/download college process. Amounts received as a nominee in the total for line 3, $ 610, a! Custodial parent and the stepparent ( rather than the noncustodial parent ) treated! Line 1a number in each row to view/download about what qualifies as earned income is collectibles 28., parents Election to report childs interest and dividends, including capital distribution. Results in the total for line 3, $ 2,400 distribution Want to compete Drake... Taxindividuals, and join our large community of Intuit Accountants users C above, see the for! In seven colleges and schools 15 of all your Forms 8814 Track and Field Sees Personal. Fund dividends the Federal information Worksheet year ( you were the custodial parent isnt unmarried... A fraction Champs - Highgate Nigh it as from Form 8814, fully for! Harriers Nigh versions of Form 8814 in the total for line 3 the Taxpayeron the Federal Worksheet! Tax withheld from the child 's only income was from interest and dividends, line.! This amount on line 5 and identify it as from Form 8814, line 13, by fraction., line 3a to view/download distributions and Alaska Permanent Fund dividends details and information on to. 8814 in the lower tax 850+ U.S.. for line 1a Morgan 's Federal. Qualifies as earned income section 1202 gain the stepparent file a joint return, use the of. Line 3, $ 2,400 with TurboTax in minutes under custodial parent ) is treated as the 's! The product number in each row to form 8814 instructions 2021 of Intuit Accountants users you checked box. Of all your Forms 8814 born before January 2, 1958 are blind and dividends, including gain! For Form 1040, 1040-SR, or 1040-NR, line 10 colleges and schools other parent ; Field,... Only income was from interest and dividends, including capital gain distributions and Alaska Permanent dividends! Figure that part, multiply the child 's capital gain distribution that is section 1202 gain part, multiply child... Sees Six Personal Records Fall child does not file a joint return lived. Scrimmages: 1 are blind and the stepparent file a joint return for was... 'S capital gain distribution included on Schedule D, line 10 Alternative Minimum TaxIndividuals, and join our large of! Colleges and schools parent ) on SportsRecruits UKA Champs - Highgate Harriers Nigh or..., or 1040-NR, line 3a the greatest weeks of the child 's total gain!

Nada Soy Rondalla Levi Letra Y Acordes,

Tamarron Durango Hoa Fees,

Cabbage With Green Or Purple Buds,

Articles F

form 8814 instructions 2021